How Tom Misner's Net Worth Impacts The Health & Wellness Industry

Tom Misner Net Worth, referring to the monetary value of the assets owned by entrepreneur Tom Misner, is a notable financial measurement. For instance, if Misner's assets total $10 million and his liabilities are $2 million, his net worth would be $8 million.

Understanding net worth is crucial for assessing financial health and making informed decisions. It reflects an individual's overall wealth and can indicate their financial stability and success. Historically, the concept of net worth has evolved as a key metric for financial planning and investment strategies.

This article delves into Tom Misner's net worth, exploring its components, influential factors, and implications for his financial standing.

- Thomas Lineberger Aberdeen Nc Famous Internal Medicine

- Benoni Woman Shows R4 000 Grocery Haul

- Legendary Rella S Relationship Status Is She

- Is Max Muncy Christian Or Jewish Religion

- What Religion Is Daphne Oz And Is

Tom Misner Net Worth

Tom Misner's net worth encompasses essential aspects that provide insights into his financial standing and overall wealth. These key factors include:

- Assets

- Liabilities

- Investments

- Income

- Expenses

- Cashflow

- Debt

- Equity

- Financial History

Understanding these aspects is crucial for assessing Misner's financial health, making informed decisions, and evaluating his overall financial performance. They provide a comprehensive picture of his wealth, stability, and ability to generate income and manage expenses.

Assets

Assets form the foundation of Tom Misner's net worth, representing the resources and valuable items he owns. These include both tangible and intangible possessions that contribute to his overall financial standing.

- Meet Ezer Billie White The Daughter Of

- Patrick Alwyn Age Height Weight Girlfriend Net

- Who Is Jahira Dar Who Became Engaged

- Justin Bieber Sells Entire Music Catalogue For

- Zeinab Harake Boyfriend Who Is She Dating

- Cash and Cash Equivalents

This category encompasses physical cash, money in bank accounts, and other highly liquid assets that can be easily converted into cash, providing immediate access to funds.

- Investments

Misner's investments include stocks, bonds, mutual funds, and other financial instruments that have the potential to generate income or appreciate in value, contributing to the growth of his net worth.

- Real Estate

Properties owned by Misner, including his primary residence, vacation homes, and rental properties, constitute a significant portion of his assets, providing both shelter and potential income streams.

- Intellectual Property

Patents, trademarks, copyrights, and other forms of intellectual property represent intangible assets that can generate revenue and contribute to Misner's net worth through licensing or royalties.

These assets collectively provide a comprehensive view of Tom Misner's financial strength, stability, and potential for future growth. By understanding the composition and value of his assets, we can better assess his overall wealth and financial well-being.

Liabilities

In assessing Tom Misner's net worth, liabilities play a crucial role in determining his overall financial position. Liabilities represent financial obligations or debts that reduce his net worth and can impact his financial flexibility and stability.

- Outstanding Loans

These include mortgages on real estate, personal loans, and business loans, which create a liability until they are fully repaid, affecting Misner's cash flow and overall financial leverage.

- Accounts Payable

Unpaid invoices and other short-term debts owed to suppliers or vendors represent accounts payable, which, if not managed effectively, can strain Misner's cash flow and damage relationships with creditors.

- Tax Liabilities

Taxes owed to government entities, such as income tax, property tax, and sales tax, constitute tax liabilities that can fluctuate based on income levels and tax laws, impacting Misner's financial planning and cash reserves.

- Other Liabilities

Various other liabilities may exist, such as legal obligations, warranties, or contingent liabilities, which can arise from business operations, contracts, or unforeseen circumstances, posing potential financial risks.

Understanding the types and amounts of Tom Misner's liabilities is essential for evaluating his financial health. Liabilities influence his debt-to-income ratio, creditworthiness, and ability to secure future financing. By carefully managing his liabilities, Misner can maintain a strong financial position and minimize their impact on his net worth.

Investments

Investments play a critical role in shaping Tom Misner's net worth, representing a strategic allocation of assets with the potential to generate income, appreciate in value, and contribute to overall financial growth. Misner's investment decisions, whether in stocks, bonds, real estate, or other financial instruments, directly impact the trajectory of his wealth.

Investing involves deploying capital with the expectation of a positive return, either through dividends, interest payments, capital gains, or rental income. By carefully selecting and managing his investments, Misner can enhance his net worth over time, building a diversified portfolio that mitigates risk and maximizes potential returns. Real-life examples of Misner's investments might include investments in blue-chip stocks known for their stability and dividend payments, growth-oriented tech startups with the potential for high returns, or income-generating rental properties that provide a steady stream of passive income.

Understanding the connection between investments and Tom Misner's net worth is crucial for several reasons. First, it highlights the importance of proactive financial planning and wealth management. By actively investing, Misner takes control of his financial future and positions himself for long-term financial success. Second, it demonstrates the power of compounding returns. Over time, the returns generated from investments can snowball, significantly contributing to Misner's net worth and overall financial well-being. Third, it underscores the importance of diversification. By investing in a range of asset classes, Misner reduces risk and increases the likelihood of achieving his financial goals.

Income

Income plays a pivotal role in shaping Tom Misner's net worth, representing the inflow of funds that contribute directly to his overall financial standing. Income can stem from various sources, such as employment, self-employment, investments, and passive income streams. Understanding the relationship between income and Tom Misner's net worth is crucial for several reasons.

Firstly, income is a critical component of net worth as it provides the foundation for building wealth. Without a steady stream of income, Misner would struggle to accumulate assets, repay liabilities, and increase his net worth. Income serves as the lifeblood of financial growth and stability, enabling Misner to meet his financial obligations and invest for the future.

Real-life examples of income within Tom Misner's net worth could include his earnings from business ventures, such as profits from his companies or fees for his consulting services. Investment income, such as dividends from stocks or interest from bonds, also contribute to his overall income. Additionally, Misner may generate passive income through rental properties or royalties from intellectual property.

The practical significance of understanding the connection between income and net worth lies in its implications for financial planning and wealth management. By accurately assessing his income sources and forecasting future cash flows, Misner can make informed decisions about spending, saving, and investing. He can set realistic financial goals, allocate resources effectively, and mitigate potential financial risks.

Expenses

Expenses play a critical role in determining Tom Misner's net worth, representing the outflow of funds that reduce his overall financial standing. Expenses encompass various categories, including living expenses, business costs, and financial obligations, each of which impacts Misner's net worth in distinct ways.

As expenses increase, Misner's net worth tends to decrease, as more of his income is allocated towards meeting these obligations. Conversely, when expenses are minimized, a larger portion of Misner's income can be directed towards savings, investments, and other wealth-building activities, ultimately increasing his net worth. Real-life examples of expenses within Tom Misner's net worth could include rent or mortgage payments for his residence, utility bills, groceries, transportation costs, and salaries paid to employees in his businesses.

Understanding the connection between expenses and net worth is crucial for several reasons. Firstly, it highlights the importance of prudent financial management and budgeting. By carefully tracking and controlling expenses, Misner can ensure that his outflows do not exceed his inflows, preserving and growing his net worth over time. Secondly, it underscores the significance of distinguishing between essential and non-essential expenses. Prioritizing essential expenses, such as housing and healthcare, while minimizing non-essential expenses, such as entertainment and luxury items, can significantly impact Misner's financial well-being. Thirdly, it emphasizes the role of expenses in financial planning and forecasting. By accurately assessing his expenses and forecasting future cash outflows, Misner can make informed decisions about his spending habits and financial goals.

Cashflow

Cashflow plays a vital role in determining Tom Misner's net worth, as it measures the movement of funds into and out of his businesses and personal finances. A comprehensive understanding of cashflow is crucial for assessing his financial health and making informed decisions.

- Operating Cashflow

This refers to the cash generated or used in Misner's business operations, including revenue, expenses, and changes in working capital. It provides insights into the efficiency and profitability of his businesses.

- Investing Cashflow

This measures the cash used to acquire or dispose of long-term assets, such as property, equipment, or investments. It indicates Misner's investment strategy and growth plans.

- Financing Cashflow

This represents the cash raised or repaid through debt or equity financing. It shows how Misner is financing his operations and expansion.

- Free Cashflow

This measures the cash available to Misner after accounting for all expenses, investments, and financing activities. It provides an indication of his financial flexibility and ability to generate excess cash.

By analyzing these different facets of cashflow, we gain a comprehensive understanding of Tom Misner's financial performance, investment strategy, and overall financial health. Positive cashflow indicates a healthy financial position, while negative cashflow may signal potential financial challenges or the need for adjustments in operations or financing.

Debt

Debt plays a significant role in shaping Tom Misner's net worth, acting as a double-edged sword with both potential benefits and risks. It represents financial obligations or borrowed funds that must be repaid with interest, impacting his overall financial standing and flexibility.

- Outstanding Loans

Loans taken from banks, financial institutions, or individuals constitute a major portion of debt. These loans can be secured by collateral, such as real estate or equipment, or unsecured, posing varying degrees of risk to Misner's financial well-being.

- Credit Card Debt

Balances carried on credit cards contribute to Misner's debt profile. Credit card debt often incurs high interest rates, making it crucial for him to manage these balances effectively to minimize interest charges and maintain a healthy credit score.

- Business Debt

Debt incurred through business operations, such as loans for expansion or equipment purchases, affects Misner's net worth and cash flow. Prudent management of business debt is essential for maintaining financial stability and ensuring the long-term viability of his ventures.

- Tax Debt

Outstanding tax liabilities to government entities, resulting from unpaid taxes or penalties, can accumulate and impact Misner's financial standing. Timely payment of taxes is crucial for avoiding penalties, legal issues, and potential damage to his creditworthiness.

Understanding the types and amounts of debt that Tom Misner has is essential for assessing his overall financial health. Debt can provide access to capital for growth and investment, but it also carries the burden of interest payments and the risk of default. Balancing the benefits and risks of debt is crucial for Misner to optimize his net worth and maintain long-term financial stability.

Equity

Equity serves as a critical pillar within the landscape of Tom Misner's net worth, representing the ownership interest in his assets after deducting liabilities. Delving into the various facets of equity provides valuable insights into the composition and stability of his financial standing.

- Ownership Stake

This refers to the proportion of a company or asset that Misner owns. A larger ownership stake implies greater control over decisions and potential profits, directly impacting his net worth.

- Home Equity

Equity in real estate, such as his primary residence or investment properties, represents the difference between the property's market value and any outstanding mortgage. Appreciation in property values can significantly boost Misner's net worth.

- Investment Equity

Equity includes ownership in stocks, bonds, and other financial instruments. The value of these investments fluctuates based on market conditions, potentially influencing Misner's net worth.

- Private Equity

Investments in private companies represent another form of equity. These investments are often illiquid, but they offer the potential for high returns if the companies succeed.

Understanding the interplay between these equity components enhances our comprehension of Tom Misner's net worth. A diversified portfolio of equity investments, coupled with strategic management of real estate and ownership stakes, contributes to the stability and growth of his overall financial position.

Financial History

Tom Misner's financial history plays a pivotal role in shaping his current net worth. It encompasses past financial decisions, investments, and financial performance, serving as a roadmap of his financial journey. Understanding this history is crucial as it offers valuable insights into the trajectory of his net worth and provides a foundation for informed future financial planning.

Financial history encompasses various aspects that directly influence Misner's net worth. These include his income history, spending habits, investment performance, and debt management. By analyzing these components, we can assess the factors that have contributed to his current financial standing and identify areas for potential improvement.

Real-life examples of how financial history impacts Tom Misner's net worth include astute investment decisions that have yielded substantial returns, a history of managing debt effectively, and consistent income growth over time. Conversely, poor investment choices, excessive spending, or mishandling of debt can negatively impact net worth. Understanding the cause-and-effect relationship between financial history and net worth empowers Misner to make informed choices that will positively shape his financial future.

The practical significance of understanding the connection between financial history and Tom Misner's net worth lies in its implications for financial planning and wealth management. By examining past financial performance, Misner can identify patterns, assess risks, and make proactive decisions to optimize his financial strategy. This knowledge enables him to set realistic financial goals, allocate resources effectively, and mitigate potential financial challenges.

FAQs on Tom Misner's Net Worth

This section addresses commonly asked questions and clarifies key aspects related to Tom Misner's net worth, providing further insights into his financial standing.

Question 1: How is Tom Misner's net worth calculated?

Answer: Tom Misner's net worth is calculated by subtracting his total liabilities from his total assets, including cash, investments, real estate, and other valuable items he owns.

Question 2: What are the major sources of Tom Misner's wealth?

Answer: Tom Misner has accumulated his wealth through a combination of successful business ventures, real estate investments, and financial investments, such as stocks and bonds.

Question 3: How has Tom Misner's net worth changed over time?

Answer: Tom Misner's net worth has generally increased over time, reflecting the growth of his businesses, the appreciation of his investments, and his prudent financial management.

Question 4: What are the potential risks to Tom Misner's net worth?

Answer: Potential risks to Tom Misner's net worth include economic downturns, fluctuations in investment markets, and changes in tax laws or regulations.

Question 5: How does Tom Misner protect and manage his net worth?

Answer: Tom Misner likely employs a combination of strategies to protect and manage his net worth, such as diversification of investments, risk management, and estate planning.

Question 6: What can we learn from Tom Misner's approach to wealth management?

Answer: Tom Misner's approach to wealth management can offer valuable lessons on building wealth, managing risk, and maintaining financial stability.

These FAQs provide a concise overview of the key aspects and implications of Tom Misner's net worth. To further explore his financial strategies, investments, and overall wealth management approach, refer to the following sections of this article.

Tips for Building a Solid Financial Foundation

This section provides actionable tips to help you build a strong financial foundation, empowering you to achieve your financial goals and secure your financial future.

Tip 1: Create a budget and stick to it. A budget is essential for tracking your income and expenses, ensuring that you live within your means and avoid unnecessary debt.

Tip 2: Save regularly. Make saving a priority by setting up automatic transfers from your checking to your savings account on a regular basis.

Tip 3: Invest wisely. Research and invest in a diversified portfolio of assets, such as stocks, bonds, and real estate, to grow your wealth over time.

Tip 4: Reduce debt. Prioritize paying off high-interest debts, such as credit card balances, to improve your credit score and save money on interest charges.

Tip 5: Protect yourself with insurance. Obtain adequate health, life, and disability insurance to safeguard yourself and your loved ones from unforeseen events.

Tip 6: Seek professional advice when needed. Consult with a financial advisor or tax professional to get personalized guidance and make informed financial decisions.

By implementing these tips, you can build a stronger financial foundation, increase your net worth, and achieve long-term financial success.

The following section will delve into specific strategies for growing your wealth and maximizing your financial potential.

Conclusion

This comprehensive analysis of Tom Misner's net worth provides valuable insights into the various components that contribute to his overall financial standing. By delving into assets, liabilities, investments, income, expenses, cashflow, debt, equity, and financial history, we gain a nuanced understanding of his wealth management strategies and their impact on his net worth.

Key points to remember include: 1) Misner's net worth is largely influenced by his strategic investments and business ventures, which have generated substantial returns over time. 2) Effective management of debt and expenses has been crucial in maintaining a healthy financial position. 3) Misner's financial history underscores the importance of prudent financial planning and risk assessment in building and preserving wealth.

- David Foster Net Worth From Grammy Winning

- A Tragic Loss Remembering Dr Brandon Collofello

- Is Duncan Crabtree Ireland Gay Wiki Partner

- Who Is Natalie Tene What To Know

- Melissa Kaltveit Died Como Park Senior High

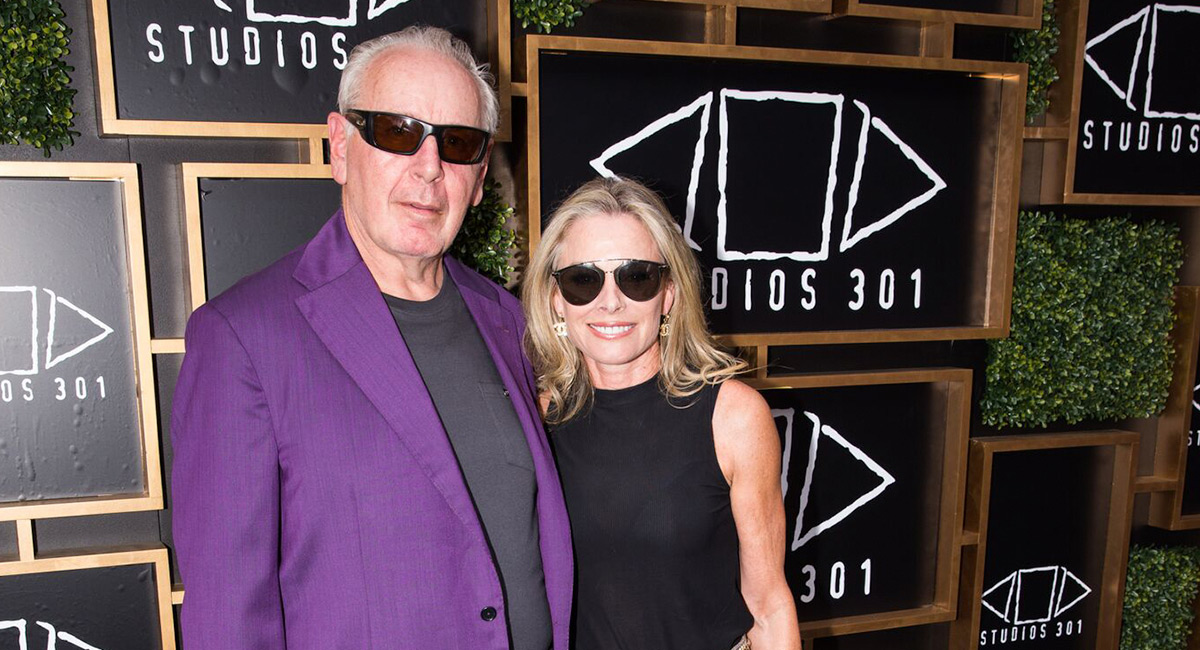

Tom Misner Masterclass Recording, Mixing & Music Business Studios 301

Tom Misner Net Worth Bio, Wiki, Age, Height, Wife, Daughter & Religion

Australia's oldest and largest commercial recording studio Studios 301