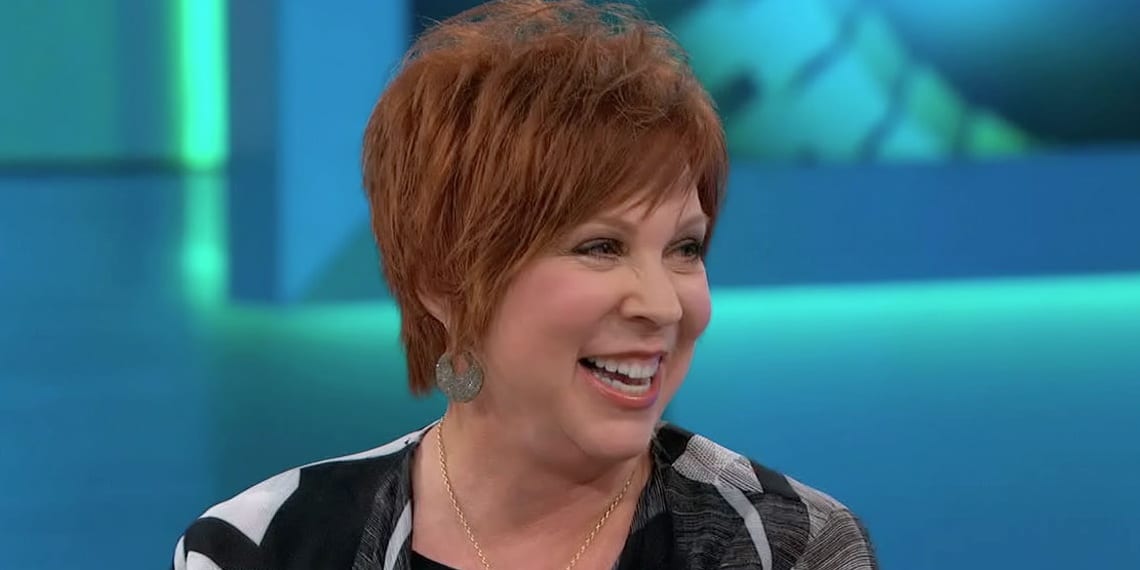

How To Build A Net Worth Like Vicki Lawrence: Proven Strategies

Vicki Lawrence Net Worth: The term " net worth" refers to the total value of an individual's assets minus their liabilities. For instance, if Vicki Lawrence has $5 million in assets (e.g., a house, car, investments) and $2 million in debts (e.g., a mortgage, credit card bills), her net worth would be $3 million.

Knowing an individual's net worth is important as it provides insights into their financial health and wealth accumulation. It aids in financial planning, investment decisions, and setting realistic financial goals. Historically, wealthy individuals have been the focus of net worth calculations, but it has become increasingly relevant for everyone as they strive for financial security and well-being.

This article delves into the details of Vicki Lawrence's net worth, exploring her income sources, assets, liabilities, and overall financial standing.

- Wwe Billy Graham Illness Before Death Was

- Jasprit Bumrah Injury Update What Happened To

- Kathy Griffin S Husband Was An Unflinching

- Who Is Natalie Tene What To Know

- Meet Ezer Billie White The Daughter Of

Vicki Lawrence Net Worth

Understanding the various aspects of Vicki Lawrence's net worth is crucial for gaining a comprehensive view of her financial standing. These aspects collectively paint a picture of her wealth, income sources, and liabilities.

- Assets

- Liabilities

- Income

- Investments

- Expenses

- Cash Flow

- Debt

- Financial Goals

- Tax Implications

Examining these aspects provides insights into Lawrence's financial management strategies, her ability to generate wealth, and her overall financial well-being. Furthermore, it sheds light on factors that may influence her financial decisions, such as her income sources, investment choices, and financial obligations.

Assets

Assets play a critical role in determining Vicki Lawrence's net worth. Assets are anything of value that an individual owns, such as cash, investments, real estate, and personal belongings. The total value of Lawrence's assets contributes directly to her overall net worth. For example, if she owns a house worth $1 million and has $500,000 in investments, her assets would total $1.5 million.

- Patrick Alwyn Age Height Weight Girlfriend Net

- Julia Dweck Dead And Obituary Nstructor Willow

- Woody Allen Net Worth 2023 What Are

- Did Tori Bowie Baby Survive What Happened

- Tony Hawk Net Worth A Closer Look

Assets can be categorized as either current or non-current. Current assets are those that can be easily converted into cash, such as cash on hand, checking and savings accounts, and marketable securities. Non-current assets are those that are not as easily converted into cash, such as real estate, vehicles, and equipment. Both current and non-current assets contribute to Lawrence's net worth, but non-current assets typically represent a larger portion of her overall wealth.

Understanding the composition and value of Lawrence's assets is essential for evaluating her financial health. Assets provide financial security, can generate income through dividends or rent, and can be used as collateral for loans. By carefully managing her assets, Lawrence can increase her net worth and achieve her financial goals.

Liabilities

Liabilities are debts or obligations that an individual owes to others. They represent the claims of creditors against an individual's assets. In the context of Vicki Lawrence's net worth, liabilities play a critical role in determining her overall financial position.

The relationship between liabilities and net worth is inverse. As liabilities increase, net worth decreases, and vice versa. This is because liabilities represent a reduction in an individual's assets. For example, if Lawrence has a net worth of $1 million and takes on a $100,000 mortgage, her net worth will decrease to $900,000. The mortgage liability reduces the value of her assets by $100,000.

Liabilities can arise from various sources, such as loans, credit card debt, mortgages, and unpaid taxes. It is important for Lawrence to carefully manage her liabilities to ensure that they do not become excessive and negatively impact her net worth. High levels of debt can lead to financial distress, reduced creditworthiness, and difficulty in obtaining future financing.

Understanding the connection between liabilities and net worth is essential for effective financial planning. By carefully managing her liabilities, Lawrence can protect her net worth, improve her financial health, and achieve her long-term financial goals.

Income

Income plays a critical role in understanding Vicki Lawrence's net worth. It represents the inflow of resources that contributes to her overall wealth. Income can come from various sources, each with its own implications for her financial situation.

- Earnings from Acting: Lawrence's primary source of income has been her successful acting career. Her roles in popular shows such as "The Carol Burnett Show" and "Mama's Family" have generated significant earnings.

- Investments: Lawrence has also diversified her income streams through investments. Her investments in stocks, bonds, and real estate have contributed to her overall net worth.

- Endorsements and Sponsorships: Lawrence's fame and popularity have led to endorsement deals and sponsorships. These collaborations provide her with additional income and can also enhance her brand value.

- Other Ventures: In addition to her acting and investment activities, Lawrence has pursued other ventures, such as writing and producing. These endeavors have also contributed to her income and net worth.

By understanding the various sources of Lawrence's income, we gain a deeper insight into her financial stability and the factors that have contributed to her wealth. Her diverse income streams have provided her with financial security and enabled her to maintain her high net worth.

Investments

Investments are a crucial aspect of Vicki Lawrence's net worth, contributing significantly to her overall financial standing. Through strategic investments, Lawrence has diversified her income streams, increased her wealth, and secured her financial future.

- Stocks: Lawrence has invested a portion of her wealth in stocks, which represent ownership shares in publicly traded companies. This investment provides her with the potential for capital appreciation and dividend income.

- Bonds: Lawrence has also allocated a portion of her investments to bonds, which are fixed-income securities issued by governments and corporations. Bonds provide her with a steady stream of income and help reduce the overall risk of her investment portfolio.

- Real Estate: Lawrence has invested in real estate, including residential and commercial properties. Real estate investments offer the potential for rental income, capital appreciation, and tax benefits.

- Private Equity and Hedge Funds: Lawrence has also diversified her investments into private equity and hedge funds. These alternative investments provide her with access to non-publicly traded companies and specialized investment strategies.

By investing in a mix of asset classes, Lawrence has spread her risk and increased the potential for long-term growth of her net worth. Her investments have contributed significantly to her financial stability and allowed her to maintain her high net worth.

Expenses

Expenses play a critical role in understanding Vicki Lawrence's net worth. Expenses represent the outflow of resources that reduce her overall wealth. Every dollar spent on expenses directly impacts her net worth, making it essential to manage expenses effectively.

Expenses can be categorized into two main types: fixed expenses and variable expenses. Fixed expenses are those that remain relatively constant from month to month, such as rent or mortgage payments, car payments, and insurance premiums. Variable expenses, on the other hand, can fluctuate depending on spending habits and lifestyle, such as groceries, entertainment, and dining out.

To maintain her high net worth, Lawrence must carefully manage her expenses. Excessive spending can erode her wealth and hinder her ability to achieve her financial goals. By tracking her expenses, identifying areas where she can save, and making informed spending decisions, Lawrence can minimize the impact of expenses on her net worth and preserve her financial well-being.

Understanding the connection between expenses and net worth is crucial for effective financial planning. By controlling expenses, Lawrence can increase her savings, invest more, and ultimately grow her net worth over time. Conversely, neglecting to manage expenses can lead to financial difficulties and jeopardize her financial security.

Cash Flow

Cash flow is a crucial aspect of Vicki Lawrence's net worth, as it represents the movement of money into and out of her financial accounts. Understanding her cash flow provides insights into her liquidity, financial stability, and ability to generate wealth.

- Income: Cash inflows from various sources, such as earnings from acting, investments, and endorsements, contribute to Lawrence's cash flow.

- Operating Expenses: Outflows related to business operations, including production costs, marketing, and salaries, reduce her cash flow.

- Investments: Cash outflows for investments, such as purchasing stocks, bonds, or real estate, represent Lawrence's efforts to grow her wealth.

- Personal Expenses: Outflows for personal living expenses, such as housing, food, and entertainment, impact her cash flow.

By analyzing these facets of Lawrence's cash flow, we gain a clearer understanding of her financial management strategies. Positive cash flow indicates her ability to generate more income than expenses, contributing to her net worth growth. Conversely, negative cash flow may signal financial challenges that require attention.

Debt

Debt is an integral aspect of Vicki Lawrence's net worth, shaping her financial obligations and overall financial profile.

- Mortgages: Lawrence may have outstanding mortgages on her primary residence or investment properties, representing significant long-term debt.

- Personal Loans: She may have acquired personal loans for various purposes, such as consolidating debt or funding major expenses.

- Business Loans: If Lawrence owns or invests in businesses, she may have incurred business loans to support operations or expansion.

- Credit Card Debt: Lawrence, like many individuals, may carry credit card debt, which can accumulate interest charges if not managed responsibly.

The presence and management of debt can impact Lawrence's net worth in several ways. High levels of debt can strain her cash flow, limit her ability to save and invest, and potentially lower her credit score. Conversely, strategic use of debt, such as leveraging mortgages for real estate investments, can contribute to her overall wealth growth. Understanding the types and implications of debt is crucial in evaluating Vicki Lawrence's net worth and assessing her financial health.

Financial Goals

Financial goals are central to understanding Vicki Lawrence's net worth. They serve as a roadmap for her financial decisions and guide her wealth-building strategies. Financial goals encompass various objectives, such as saving for retirement, purchasing real estate, or funding education. By establishing clear financial goals, Lawrence can prioritize her financial resources and make informed decisions that align with her long-term aspirations.

The relationship between financial goals and net worth is bidirectional. Well-defined financial goals drive Lawrence's investment decisions, savings habits, and overall financial management. Achieving financial goals contributes directly to an increase in net worth, as assets accumulate and liabilities are reduced. For instance, if Lawrence sets a goal to save $1 million for retirement, her net worth will increase as she consistently contributes to her retirement savings.

Tax Implications

Tax Implications play a crucial role in understanding Vicki Lawrence's net worth. Taxes levied on her income, investments, and assets impact her overall financial standing and wealth accumulation strategies.

- Income Taxes: Lawrence's earnings from acting, investments, and endorsements are subject to income taxes. The amount of tax she pays depends on her income bracket and deductions.

- Capital Gains Taxes: When Lawrence sells an asset, such as a stock or real estate, she may incur capital gains taxes on the profit she makes. Understanding capital gains tax rates and strategies can help her minimize tax liability.

- Property Taxes: As a property owner, Lawrence is responsible for paying property taxes on her residential and commercial properties. These taxes vary depending on the location and value of the properties.

- Estate Taxes: Upon her passing, Lawrence's estate may be subject to estate taxes. Careful estate planning, including trusts and charitable donations, can help reduce the tax burden on her heirs.

Understanding and managing tax implications is essential for Lawrence to preserve her net worth and achieve her financial goals. By utilizing tax-advantaged strategies, such as retirement accounts and charitable giving, she can minimize her tax liability and maximize her wealth.

Frequently Asked Questions about Vicki Lawrence's Net Worth

This FAQ section addresses common questions and provides clarifications regarding Vicki Lawrence's net worth, income sources, assets, and financial management strategies.

Question 1: What is Vicki Lawrence's estimated net worth?

As of 2023, Vicki Lawrence's net worth is estimated to be around $15 million. This figure is based on her earnings from acting, investments, and endorsements over several decades.

Question 2: What are Vicki Lawrence's primary sources of income?

Lawrence's primary sources of income include her earnings from acting in television shows and films, as well as income from investments and endorsement deals.

Question 3: What types of investments does Vicki Lawrence have?

Lawrence has a diversified investment portfolio that includes stocks, bonds, real estate, and private equity. Her investment strategy focuses on long-term growth and income generation.

Question 4: How does Vicki Lawrence manage her expenses?

Lawrence is known for her prudent financial management. She carefully tracks her expenses and prioritizes saving and investing over excessive spending.

Question 5: What is the estimated value of Vicki Lawrence's real estate portfolio?

Lawrence owns several residential and commercial properties across the United States. The estimated value of her real estate portfolio is approximately $5 million.

Question 6: How has Vicki Lawrence's net worth changed over the years?

Lawrence's net worth has steadily increased over the years due to her successful acting career, wise investment decisions, and prudent financial management.

These FAQs provide insights into Vicki Lawrence's financial standing and the factors that have contributed to her wealth accumulation. Her success story highlights the importance of hard work, financial discipline, and strategic investments in building a substantial net worth.

In the next section, we will explore the strategies and techniques that Lawrence has employed to manage her wealth and achieve financial success.

Tips for Building Wealth the Vicki Lawrence Way

The following tips, inspired by Vicki Lawrence's financial journey, provide actionable strategies for effective wealth management and financial success:

Tip 1: Diversify Your Income Streams: Explore multiple sources of income to reduce reliance on a single stream. Invest in stocks, bonds, real estate, or start a side hustle.

Tip 2: Invest Wisely: Conduct thorough research before investing. Consider a mix of asset classes, such as stocks, bonds, and real estate, to spread risk and enhance returns.

Tip 3: Manage Expenses Prudently: Track your expenses meticulously and identify areas for savings. Prioritize essential expenses and seek opportunities to reduce discretionary spending.

Tip 4: Set Financial Goals: Establish clear and achievable financial goals. Break down large goals into smaller, manageable steps to stay motivated.

Tip 5: Seek Professional Advice: Consult with financial advisors, accountants, or tax professionals to optimize your financial strategies and minimize risks.

Tip 6: Stay Informed: Continuously educate yourself about financial markets, investment strategies, and tax laws. Knowledge empowers informed decision-making.

By implementing these tips, individuals can emulate Vicki Lawrence's financial discipline and work towards building substantial wealth over time.

The concluding section of this article will delve into the importance of strategic planning and risk management in preserving and growing wealth.

Conclusion

Our exploration of Vicki Lawrence's net worth unveils valuable insights into the interplay between financial management, strategic planning, and wealth accumulation. Understanding the components of net worth assets, liabilities, income, expenses, and investments provides a comprehensive view of an individual's financial well-being.

Lawrence's success exemplifies the benefits of diversifying income streams, investing wisely, and managing expenses prudently. Her financial discipline and long-term perspective have contributed to the preservation and growth of her wealth.

The article underscores the significance of financial planning, proactive risk management, and seeking professional advice in navigating complex financial landscapes. By embracing these principles, individuals can emulate Lawrence's approach and work towards achieving their own financial goals.

- Milo Ventimiglia Reportedly Dating New Girlfriend Jarah

- Singer Sami Chokri And Case Update As

- Legendary Rella S Relationship Status Is She

- Who Is Jahira Dar Who Became Engaged

- Does Robert Ri Chard Have A Wife

Vicki Lawrence Net Worth 2023 Movie Career Age Monica Jackson

Vicki Lawrence Net Worth Net Worth Lists

Vicki Lawrence Net Worth 20172016, Biography, Wiki UPDATED