Unlocking The Secrets Of Kenneth Nelson's Net Worth: A Guide To Building Wealth

Kenneth Nelson Net Worth is a measure of the financial value of the assets and liabilities held by Kenneth Nelson, an individual. Similar to other measures of wealth, it represents the total value of a person's financial holdings, including cash, investments, real estate, and other assets, minus any debts or liabilities.

Understanding the net worth of individuals like Kenneth Nelson can be relevant for various reasons. It provides insights into their financial success, investment strategies, and overall financial well-being. Analyzing net worth can also help assess the potential impact of financial decisions and guide future financial planning.

Historically, the concept of net worth has been recognized as a crucial indicator of financial health and stability. It has influenced financial planning strategies and policies, contributing to the development of modern financial systems and wealth management practices. As a result, Kenneth Nelson's net worth serves as a valuable reference point for understanding the financial landscape and the factors shaping individual wealth.

- Meet Jordyn Hamilton Dave Portnoy S Ex

- What Is Sonia Acevedo Doing Now Jamison

- Wiki Biography Age Height Parents Nationality Boyfriend

- Tony Hawk Net Worth A Closer Look

- Thomas Lineberger Aberdeen Nc Famous Internal Medicine

Kenneth Nelson Net Worth

Understanding the essential aspects of Kenneth Nelson's net worth is crucial for assessing his financial well-being and the factors contributing to his wealth. These aspects encompass various dimensions, including:

- Assets

- Investments

- Income

- Liabilities

- Debt

- Cash Flow

- Financial Planning

- Investment Strategies

- Tax Implications

By analyzing these key aspects, we can gain insights into Kenneth Nelson's financial decision-making, risk tolerance, and overall financial health. This information can provide valuable context for understanding his financial trajectory and the strategies that have shaped his net worth.

Assets

Assets play a pivotal role in determining Kenneth Nelson's net worth. They represent the resources and properties he owns, which hold monetary value and contribute to his overall financial well-being. Assets can include various forms, such as cash, investments, real estate, vehicles, and other tangible and intangible properties.

- Is Gerrit Cole Jewish Or Christian Ethnicity

- Tammy Camacho Obituary A Remarkable Life Remembered

- Malachi Barton S Dating Life Girlfriend Rumors

- Where Was I Want You Back Filmed

- Tlc S I Love A Mama S

The value of Kenneth Nelson's assets directly impacts his net worth. A higher value of assets generally leads to a higher net worth, indicating greater financial wealth. Changes in asset values, whether through appreciation or depreciation, can cause fluctuations in his net worth over time.

Understanding the composition of Kenneth Nelson's assets provides insights into his investment strategies and financial goals. For instance, a high proportion of real estate assets may indicate a focus on long-term investments and potential rental income, while a diversified portfolio of stocks and bonds suggests a strategy aimed at balancing risk and return.

In summary, assets are a critical component of Kenneth Nelson's net worth, influencing its value and providing insights into his financial decision-making. Analyzing the types and value of assets he holds can help assess his financial health, investment strategies, and overall financial well-being.

Investments

Investments are a vital part of Kenneth Nelson's net worth, representing the assets or financial instruments he holds with the expectation of generating income or capital appreciation over time. Investments can encompass a wide range of asset classes, including stocks, bonds, real estate, and commodities.

- Stocks: Stocks represent ownership in publicly traded companies and can provide investors with potential returns through dividends and capital appreciation. Kenneth Nelson's investments in stocks indicate his exposure to the stock market and his belief in the growth potential of specific companies.

- Bonds: Bonds are fixed-income securities that pay periodic interest payments and return the principal amount at maturity. Kenneth Nelson's bond investments suggest a focus on generating regular income and preserving capital, while diversifying his overall portfolio.

- Real Estate: Real estate investments involve purchasing properties, such as land, buildings, or rental units, with the aim of generating rental income, capital appreciation, or both. Kenneth Nelson's real estate investments indicate his exposure to the property market and his belief in the value of tangible assets.

- Commodities: Commodities are raw materials or agricultural products, such as gold, oil, or wheat, which are traded on exchanges. Kenneth Nelson's investments in commodities suggest an attempt to diversify his portfolio by investing in assets that may perform differently from stocks and bonds.

In conclusion, Kenneth Nelson's investments are a multifaceted aspect of his net worth, reflecting his financial goals, risk tolerance, and investment strategies. Analyzing the types and value of his investments provides valuable insights into his financial decision-making and overall financial well-being.

Income

Income plays a pivotal role in determining Kenneth Nelson's net worth. It represents the inflow of funds from various sources, such as employment, investments, and business activities, which directly contribute to his overall financial well-being. A steady and substantial income is crucial for building and maintaining wealth.

Income acts as a primary source of funds to acquire assets, make investments, and cover expenses. Without sufficient income, it is challenging to accumulate wealth and increase net worth. Kenneth Nelson's income allows him to invest in stocks, bonds, and real estate, thereby diversifying his portfolio and potentially generating capital appreciation and passive income. Additionally, a steady income stream enables him to meet his living expenses, pay taxes, and save for the future, all of which contribute to his financial stability and net worth growth.

In summary, income is a critical component of Kenneth Nelson's net worth, providing the necessary funds to acquire assets, make investments, and sustain his lifestyle. By analyzing his income sources and patterns, we gain insights into his earning potential, financial habits, and overall financial well-being. This understanding can help individuals assess their own income streams and develop strategies to increase their net worth.

Liabilities

Liabilities represent the financial obligations and debts owed by Kenneth Nelson, which can affect his net worth and overall financial standing. Understanding the types and amounts of liabilities he holds is crucial for assessing his financial health and risk profile.

- Outstanding Loans: Loans such as mortgages, auto loans, or personal loans contribute to Kenneth Nelson's liabilities. These obligations require regular payments, including principal and interest, which can impact his cash flow and net worth.

- Credit Card Debt: Credit card balances represent a common form of liability. High credit card debt can lead to high-interest payments, potentially straining Kenneth Nelson's finances and reducing his net worth.

- Unpaid Taxes: Liabilities can also arise from unpaid taxes, such as income tax, property tax, or sales tax. Failure to fulfill tax obligations can result in penalties and interest charges, further impacting his net worth.

- Business Liabilities: If Kenneth Nelson owns a business, he may have business-related liabilities, such as outstanding payments to suppliers, unpaid wages, or legal obligations. These liabilities can affect the financial performance of his business and, consequently, his net worth.

In summary, Kenneth Nelson's liabilities represent his financial obligations and debts, which can influence his net worth and financial stability. By analyzing the types and amounts of liabilities he holds, we gain insights into his financial management practices, risk tolerance, and overall financial well-being.

Debt

Debt is a crucial aspect of Kenneth Nelson's net worth, representing the financial obligations and borrowed funds that he owes to creditors. Understanding the types and amounts of debt he holds is essential for assessing his financial health and overall financial standing.

- Outstanding Loans: Loans such as mortgages, auto loans, or personal loans contribute to Kenneth Nelson's debt. These obligations require regular payments, including principal and interest, which can impact his monthly cash flow and net worth.

- Credit Card Debt: Credit card balances represent a common form of debt. High credit card debt can lead to high-interest payments, potentially straining Kenneth Nelson's finances and negatively affecting his net worth.

- Unpaid Taxes: Liabilities can also arise from unpaid taxes, such as income tax, property tax, or sales tax. Failure to fulfill tax obligations can result in penalties and interest charges, further impacting his net worth.

- Business Debt: If Kenneth Nelson owns a business, he may have business-related debt, such as outstanding payments to suppliers, unpaid wages, or legal obligations. These liabilities can affect the financial performance of his business and, consequently, his net worth.

In summary, Kenneth Nelson's debt represents his financial obligations and borrowed funds, which can influence his net worth and financial stability. By analyzing the types and amounts of debt he holds, we gain insights into his financial management practices, risk tolerance, and overall financial well-being.

Cash Flow

Understanding the relationship between cash flow and Kenneth Nelson's net worth is critical for assessing his financial health and overall economic well-being. Cash flow represents the movement of funds into and out of his financial accounts, directly influencing his net worth over time. Positive cash flow, where inflows exceed outflows, contributes to an increase in net worth, while negative cash flow leads to a decrease.

Kenneth Nelson's net worth is heavily influenced by his cash flow patterns. Consistent and substantial inflows, such as income from employment, investments, or business activities, provide him with the necessary funds to acquire assets, make investments, and cover expenses. This positive cash flow allows him to build and maintain wealth, contributing to an increase in his net worth.

Conversely, negative cash flow, where outflows exceed inflows, can strain Kenneth Nelson's financial resources and hinder his ability to accumulate wealth. Expenses that outpace income, such as excessive spending, high debt payments, or unexpected financial obligations, can deplete his cash reserves and potentially lead to a decrease in net worth. Therefore, managing cash flow effectively is crucial for Kenneth Nelson to maintain financial stability and grow his net worth over the long term.

In conclusion, cash flow plays a vital role in shaping Kenneth Nelson's net worth. Positive cash flow enables him to acquire assets, invest, and build wealth, while negative cash flow can hinder his financial progress. Understanding the dynamics between cash flow and net worth provides valuable insights into his financial health and decision-making, allowing for informed strategies to optimize his financial well-being.

Financial Planning

Financial planning plays a pivotal role in the overall assessment of Kenneth Nelson's net worth. It encompasses a range of strategies and decisions aimed at optimizing his financial resources and achieving long-term financial goals. Effective financial planning helps individuals like Kenneth Nelson make informed decisions, manage risks, and maximize their wealth-building potential.

- Investment Planning: This involves allocating assets across different investment options, such as stocks, bonds, and real estate, to achieve desired returns and manage risk. Kenneth Nelson's investment plan will outline his investment goals, risk tolerance, and diversification strategies.

- Retirement Planning: It focuses on accumulating funds and managing investments for retirement, ensuring financial security in later years. Kenneth Nelson's retirement plan may include contributions to tax-advantaged retirement accounts and planning for potential healthcare expenses.

- Estate Planning: Estate planning involves managing the distribution of assets after death, minimizing estate taxes, and ensuring the smooth transfer of wealth to beneficiaries. Kenneth Nelson's estate plan will include a will or trust, as well as strategies for minimizing estate taxes.

- Tax Planning: It aims to minimize tax liability and optimize tax savings through legal means. Kenneth Nelson's tax plan will involve understanding tax laws, utilizing tax-advantaged investments, and implementing strategies to reduce tax exposure.

These facets of financial planning are interconnected and work together to enhance Kenneth Nelson's financial well-being. By considering these aspects, he can make informed decisions that align with his financial goals and contribute to the growth and preservation of his net worth over time.

Investment Strategies

Investment strategies are a crucial aspect of Kenneth Nelson's net worth, outlining the specific approaches and techniques he employs to allocate and manage his financial resources. These strategies play a significant role in determining the growth and preservation of his wealth over time.

- Asset Allocation: This involves dividing investments among different asset classes, such as stocks, bonds, real estate, and cash, to manage risk and optimize returns. Kenneth Nelson's asset allocation strategy will consider his financial goals, risk tolerance, and investment horizon.

- Diversification: By investing in a range of assets that perform differently in various economic conditions, Kenneth Nelson reduces risk and enhances the stability of his portfolio. His diversification strategy may include investments across different industries, sectors, and geographic regions.

- Risk Management: Kenneth Nelson's investment strategies incorporate risk management techniques to mitigate potential losses. This may include setting stop-loss orders, hedging positions, or utilizing options strategies to limit downside exposure.

- Investment Selection: The selection of individual investments is a critical aspect of Kenneth Nelson's investment strategy. He will conduct thorough research and analysis to identify undervalued assets, growth opportunities, and income-generating investments that align with his financial objectives.

These investment strategies, when implemented effectively, contribute to the overall growth and preservation of Kenneth Nelson's net worth. By carefully managing his investments, he can navigate market fluctuations, capture growth opportunities, and achieve his long-term financial goals.

Tax Implications

Tax Implications are an intrinsic aspect of Kenneth Nelson's net worth, significantly influencing its composition and growth trajectory. Navigating tax laws and regulations is crucial for optimizing his financial well-being and ensuring compliance with legal obligations.

- Taxable Income: Kenneth Nelson's taxable income forms the basis for calculating his tax liability. Understanding the sources of his income, such as salary, investments, and business profits, helps determine the amount of income subject to taxation.

- Tax Deductions: Kenneth Nelson can reduce his taxable income by claiming eligible deductions, such as mortgage interest, charitable contributions, and retirement savings contributions. Maximizing these deductions lowers his tax liability, effectively increasing his net worth.

- Tax Rates: The applicable tax rates determine the percentage of Kenneth Nelson's taxable income that is owed as taxes. These rates vary based on his income level and filing status, impacting his net worth by altering his after-tax income.

- Tax Credits: Kenneth Nelson may qualify for tax credits, which directly reduce his tax liability dollar-for-dollar. Examples include the child tax credit and the earned income tax credit. Utilizing these credits further enhances his net worth by lowering his tax burden.

In summary, Tax Implications play a multifaceted role in shaping Kenneth Nelson's net worth. By understanding the nuances of taxable income, deductions, tax rates, and tax credits, he can implement strategies to minimize his tax liability and maximize his wealth accumulation over time.

Frequently Asked Questions (FAQs) on Kenneth Nelson's Net Worth

This section addresses common questions and clarifies key aspects related to Kenneth Nelson's net worth, providing a deeper understanding of its composition and significance.

Question 1: How is Kenneth Nelson's net worth calculated?

Kenneth Nelson's net worth is calculated by subtracting his total liabilities from his total assets. Assets include cash, investments, real estate, and other valuable possessions, while liabilities represent debts, loans, and outstanding payments.

Question 2: What are the primary sources of Kenneth Nelson's wealth?

Kenneth Nelson's wealth stems primarily from his successful business ventures, strategic investments, and income from various sources. His business acumen and investment savvy have significantly contributed to his overall net worth.

Question 3: How does Kenneth Nelson manage and preserve his wealth?

Kenneth Nelson employs a diversified investment strategy, spreading his assets across various asset classes and industries. He also engages in financial planning and tax optimization strategies to minimize liabilities and maximize returns.

Question 4: What is Kenneth Nelson's investment philosophy?

Kenneth Nelson adopts a long-term investment approach, focusing on value investing and identifying undervalued assets with growth potential. He believes in thorough research and analysis before making investment decisions.

Question 5: How does philanthropy impact Kenneth Nelson's net worth?

Kenneth Nelson's philanthropic endeavors may result in a reduction of his net worth due to charitable donations. However, his contributions to society and support of various causes can have a positive impact on his overall legacy and public perception.

Question 6: What are the potential risks to Kenneth Nelson's net worth?

Kenneth Nelson's net worth is subject to market fluctuations, economic downturns, and changes in tax laws. Fluctuations in the value of his assets or unexpected liabilities can impact his overall wealth.

In summary, these FAQs provide insights into the calculation, sources, management, and potential risks associated with Kenneth Nelson's net worth. Understanding these aspects deepens our comprehension of his financial standing and wealth-building strategies.

The next section will explore the key factors that have contributed to Kenneth Nelson's financial success, examining the strategies and decisions that have shaped his impressive net worth.

Tips to Enhance Your Financial Well-being

The following tips provide actionable strategies to improve your financial situation and work towards long-term financial success:

Tip 1: Create a Comprehensive Budget: Track your income and expenses meticulously to gain a clear understanding of your cash flow. This will help you identify areas for optimization and make informed decisions about your spending habits.

Tip 2: Live Below Your Means: Avoid overspending by consciously choosing to live within your means. Prioritize essential expenses and identify areas where you can cut back on discretionary spending.

Tip 3: Increase Your Income: Explore opportunities to supplement your income through side hustles, part-time work, or negotiating a salary increase. Additional income can provide a buffer for unexpected expenses and accelerate your financial progress.

Tip 4: Invest Wisely: Start investing early, even with small amounts, to harness the power of compound interest. Diversify your investments across different asset classes to mitigate risk and optimize returns.

Tip 5: Reduce Debt: Prioritize paying off high-interest debts, such as credit card balances and personal loans. Consider debt consolidation or refinancing options to lower interest rates and save money on monthly payments.

Tip 6: Build an Emergency Fund: Establish an emergency fund to cover unexpected expenses and financial setbacks. Aim to save at least 3-6 months' worth of living expenses.

Tip 7: Seek Professional Advice: Consult with a financial advisor to gain personalized guidance and develop a tailored financial plan that aligns with your specific goals and circumstances.

Tip 8: Stay Informed: Continuously educate yourself about financial matters, including investing, budgeting, and tax strategies. Knowledge is power when it comes to managing your finances effectively.

In summary, implementing these tips can empower you to make informed financial decisions, achieve your financial goals, and secure your financial future. They lay the foundation for the final section of this article, which will explore advanced strategies for long-term wealth creation and preservation.

Conclusion

In exploring the intricacies of Kenneth Nelson's net worth, this article has illuminated the multifaceted nature of wealth accumulation and management. Key insights gained include the importance of strategic asset allocation, prudent risk management, and effective tax optimization.

Three main points stand out in this regard: firstly, diversification across asset classes helps mitigate market volatility and protect against downturns. Secondly, proactive tax planning can significantly enhance the preservation and growth of wealth over time. Lastly, understanding and leveraging investment strategies that align with individual risk tolerance and financial goals is crucial for long-term success.

The analysis of Kenneth Nelson's net worth serves as a reminder that wealth creation and management are not solely determined by income levels, but rather through a combination of informed decision-making, calculated risk-taking, and a disciplined approach to financial planning. Embracing these principles can empower individuals to chart their own course towards financial well-being and secure a prosperous future.

- Hilaree Nelson Wiki Missing Husband Family Net

- Discover The Net Worth Of American Actress

- New Roms Xci Nsp Juegos Nintendo Switch

- Meet Maya Erskine S Parents Mutsuko Erskine

- Carson Peters Berger Age Parents Mom Rape

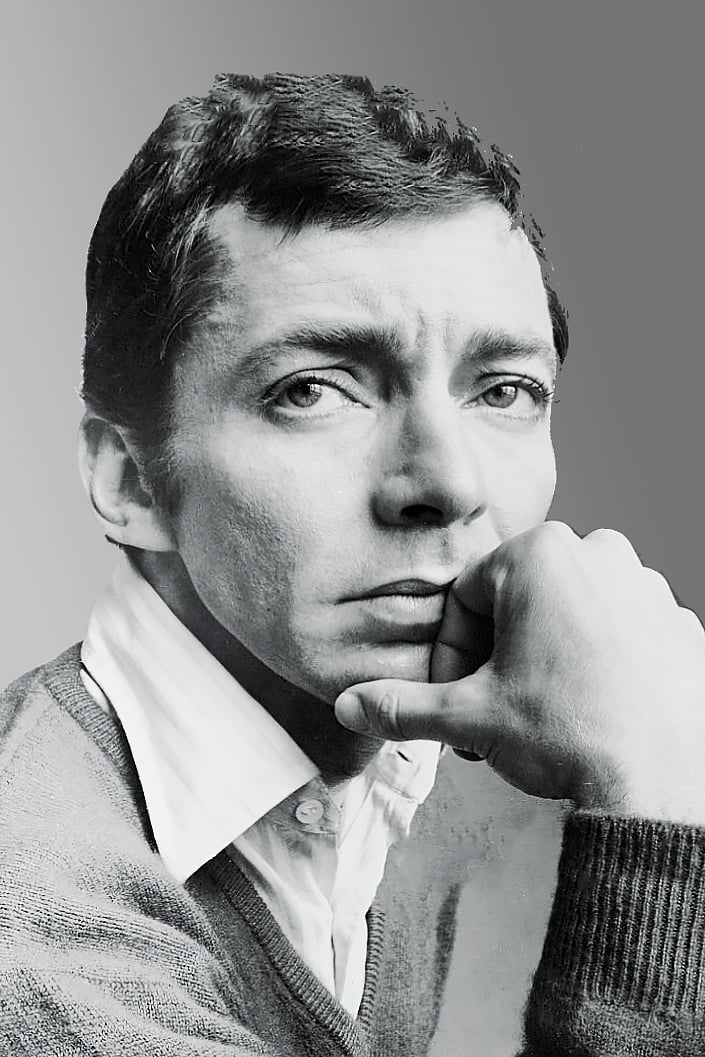

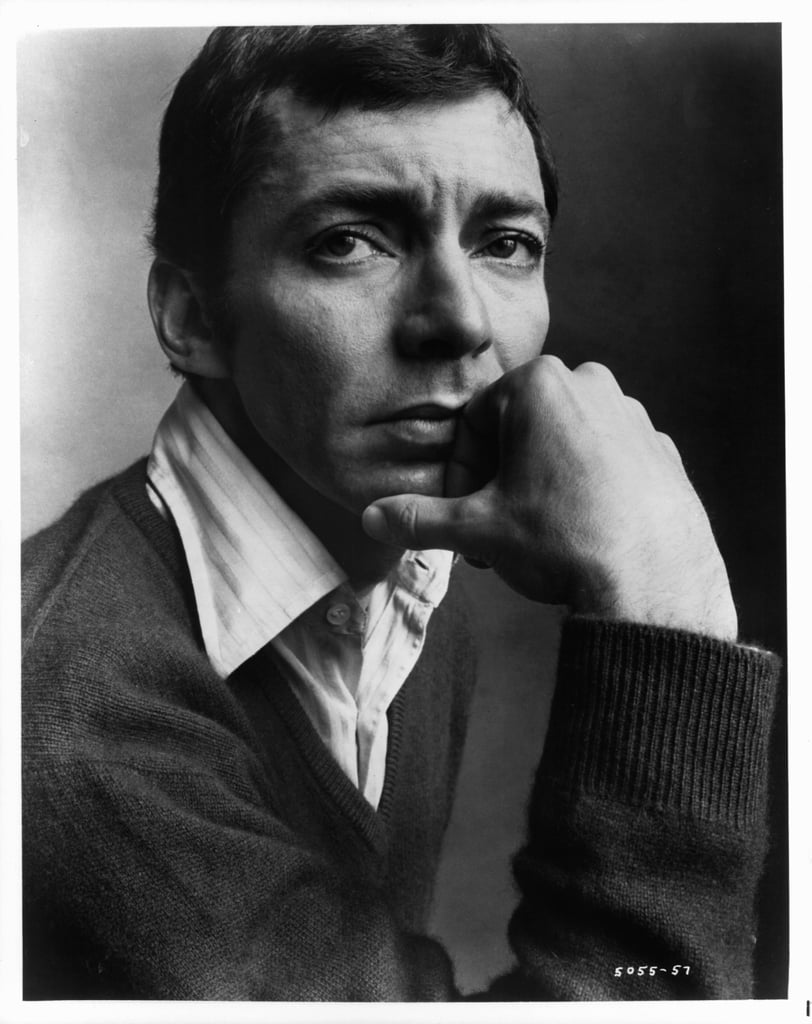

Nelson Filmek, képek, díjak Személyiség adatlap Mafab.hu

Nelson as Michael The Boys in the Band Original Movie Cast

Nelson Movies, Bio and Lists on MUBI