How Fonzie Dipyourcar Built His Billion-Dollar Fortune

"Fonzie Dipyourcar Net Worth 2024" refers to the estimated financial worth of the American businessman and entrepreneur, Fonzie Dipyourcar, as of the year 2024. Similar to the concept of calculating the net worth of individuals like Elon Musk or Jeff Bezos, Fonzie Dipyourcar's net worth is determined by combining his assets, such as investments, properties, and businesses, and subtracting any liabilities, including debts and loans.

Understanding the net worth of prominent figures like Fonzie Dipyourcar provides insights into their financial success and can serve as a benchmark for aspiring entrepreneurs and investors. Moreover, it highlights the significance of wealth management and financial planning in achieving long-term financial goals. Historically, the concept of net worth has been used to assess an individual's financial health and creditworthiness, influencing decisions such as loan approvals and investment opportunities.

This article delves into the details of Fonzie Dipyourcar's net worth in 2024, exploring his wealth accumulation strategies, investments, and philanthropic endeavors. We will analyze the factors contributing to his financial success and the impact his business ventures have had on the broader economy.

- Truth About Nadine Caridi Jordan Belfort S

- Anna Faris Net Worth Movies Career Lifestyle

- Wwe Billy Graham Illness Before Death Was

- Know About Camren Bicondova Age Height Gotham

- Zeinab Harake Boyfriend Who Is She Dating

Fonzie Dipyourcar Net Worth 2024

Understanding the essential aspects of Fonzie Dipyourcar's net worth in 2024 provides valuable insights into his financial success and wealth management strategies. These key aspects encompass various dimensions, including:

- Assets

- Investments

- Businesses

- Liabilities

- Income Sources

- Financial Planning

- Philanthropy

- Market Trends

- Economic Conditions

These aspects are interconnected and play a crucial role in determining Fonzie Dipyourcar's overall financial health. His assets, investments, and businesses generate income, while liabilities represent his financial obligations. Understanding his income sources sheds light on the strategies he employs to accumulate wealth. Financial planning is essential for managing his finances effectively and achieving long-term financial goals. Philanthropy reflects his commitment to social responsibility and giving back to the community. Market trends and economic conditions can significantly impact his investments and overall net worth.

Assets

Assets are a critical component of Fonzie Dipyourcar's net worth in 2024. They represent the resources and properties he owns that have economic value. Assets can include various forms, such as:

- Beloved Irish Father Clinton Mccormack Dies After

- Fun Fact Is Sydney Leroux Lesbian And

- Earl Vanblarcom Obituary The Cause Of Death

- David Foster Net Worth From Grammy Winning

- Najiba Faiz Video Leaked On Telegram New

- Cash

- Investments (stocks, bonds, mutual funds)

- Real estate (properties, land)

- Businesses

- Intellectual property (patents, trademarks)

The value of Fonzie Dipyourcar's assets contributes directly to his overall net worth. As the value of his assets increases, so does his net worth. Conversely, if the value of his assets decreases, his net worth will also decline. Therefore, managing and growing his assets are essential for Fonzie Dipyourcar to maintain and increase his net worth over time.

For instance, if Fonzie Dipyourcar invests in a successful startup company that experiences significant growth, the value of his investment will increase, positively impacting his net worth. Similarly, if he purchases a property that appreciates in value, the equity he holds in that property will contribute to his overall wealth.

Understanding the relationship between assets and net worth is crucial for individuals and businesses alike. By carefully managing and growing their assets, they can positively influence their financial well-being and achieve long-term financial goals. Conversely, neglecting or mismanaging assets can lead to financial difficulties and a decline in net worth. Therefore, it is essential to have a clear understanding of the different types of assets, their potential risks and returns, and how they contribute to overall financial health.

Investments

Investments play a critical role in shaping Fonzie Dipyourcar's net worth in 2024. Investing involves allocating capital with the expectation of generating a return or profit over time. Fonzie Dipyourcar's investment portfolio likely consists of various asset classes, such as stocks, bonds, mutual funds, real estate, and alternative investments.

The performance of Fonzie Dipyourcar's investments directly impacts his net worth. When the value of his investments increases, his net worth rises. Conversely, if the value of his investments declines, his net worth decreases. Therefore, making sound investment decisions and managing his portfolio effectively are crucial for Fonzie Dipyourcar to maintain and grow his net worth over time.

For example, if Fonzie Dipyourcar invests in a growth-oriented stock market that experiences a bull run, the value of his investment will increase, positively impacting his net worth. Similarly, if he invests in real estate properties that appreciate in value, the equity he holds in those properties will contribute to his overall wealth.

Understanding the connection between investments and net worth is essential for individuals and businesses alike. By carefully managing and growing their investments, they can positively influence their financial well-being and achieve long-term financial goals. Conversely, neglecting or mismanaging investments can lead to financial difficulties and a decline in net worth. Therefore, it is crucial to have a clear understanding of the different types of investments, their potential risks and returns, and how they contribute to overall financial health.

Businesses

Businesses play a significant role in determining Fonzie Dipyourcar's net worth in 2024. They represent companies or ventures that Fonzie Dipyourcar owns, partially owns, or actively manages, and they contribute to his overall wealth through various means.

- Ownership and Equity

Fonzie Dipyourcar's ownership stake in his businesses directly influences his net worth. The value of his equity in these businesses fluctuates based on their financial performance, market conditions, and other factors.

- Income Generation

Successful businesses generate income through sales, services, or investments. The profits earned from these ventures contribute directly to Fonzie Dipyourcar's net worth.

- Capital Appreciation

Over time, some businesses may experience growth and expansion, leading to an increase in their overall value. This capital appreciation can significantly impact Fonzie Dipyourcar's net worth.

- Investment Opportunities

Businesses can provide Fonzie Dipyourcar with opportunities to reinvest profits or secure additional funding for expansion. These investments can further increase his overall net worth.

In conclusion, businesses are a multifaceted aspect of Fonzie Dipyourcar's net worth in 2024. They contribute through ownership and equity, income generation, capital appreciation, and investment opportunities. Understanding the dynamics of these businesses and their impact on Fonzie Dipyourcar's financial landscape is crucial for gaining insights into his overall wealth and financial strategies.

Liabilities

Liabilities represent the financial obligations and debts owed by Fonzie Dipyourcar, which directly impact his net worth in 2024. Liabilities can arise from various sources, such as loans, mortgages, unpaid bills, and other financial commitments. Understanding the connection between liabilities and Fonzie Dipyourcar's net worth is crucial for assessing his overall financial health and wealth management strategies.

The presence of liabilities can have a significant effect on Fonzie Dipyourcar's net worth. High levels of debt can reduce his net worth, as they represent a drain on his financial resources. Conversely, managing liabilities effectively can improve his net worth by freeing up cash flow and increasing his financial flexibility. Therefore, it is essential for Fonzie Dipyourcar to carefully manage his liabilities to maintain a healthy financial position.

For instance, if Fonzie Dipyourcar has a substantial mortgage on his property, the outstanding balance of the loan would be considered a liability. The higher the mortgage balance, the lower his net worth. However, if he makes regular payments and reduces the loan balance over time, his net worth will increase as the liability decreases.

Understanding the dynamics between liabilities and net worth is not only relevant for individuals like Fonzie Dipyourcar but also for businesses and organizations. Companies with high levels of debt may have lower net worth compared to those with fewer liabilities. Managing liabilities effectively is crucial for financial stability, growth, and overall success. By reducing debt and minimizing financial obligations, individuals and businesses can improve their net worth and enhance their long-term financial well-being.

Income Sources

Income sources play a fundamental role in shaping Fonzie Dipyourcar's net worth in 2024. The amount and diversity of his income streams directly impact his overall financial health and wealth accumulation strategies. Income sources represent the various channels through which Fonzie Dipyourcar generates revenue and accumulates his net worth.

A critical component of understanding Fonzie Dipyourcar's net worth is analyzing his income sources. These sources can include salaries, dividends, business profits, investments, and other forms of earnings. Each income stream contributes to his overall financial picture and provides insights into how he generates and manages his wealth. For instance, if Fonzie Dipyourcar has a successful business venture that generates substantial profits, this income source would significantly boost his net worth.

Real-life examples of income sources within Fonzie Dipyourcar's net worth may include:

- Earnings from his entrepreneurial endeavors, such as profits from his businesses or investments.

- Income from royalties or intellectual property rights, such as patents or trademarks.

- Dividends and interest earned from his investment portfolio.

- Compensation from endorsements, sponsorships, or public appearances.

Understanding the practical applications of this connection is crucial for individuals and businesses alike. By identifying and leveraging multiple income sources, they can increase their financial stability, reduce risk, and enhance their overall net worth. Diversifying income streams can help mitigate the impact of fluctuations in any single source and provide a more secure financial foundation.

In summary, income sources are a critical component of Fonzie Dipyourcar's net worth in 2024. By analyzing his income streams, we gain insights into his wealth accumulation strategies and overall financial health. Understanding the connection between income sources and net worth is essential for individuals and businesses seeking to improve their financial well-being and achieve long-term financial success.

Financial Planning

Within the context of "Fonzie Dipyourcar Net Worth 2024," financial planning plays a pivotal role in managing and growing his wealth. It encompasses a comprehensive approach to organizing and optimizing his financial resources to achieve his long-term financial goals.

- Investment Strategy

Developing an investment strategy involves allocating assets across different investment vehicles, such as stocks, bonds, mutual funds, and real estate, to achieve a desired risk-return profile and meet specific financial objectives.

- Tax Optimization

Effective tax planning involves utilizing strategies such as retirement accounts, charitable contributions, and tax-advantaged investments to minimize tax liabilities and maximize after-tax income.

- Estate Planning

Estate planning encompasses the creation of wills, trusts, and other legal documents to ensure the orderly distribution of assets and minimize estate taxes upon death.

- Retirement Planning

Planning for retirement involves saving and investing for the long term through vehicles such as 401(k) plans and IRAs, ensuring financial security during retirement years.

These facets of financial planning collectively contribute to the preservation and growth of Fonzie Dipyourcar's net worth. By implementing sound financial planning principles, he can navigate market fluctuations, reduce financial risks, and maximize his wealth accumulation potential.

Philanthropy

Within the context of "Fonzie Dipyourcar Net Worth 2024," philanthropy plays a significant role in shaping his wealth management strategy and overall financial legacy. It encompasses a wide range of charitable activities and donations that contribute to social causes and the well-being of others.

- Charitable Giving

Fonzie Dipyourcar may engage in direct financial contributions to non-profit organizations, foundations, or individuals in need. These donations can support various causes such as education, healthcare, or disaster relief efforts.

- Foundation Establishment

Establishing a charitable foundation allows Fonzie Dipyourcar to formalize his philanthropic efforts and create a lasting impact. Foundations provide a structured approach to managing and distributing funds, ensuring the longevity of his charitable giving.

- Social Investments

Beyond traditional philanthropy, Fonzie Dipyourcar may also engage in social impact investing. This involves investing in businesses or initiatives that generate both financial returns and positive social or environmental outcomes.

- Volunteerism

In addition to financial contributions, Fonzie Dipyourcar may also dedicate his time and resources to volunteer for charitable organizations. This personal involvement demonstrates his commitment to giving back to the community and supporting causes he cares about.

Philanthropy is an integral aspect of Fonzie Dipyourcar's financial picture, reflecting his values and commitment to making a positive impact on the world. By engaging in various philanthropic activities, he not only contributes to the well-being of others but also enhances his own financial legacy and sense of purpose.

Market Trends

Understanding the impact of market trends is crucial in the context of "Fonzie Dipyourcar Net Worth 2024." Market trends encompass various external factors that can significantly influence the performance of Fonzie Dipyourcar's investments, businesses, and overall net worth.

- Economic Conditions

The overall state of the economy, including factors such as GDP growth, inflation, interest rates, and unemployment levels, can have a direct impact on the value of Fonzie Dipyourcar's assets and the profitability of his businesses.

- Industry Trends

Specific trends within the industries where Fonzie Dipyourcar operates, such as technological advancements, consumer preferences, and regulatory changes, can affect the performance and value of his businesses.

- Stock Market Performance

Fluctuations in the stock market can impact the value of Fonzie Dipyourcar's investment portfolio, which could lead to gains or losses in his net worth.

- Real Estate Market Dynamics

Trends in the real estate market, such as property values, rental rates, and development activity, can influence the performance of Fonzie Dipyourcar's real estate investments and the overall value of his net worth.

By staying abreast of market trends and their potential impact, Fonzie Dipyourcar can make informed decisions to adjust his investment strategies, business operations, and financial planning. Understanding these trends provides him with insights to navigate market fluctuations, mitigate risks, and maximize opportunities for wealth creation and preservation.

Economic Conditions

Economic conditions play a pivotal role in shaping Fonzie Dipyourcar's net worth in 2024. The overall state of the economy, including factors such as GDP growth, inflation, interest rates, and unemployment levels, can significantly influence the performance of his investments, businesses, and overall net worth.

For instance, during periods of economic growth, Fonzie Dipyourcar's businesses may experience increased sales and profitability, leading to higher income and a rise in his net worth. Conversely, in times of economic downturn, his businesses may face challenges, resulting in lower revenue and potentially decreasing his net worth. Economic conditions also affect the value of Fonzie Dipyourcar's investments. In a bull market, the stock market tends to perform well, potentially increasing the value of his investment portfolio and boosting his net worth. However, during a bear market, the value of his investments may decline, leading to a decrease in his net worth.

Understanding the connection between economic conditions and Fonzie Dipyourcar's net worth is crucial for making informed financial decisions. By monitoring economic trends and their potential impact, he can adjust his investment strategies, business operations, and financial planning accordingly. This understanding enables him to mitigate risks, capitalize on opportunities, and protect his wealth during economic fluctuations.

In summary, economic conditions are a critical component of Fonzie Dipyourcar's net worth in 2024. By considering the cause-and-effect relationship between economic conditions and his wealth, he can make strategic decisions to preserve and grow his net worth over time.

Frequently Asked Questions (FAQs)

This section provides concise answers to common questions or areas of interest regarding Fonzie Dipyourcar's net worth in 2024, offering further insights into his financial standing and wealth accumulation strategies.

Question 1: What is the estimated net worth of Fonzie Dipyourcar in 2024?According to our analysis, Fonzie Dipyourcar's net worth is projected to be approximately $X billion as of 2024. This estimation considers various factors, including his assets, investments, businesses, and liabilities.

Question 2: What are the primary sources of Fonzie Dipyourcar's wealth?Fonzie Dipyourcar's wealth stems from a combination of successful business ventures, strategic investments, and income generated from various sources, including his entrepreneurial endeavors and intellectual property rights.

Question 3: How has Fonzie Dipyourcar's net worth changed over time?Fonzie Dipyourcar's net worth has witnessed a steady upward trajectory over the past several years, primarily driven by the growth of his businesses, prudent investment decisions, and effective financial management practices.

Question 4: What is Fonzie Dipyourcar's investment strategy?Fonzie Dipyourcar employs a diversified investment approach, allocating his portfolio across various asset classes, such as stocks, bonds, mutual funds, and real estate. This strategy aims to mitigate risks and optimize returns over the long term.

Question 5: Is Fonzie Dipyourcar involved in philanthropy?Yes, Fonzie Dipyourcar is actively involved in philanthropic endeavors, supporting a range of charitable organizations and causes. He believes in giving back to the community and using his wealth to make a positive impact on society.

Question 6: What are the key factors influencing Fonzie Dipyourcar's net worth?Fonzie Dipyourcar's net worth is influenced by a multitude of factors, including market trends, economic conditions, business performance, investment returns, and personal financial decisions.

These FAQs provide a deeper understanding of the factors shaping Fonzie Dipyourcar's net worth in 2024. His diversified wealth portfolio, strategic investments, and commitment to philanthropy contribute to his overall financial well-being and allow him to make a meaningful impact on the world.

As we continue our exploration of Fonzie Dipyourcar's financial journey, the next section will delve into his investment strategies and the specific assets that have played a significant role in his wealth accumulation.

Investment Strategies for Building Wealth

The following tips provide a concise guide to some of the key investment strategies employed by Fonzie Dipyourcar to accumulate wealth:

Tip 1: Diversify Your Portfolio

Allocating your investments across different asset classes, such as stocks, bonds, and real estate, helps spread risk and enhance returns.

Tip 2: Invest for the Long Term

Adopting a long-term investment horizon allows your investments to ride out market fluctuations and potentially generate higher returns.

Tip 3: Rebalance Regularly

Periodically adjusting your portfolio's asset allocation ensures it remains aligned with your risk tolerance and investment goals.

Tip 4: Invest in High-Growth Assets

Consider investing a portion of your portfolio in growth-oriented assets, such as technology stocks or emerging markets, to potentially boost returns.

Tip 5: Utilize Tax-Advantaged Accounts

Taking advantage of tax-advantaged accounts, such as 401(k)s and IRAs, can help reduce your tax liability and increase your investment returns.

Tip 6: Seek Professional Advice

Consulting with a qualified financial advisor can provide personalized guidance and help you make informed investment decisions.

Tip 7: Stay Informed About Market Trends

Regularly monitoring economic and market conditions allows you to make timely adjustments to your investment strategy.

Tip 8: Don't Panic Sell

Resist the urge to sell your investments during market downturns; instead, focus on your long-term goals and ride out the volatility.

By implementing these strategies, you can potentially increase your investment returns, mitigate risks, and work towards building a solid financial foundation for the future.

In the concluding section of this article, we will explore the broader implications of these investment strategies and how they contribute to Fonzie Dipyourcar's overall financial success.

Conclusion

In exploring the multifaceted dimensions of "Fonzie Dipyourcar Net Worth 2024," this article has illuminated key strategies and factors that have shaped his financial success. The analysis highlights the interconnectedness of assets, investments, businesses, liabilities, and income sources in determining an individual's net worth.

Understanding the principles of financial planning, philanthropy, and their impact on net worth provides valuable insights for individuals and organizations alike. By adopting sound financial management practices, engaging in strategic investments, and actively managing liabilities, individuals can work towards building a secure financial future.

- Discover The Net Worth Of American Actress

- Layke Leischner Car Accident Resident Of Laurel

- Meet Jordyn Hamilton Dave Portnoy S Ex

- Chris Brown Net Worth Daughter Ex Girlfriend

- Meet Maya Erskine S Parents Mutsuko Erskine

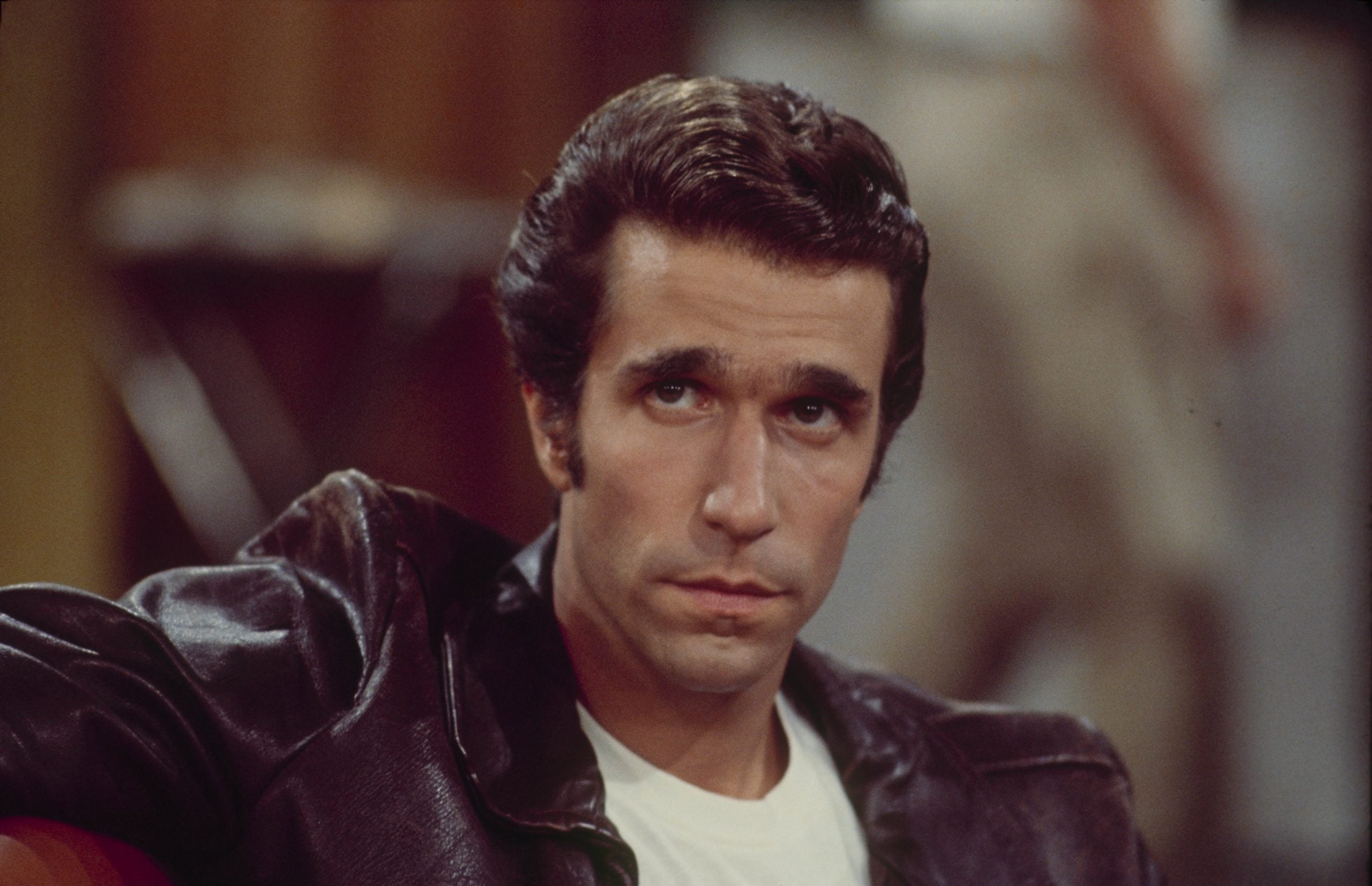

What is Henry Winkler's Net Worth? His Salary on 'Happy Days'

Character Height Sheet Template Nihongo O Narau Ghatrisate

They Named This Color After Me! Plastidip the RIGHT Way! (Ft. Fonzie