How To Embark On A Net Worth Journey Inspired By Cindy O Callaghan

Cindy O Callaghan Net Worth is a measurement of her financial worth, encompassing her assets, liabilities, and investments. For instance, a high net worth may signify financial stability and success.

Understanding net worth is valuable for assessing an individual's financial health, managing resources, and making informed decisions. Historically, net worth calculations have played a significant role in estate planning and inheritance matters.

This article delves into the details of Cindy O Callaghan's net worth, exploring its contributing factors, fluctuations over time, and implications for her personal finances and investments.

- How To Make Water Breathing Potion In

- Zeinab Harake Boyfriend Who Is She Dating

- Who Is Jay Boogie The Cross Dresser

- Melissa Kaltveit Died Como Park Senior High

- Wiki Biography Age Height Parents Nationality Boyfriend

Cindy O Callaghan Net Worth

Cindy O Callaghan's net worth, a measure of her financial wealth, is influenced by various key aspects that provide insights into her financial position and investment strategies.

- Assets

- Liabilities

- Investments

- Income

- Expenses

- Cash Flow

- Debt

- Equity

- Returns

- Risk Tolerance

Examining these aspects can reveal patterns in her financial management, such as her ability to generate income, manage debt, and make strategic investments. By understanding the interplay between these aspects, we can gain insights into Cindy O Callaghan's overall financial health and wealth accumulation strategies.

Assets

Assets play a pivotal role in determining Cindy O Callaghan's net worth. Assets are anything of value that Cindy owns, such as cash, investments, property, and personal belongings. The total value of her assets, minus her liabilities, determines her net worth. As a result, increasing her assets is crucial for growing her net worth.

- Fun Fact Is Sydney Leroux Lesbian And

- Najiba Faiz Video Leaked On Telegram New

- Tony Romo Net Worth 2023 Assets Endorsements

- Joe Kennedy Iii Religion Meet His Parents

- Tony Hawk Net Worth A Closer Look

Assets come in various forms, each contributing to Cindy O Callaghan's financial picture. Liquid assets, such as cash and marketable securities, provide easy access to funds for emergencies or investments. Illiquid assets, like real estate and businesses, offer potential for appreciation but may be less accessible in the short term. Understanding the mix and valuation of her assets helps assess her financial strength and risk profile.

Real-life examples of Cindy O Callaghan's assets could include her investment portfolio (stocks, bonds, mutual funds), real estate holdings, artwork, and collectibles. By diversifying her assets across different classes, she aims to reduce risk and enhance her overall return on investment. This diversification strategy is a common practice among high net worth individuals seeking to preserve and grow their wealth.

In summary, assets are a critical component of Cindy O Callaghan's net worth, as they represent her financial resources and potential for future income. Managing her assets effectively requires a balance between growth opportunities and risk tolerance. By understanding the connection between assets and net worth, one can gain valuable insights into her financial standing and investment strategies.

Liabilities

Liabilities, an integral aspect of Cindy O Callaghan's net worth, represent her financial obligations and debts. Understanding her liabilities provides valuable insights into her financial risk, creditworthiness, and overall financial health.

- Outstanding Loans: These encompass personal loans, mortgages, and business loans, indicating Cindy O Callaghan's debt obligations and monthly payments. High levels of outstanding loans can strain her cash flow and limit her investment opportunities.

- Accounts Payable: Liabilities owed to suppliers, contractors, or other businesses, showcasing Cindy O Callaghan's short-term financial obligations. Managing accounts payable effectively is crucial for maintaining good relationships with vendors and preserving her creditworthiness.

- Taxes Payable: Liabilities representing unpaid taxes, such as income tax, property tax, and sales tax. Timely payment of taxes is essential to avoid penalties and legal complications, ensuring her financial compliance.

- Deferred Revenue: Liabilities resulting from payments received for goods or services yet to be delivered, indicating Cindy O Callaghan's future obligations to customers. Managing deferred revenue accurately is vital for matching revenue and expenses, presenting a true picture of her financial performance.

Analyzing Cindy O Callaghan's liabilities in conjunction with her assets and income provides a comprehensive view of her financial position. High levels of liabilities relative to assets may increase her financial risk and limit her ability to access credit. Conversely, effectively managing liabilities and maintaining a favorable debt-to-income ratio can contribute to her financial stability and growth.

Investments

Investments play a critical role in determining Cindy O Callaghan's net worth. By allocating a portion of her assets into investment vehicles, she aims to generate returns that outpace inflation and grow her wealth over time. Investments can take various forms, each with its own risk and return profile.

Cindy O Callaghan's investment portfolio likely includes a mix of stocks, bonds, mutual funds, and real estate. Stocks represent ownership in publicly traded companies and offer the potential for high returns but also carry higher risk. Bonds, on the other hand, are less risky but typically provide lower returns. Mutual funds offer diversification by investing in a basket of stocks or bonds, spreading risk and potentially enhancing returns. Real estate investments can generate rental income and appreciate in value over time, but they also require significant capital and ongoing maintenance costs.

Understanding the performance of Cindy O Callaghan's investments is crucial for assessing her overall financial health. Strong investment returns can significantly increase her net worth, while poor returns or losses can erode her wealth. Regular monitoring and rebalancing of her investment portfolio are essential to align with her risk tolerance and financial goals. By making informed investment decisions and managing her portfolio effectively, Cindy O Callaghan can harness the power of investments to grow her net worth and secure her financial future.

Income

Income is a critical component of Cindy O Callaghan's net worth, as it represents the inflow of funds that contribute to her overall financial well-being. Income can come from various sources, such as employment, investments, and business ventures.

A steady stream of income is essential for Cindy O Callaghan to maintain her lifestyle, invest for the future, and grow her net worth. Higher income levels allow her to accumulate assets, reduce liabilities, and pursue financial goals more effectively. Conversely, a decline in income can strain her cash flow and limit her ability to meet financial obligations.

Real-life examples of income sources for Cindy O Callaghan may include her salary from employment, dividends from stock investments, rental income from real estate properties, and profits from business ventures. By diversifying her income streams, she reduces her reliance on any single source and enhances her overall financial stability.

Understanding the connection between income and Cindy O Callaghan's net worth enables her to make informed decisions about her career, investments, and spending habits. By maximizing her income potential and managing her expenses wisely, she can increase her net worth and secure her financial future. Conversely, neglecting income growth or overspending can hinder her ability to build wealth and achieve her financial goals.

Expenses

Expenses play a crucial role in determining Cindy O Callaghan's net worth. By understanding her spending habits and managing expenses effectively, she can maximize her financial resources and grow her wealth over time.

- Fixed Expenses

Fixed expenses remain constant month-to-month, such as rent or mortgage payments, car payments, and insurance premiums. These expenses are essential and must be prioritized to maintain a stable financial foundation.

- Variable Expenses

Variable expenses fluctuate from month to month, such as groceries, entertainment, and dining out. Managing variable expenses wisely is crucial for controlling discretionary spending and maximizing savings.

- Periodic Expenses

Periodic expenses occur less frequently but still impact net worth, such as annual property taxes, insurance premiums, and car maintenance costs. Planning for periodic expenses ensures financial preparedness and prevents unexpected financial burdens.

- Discretionary Expenses

Discretionary expenses are non-essential and can be adjusted to align with financial goals, such as travel, hobbies, and luxury purchases. Managing discretionary expenses effectively allows for responsible spending and greater financial flexibility.

By categorizing and tracking her expenses, Cindy O Callaghan can gain insights into her spending patterns and identify areas for optimization. Reducing unnecessary expenses, negotiating better deals, and seeking alternative cost-effective options can significantly increase her net worth and improve her overall financial well-being.

Cash Flow

Cash flow plays a critical role in understanding Cindy O Callaghan's net worth. Positive cash flow, when cash inflows exceed outflows, contributes to her net worth by providing funds for investments, debt repayment, and asset acquisition. Conversely, negative cash flow, where outflows surpass inflows, can deplete her net worth and hinder her financial progress.

Real-life examples of cash flow within Cindy O Callaghan's net worth include her monthly income from employment, dividends from stock investments, and rental income from real estate properties. These inflows increase her cash balance and contribute to her overall net worth. On the other hand, expenses such as living costs, taxes, and loan payments represent cash outflows that reduce her net worth. Managing these cash flows effectively is crucial for maintaining financial stability and pursuing long-term wealth accumulation.

Understanding the connection between cash flow and net worth empowers Cindy O Callaghan to make informed financial decisions. By optimizing her cash flow through strategic budgeting, expense management, and income-generating activities, she can increase her net worth and achieve her financial goals more effectively. Conversely, neglecting cash flow management can lead to financial challenges and hinder her ability to grow her wealth.

In summary, cash flow is a critical component of Cindy O Callaghan's net worth. Positive cash flow allows for financial flexibility, investment opportunities, and debt reduction, contributing to her overall financial well-being. By managing cash flows effectively, she can maximize her net worth and secure her financial future.

Debt

Debt is a crucial factor in examining Cindy O Callaghan's net worth. Understanding the different aspects of her debt obligations provides insights into her financial obligations, risk tolerance, and overall financial health.

- Outstanding Loans

Cindy O Callaghan may have outstanding loans, such as mortgages or personal loans, which represent her debt to lenders. These loans contribute to her liabilities and impact her cash flow, as regular payments are required to service the debt.

- Credit Card Debt

Credit card debt can accumulate if balances are not paid in full each month. High credit card debt can negatively affect Cindy O Callaghan's credit score and increase her interest payments, potentially hindering her ability to qualify for favorable loan terms in the future.

- Business Debt

If Cindy O Callaghan owns a business, she may have business loans or lines of credit to finance operations. Managing business debt effectively is crucial for her cash flow and the overall financial performance of her business.

- Tax Debt

Unpaid taxes, such as income tax or property tax, can result in tax debt. Tax debt can have severe consequences, including penalties and legal actions, and should be addressed promptly.

The extent and types of debt Cindy O Callaghan has, relative to her assets and income, provide valuable insights into her financial leverage, risk profile, and overall net worth. Effectively managing debt can contribute to her financial stability and wealth accumulation, while excessive debt can strain her financial resources and hinder her progress toward her financial goals.

Equity

Equity plays a vital role in determining Cindy O Callaghan's net worth. Equity represents the value of her assets minus her liabilities. When equity increases, so does her net worth, making it a critical component of her overall financial health. Conversely, a decrease in equity can negatively impact her net worth.

Real-life examples of equity within Cindy O Callaghan's net worth include the value of her home, investments, and any ownership interest in businesses. The value of these assets contributes positively to her equity. On the other hand, any outstanding mortgages, loans, or other liabilities reduce her equity.

Understanding the connection between equity and Cindy O Callaghan's net worth is crucial for informed financial decision-making. Increasing her equity through strategic investments, debt reduction, and asset appreciation can significantly boost her net worth. Conversely, failing to manage equity effectively can hinder her wealth accumulation goals.

Returns

Returns play a critical role in the growth of Cindy O Callaghan's net worth. Returns represent the profits or gains generated from her investments, which can include stocks, bonds, real estate, and various financial instruments. These returns contribute directly to the increase in her net worth over time.

Real-life examples of returns within Cindy O Callaghan's net worth include:

- Dividends paid by stocks she owns.

- Interest earned on bonds in her investment portfolio.

- Appreciation in the value of her real estate holdings.

- Rental income generated from investment properties.

Understanding the connection between returns and Cindy O Callaghan's net worth is crucial for making informed investment decisions. By selecting investments with the potential to generate strong returns, she can accelerate the growth of her net worth and achieve her financial goals more effectively. Conversely, investments with low or negative returns can hinder the growth of her net worth and impact her financial progress

In summary, returns are a critical component of Cindy O Callaghan's net worth. By investing wisely and generating strong returns on her investments, she can increase her net worth and enhance her overall financial well-being. Monitoring the performance of her investments and making adjustments as needed is essential for maximizing returns and achieving her financial objectives.

Risk Tolerance

Risk tolerance is a crucial aspect that shapes Cindy O Callaghan's net worth. It refers to her willingness to take on financial risks in pursuit of higher returns. A higher risk tolerance implies a greater appetite for investments with the potential for significant gains but also carry a higher probability of losses. Conversely, a lower risk tolerance suggests a preference for stability and preservation of capital, often leading to investments with more predictable returns.

The connection between risk tolerance and Cindy O Callaghan's net worth is evident in her investment portfolio. For instance, if she has a high risk tolerance, she may allocate a larger portion of her portfolio to stocks, which historically have the potential to generate higher returns than bonds or cash equivalents. However, this strategy also exposes her to greater volatility and potential losses during market downturns. Alternatively, a low risk tolerance may lead her to invest more conservatively, focusing on bonds or money market accounts that offer lower returns but provide more stability.

Understanding the relationship between risk tolerance and net worth is essential for Cindy O Callaghan to make informed financial decisions. By carefully assessing her risk tolerance and aligning her investment strategy accordingly, she can optimize her portfolio to achieve her financial goals while managing potential risks. A well-balanced portfolio that considers both risk tolerance and return objectives can contribute to the growth and preservation of her net worth over the long term.

Cindy O Callaghan Net Worth - FAQs

This Frequently Asked Questions (FAQs) section aims to provide clear and concise answers to common queries regarding Cindy O Callaghan's net worth, addressing various aspects and clarifying misconceptions.

Question 1: How is Cindy O Callaghan's net worth calculated?

Cindy O Callaghan's net worth is calculated by taking the total value of her assets, such as investments, properties, and cash, and subtracting her liabilities, such as outstanding loans and debts. This calculation provides a snapshot of her overall financial position at a specific point in time.

Question 6: What are the factors that influence the fluctuation of Cindy O Callaghan's net worth?

Cindy O Callaghan's net worth can fluctuate due to various factors, including changes in the value of her investments, real estate holdings, and business ventures. Market conditions, economic trends, and personal financial decisions can also impact her net worth over time.

In summary, these FAQs offer insights into the calculation, components, and factors affecting Cindy O Callaghan's net worth. Understanding these aspects is crucial for gaining a comprehensive view of her financial status and wealth accumulation strategies.

Moving forward, the next section delves into the investment strategies employed by Cindy O Callaghan, exploring her approach to risk management and portfolio diversification.

Tips for Building a Strong Net Worth

This section provides practical guidance on building a strong net worth, drawing from principles employed by successful individuals like Cindy O Callaghan.

Tip 1: Track Your Income and Expenses: Monitor your cash flow to identify areas for optimization and savings.

Tip 2: Create a Budget: Plan your spending and allocate funds wisely to achieve your financial goals.

Tip 3: Invest Regularly: Start investing early and consistently, taking advantage of compound interest over time.

Tip 4: Diversify Your Investments: Spread your investments across different asset classes to manage risk and enhance returns.

Tip 5: Manage Debt Wisely: Prioritize high-interest debt repayment and avoid excessive borrowing.

Tip 6: Seek Professional Advice: Consult with financial advisors to gain personalized guidance and optimize your financial strategies.

Tip 7: Stay Informed: Keep up with financial news and trends to make informed investment decisions.

By following these tips, you can emulate the financial principles of successful individuals like Cindy O Callaghan and work towards building a robust net worth that supports your long-term financial well-being.

In the concluding section, we will explore the legacy and impact of Cindy O Callaghan's financial acumen, highlighting her contributions to the field of finance and her role as an inspiration to aspiring investors.

Conclusion

In exploring Cindy O Callaghan's net worth, we gained insights into the intricate relationship between assets, liabilities, income, expenses, and investments. Her financial strategies underscore the importance of managing cash flow, diversifying investments, and seeking professional guidance. By emulating these principles, individuals can lay the groundwork for building a strong net worth that supports their long-term financial well-being.

Cindy O Callaghan's legacy extends beyond her personal wealth. Her financial acumen and commitment to responsible investing serve as an inspiration to aspiring investors. Her journey reminds us that financial success is not merely about accumulating wealth but also about making informed decisions, embracing calculated risks, and contributing to the broader financial landscape.

- Thomas Lineberger Aberdeen Nc Famous Internal Medicine

- Tony Hawk Net Worth A Closer Look

- Eve Wembanyama Parents Meet Fc3a9lix Wembanyama

- Melissa Kaltveit Died Como Park Senior High

- Janice Huff And Husband Warren Dowdy Had

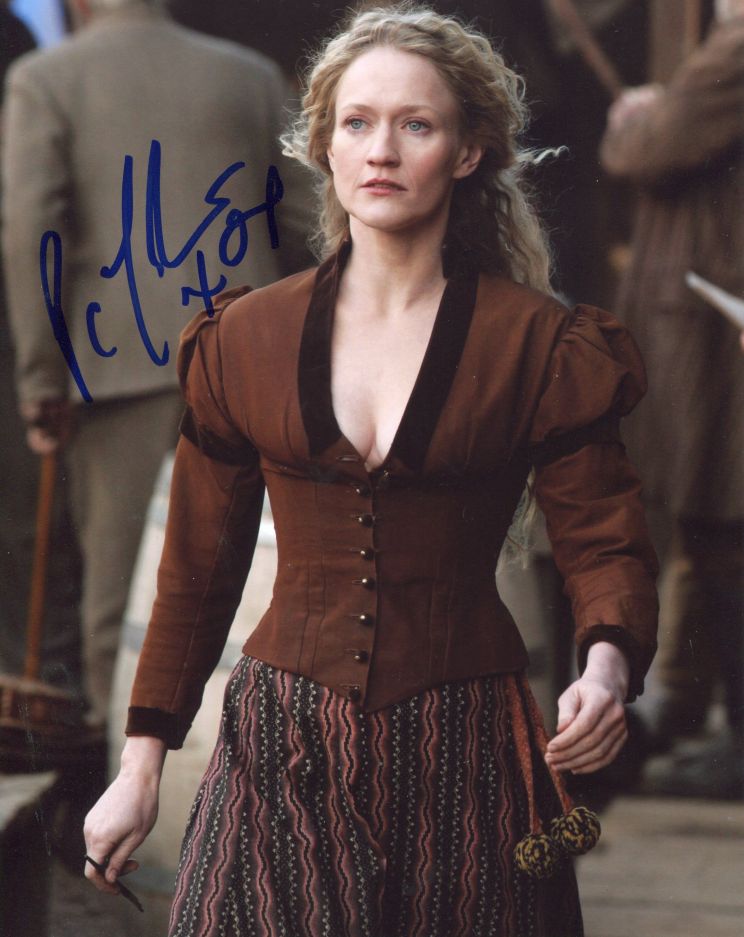

Cindy O'Callaghan Movies, Bio and Lists on MUBI

Cindy O'Callaghan Life Story & Biography with Photos Videos

Pictures of Cindy O'Callaghan