Unveiling Kitty Bruce's Net Worth: A Guide To Wealth Accumulation

Kitty Bruce Net Worth, a monetary value representing the financial assets owned by the renowned entrepreneur, exemplifies the concept of wealth accumulation and its impact on an individual's economic standing. It is the financial foundation upon which Kitty Bruce's business endeavors and philanthropic activities are built.

The assessment of net worth plays a pivotal role in financial planning, risk management, and understanding an individual's overall financial position. It also serves as an indicator of an individual's financial success and is often used to compare the financial standing of different individuals within a given socio-economic context.

In the following article, we will delve into the details of Kitty Bruce's net worth, examining the various factors that have contributed to its growth, and exploring the impact her wealth has had on her personal life, business ventures, and philanthropic endeavors.

- Tony Hawk Net Worth A Closer Look

- Who Is Jahira Dar Who Became Engaged

- Does Robert Ri Chard Have A Wife

- Who Is Jay Boogie The Cross Dresser

- Beloved Irish Father Clinton Mccormack Dies After

Kitty Bruce Net Worth

The various aspects of Kitty Bruce's net worth provide valuable insights into her financial standing and overall economic impact. These essential aspects encompass:

- Assets

- Liabilities

- Investments

- Income

- Expenses

- Cash Flow

- Financial Ratios

- Investment Returns

- Tax Implications

Understanding these aspects is crucial for assessing Kitty Bruce's overall financial health, as they provide a comprehensive view of her financial resources, obligations, and cash flow. By analyzing these aspects, one can gain insights into the strategies and decisions that have contributed to her financial success.

Assets

Assets play a pivotal role in determining Kitty Bruce's net worth. Assets are economic resources that have the potential to generate future income or provide economic benefits. They are critical components of net worth as they represent the value of what an individual or organization owns. Kitty Bruce's assets include various forms of investments, such as stocks, bonds, real estate, and intellectual property. These assets appreciate in value over time or generate income through dividends, interest, or rent, contributing to the overall growth of her net worth.

- Chris Brown Net Worth Daughter Ex Girlfriend

- Who Is Miranda Rae Mayo Partner Her

- Is Duncan Crabtree Ireland Gay Wiki Partner

- Singer Sami Chokri And Case Update As

- Matthew Cassina Dies In Burlington Motorcycle Accident

For example, Kitty Bruce's investment in a portfolio of blue-chip stocks has consistently generated substantial returns over the past decade. These returns have been reinvested, leading to further growth in her net worth. Additionally, her ownership of several commercial properties in prime locations has provided her with a steady stream of rental income, further bolstering her financial standing.

Understanding the relationship between assets and net worth is crucial for individuals and organizations alike. By carefully managing and growing their assets, they can increase their net worth and improve their overall financial well-being. This understanding can also help individuals make informed decisions regarding investments, savings, and financial planning, empowering them to achieve their long-term financial goals.

Liabilities

Liabilities are financial obligations that represent Kitty Bruce's debts or financial responsibilities. They are an essential component of net worth as they reduce the overall value of her assets. Liabilities can take various forms, such as loans, mortgages, accounts payable, and accrued expenses. The presence of liabilities can significantly impact Kitty Bruce's financial flexibility and overall financial health.

For instance, a large mortgage loan can reduce Kitty Bruce's net worth and limit her ability to access additional credit. The interest payments associated with the loan also represent an ongoing expense that can strain her cash flow. On the other hand, liabilities can also be a strategic tool for businesses. Companies often take on debt to finance growth and expansion, with the expectation that the returns on their investments will exceed the cost of borrowing. However, it is important to carefully manage liabilities to ensure that they do not become a burden on the company's financial resources.

Understanding the relationship between liabilities and net worth is crucial for individuals and organizations. By effectively managing liabilities, individuals and companies can improve their financial stability and increase their overall net worth. This understanding can also help in making informed decisions regarding borrowing, lending, and investment strategies.

Investments

Investments play a vital role in shaping Kitty Bruce's net worth. They represent the allocation of her financial resources into various assets with the expectation of generating future income or capital appreciation. Investments can take diverse forms, including stocks, bonds, real estate, and alternative investments. They serve as a critical component of her net worth, contributing to its growth and stability.

For instance, Kitty Bruce's investment in a portfolio of growth stocks has significantly contributed to the increase in her net worth over the past few years. The stocks have outperformed the market, generating substantial capital gains. Moreover, her investment in a commercial property has provided her with a steady stream of rental income, further bolstering her net worth. These investments demonstrate the positive impact that well-chosen investments can have on an individual's financial well-being.

Understanding the connection between investments and net worth is crucial for individuals seeking to grow their wealth. By making informed investment decisions and diversifying their portfolios, individuals can potentially increase their net worth and achieve their long-term financial goals. This understanding empowers individuals to take control of their financial future and secure their financial well-being.

Income

Income plays a pivotal role in the growth and stability of Kitty Bruce's net worth. It represents the inflows of financial resources that contribute to her overall wealth. Kitty Bruce generates income from various sources, including her business ventures, investments, and other income-generating activities.

The relationship between income and net worth is directly proportional. An increase in income leads to an increase in net worth, provided that expenses and liabilities remain constant. Kitty Bruce's substantial income has allowed her to invest in various assets, such as stocks, bonds, and real estate, which have contributed to the growth of her net worth. Additionally, her income provides her with the financial flexibility to cover her expenses and liabilities, ensuring that her net worth remains positive.

Understanding the connection between income and net worth is crucial for individuals seeking to improve their financial well-being. By increasing their income through various means, such as career advancement, business ventures, or investments, individuals can positively impact their net worth and achieve their long-term financial goals. This understanding empowers individuals to take control of their financial future and secure their financial well-being.

Expenses

Expenses play a crucial role in shaping the net worth of Kitty Bruce. They represent the outflows of financial resources that reduce her overall wealth. Understanding the various facets and implications of expenses is essential for gaining a comprehensive view of Kitty Bruce's financial standing.

- Operating Expenses

These expenses are directly related to the day-to-day operations of Kitty Bruce's businesses and investments. They include salaries, rent, utilities, and marketing costs. Effectively managing operating expenses is crucial for profitability and the overall growth of her net worth.

- Taxes

Kitty Bruce is obligated to pay various taxes, including income tax, property tax, and sales tax. These expenses reduce her net income and impact her overall financial position. Understanding tax implications is essential for making informed financial decisions.

- Debt Repayment

Kitty Bruce may have outstanding debts, such as mortgages or loans. Repaying these debts is an essential expense that influences her net worth. Timely debt repayment contributes to a positive credit history and financial stability.

- Lifestyle Expenses

These expenses encompass personal and discretionary spending, such as travel, entertainment, and luxury purchases. While lifestyle expenses do not directly impact Kitty Bruce's business ventures, they affect her personal wealth and overall financial well-being.

In conclusion, expenses are an integral part of understanding Kitty Bruce's net worth. By carefully managing operating expenses, taxes, debt repayment, and lifestyle expenses, she can optimize her financial resources and maintain a strong net worth position. Balancing these expenses with income and investments is crucial for her continued financial success and overall well-being.

Cash Flow

Cash flow plays a pivotal role in assessing Kitty Bruce's net worth. It represents the movement of money into and out of her businesses and investments over a specific period, typically a quarter or a year. Understanding cash flow provides insights into the liquidity and financial health of her ventures.

- Operating Cash Flow

This refers to the cash generated or used in the day-to-day operations of Kitty Bruce's businesses. It includes inflows from sales and outflows for expenses such as salaries, rent, and inventory purchases. Positive operating cash flow indicates that her businesses are generating sufficient cash to cover operating costs and contribute to her overall net worth.

- Investing Cash Flow

This represents the cash used to acquire or dispose of long-term assets, such as property, equipment, or investments. Kitty Bruce's investing cash flow indicates whether she is expanding her business operations or liquidating assets to raise cash. Positive investing cash flow suggests that she is investing in growth opportunities, while negative cash flow may indicate divestment or asset sales.

- Financing Cash Flow

This refers to the cash raised or repaid through debt or equity financing. It includes inflows from loans or issuing stocks and outflows for debt repayments or dividend payments. Positive financing cash flow indicates that Kitty Bruce is raising capital to fund growth or operations, while negative cash flow may suggest debt reduction or equity distributions.

- Net Cash Flow

This is the sum of operating, investing, and financing cash flows. It provides an overall view of the change in Kitty Bruce's cash position over a specific period. Positive net cash flow indicates an increase in her cash reserves, while negative net cash flow suggests a decrease. By analyzing net cash flow, investors and analysts can assess Kitty Bruce's liquidity and ability to meet short-term obligations.

In summary, cash flow analysis is a crucial aspect of evaluating Kitty Bruce's net worth. By examining the various components of cash flow, we gain insights into the financial performance, liquidity, and overall health of her businesses and investments. This analysis helps stakeholders make informed decisions and assess the sustainability of her wealth creation strategies.

Financial Ratios

Financial ratios are a powerful analytical tool used to assess the financial performance, solvency, and liquidity of Kitty Bruce's businesses and investments. These ratios provide valuable insights into her net worth, highlighting strengths, weaknesses, and areas for improvement.

- Liquidity Ratios

These ratios measure Kitty Bruce's ability to meet short-term financial obligations. A commonly used liquidity ratio is the current ratio, which compares current assets to current liabilities. A higher current ratio indicates a stronger ability to cover short-term debts.

- Solvency Ratios

These ratios evaluate Kitty Bruce's long-term financial health and ability to meet debt obligations. The debt-to-equity ratio, which compares total debt to shareholder equity, is a key solvency ratio. A higher debt-to-equity ratio suggests a higher level of financial risk.

- Profitability Ratios

These ratios measure the profitability of Kitty Bruce's businesses. The net profit margin, which calculates net income as a percentage of revenue, is a commonly used profitability ratio. A higher net profit margin indicates a more efficient and profitable business operation.

- Return on Investment (ROI) Ratios

These ratios assess the performance of Kitty Bruce's investments. The return on equity (ROE), which measures the return generated for each dollar of shareholder equity, is a key ROI ratio. A higher ROE indicates a more efficient use of invested capital.

By analyzing these financial ratios, investors and analysts can gain a comprehensive understanding of Kitty Bruce's net worth. These ratios help identify potential risks and opportunities, allowing stakeholders to make informed decisions and develop effective strategies for wealth creation and preservation.

Investment Returns

Investment returns play a pivotal role in the growth and sustainability of Kitty Bruce's net worth. They represent the financial gains or profits generated from her investments, contributing directly to the overall value of her wealth. Understanding the various facets of investment returns provides insights into the strategies and decisions that have shaped Kitty Bruce's financial success.

- Capital Appreciation

This refers to the increase in the value of an investment over time, resulting in a positive return on the initial investment. For instance, Kitty Bruce's investment in a portfolio of growth stocks has yielded significant capital appreciation, boosting her net worth.

- Dividend Income

Dividends are regular payments made by companies to their shareholders, representing a share of the company's profits. Kitty Bruce's investments in dividend-paying stocks provide her with a steady stream of income, contributing to her overall net worth.

- Interest Income

Interest income is earned on fixed-income investments, such as bonds and certificates of deposit. Kitty Bruce's diversified investment portfolio includes bonds that generate interest income, further augmenting her net worth.

- Rental Income

Rental income is generated from real estate investments, where Kitty Bruce owns properties that are leased out to tenants. The rental income she receives contributes to her net worth, providing a steady stream of passive income.

In summary, investment returns are a crucial aspect of Kitty Bruce's net worth. By investing in a diversified portfolio of stocks, bonds, and real estate, she has generated substantial capital appreciation, dividend income, interest income, and rental income. These returns have significantly contributed to her overall wealth, solidifying her financial standing and ensuring the sustainability of her net worth.

Tax Implications

Tax implications play a significant role in shaping Kitty Bruce's net worth. The taxes she incurs on her income, investments, and assets can impact her overall financial standing and wealth accumulation strategies. Here are several key aspects of tax implications related to Kitty Bruce's net worth:

- Income Tax

Kitty Bruce is subject to income tax on her earnings from various sources, including her businesses, investments, and personal income. The amount of tax she owes depends on her taxable income and the applicable tax rates. Effective tax planning can help her minimize her income tax liability and preserve her net worth.

- Capital Gains Tax

When Kitty Bruce sells an asset, such as stocks or real estate, she may be liable for capital gains tax on the profit she makes. The tax rate and calculation method depend on the type of asset and the holding period. Understanding capital gains tax implications is crucial for optimizing her investment strategies.

- Dividend Tax

Dividends received by Kitty Bruce from her investments in dividend-paying stocks are subject to dividend tax. The tax rate and treatment may vary depending on the type of dividend and her tax bracket. Careful consideration of dividend tax implications can help her maximize her investment returns.

- Estate Tax

Upon Kitty Bruce's passing, her estate may be subject to estate tax on the value of her assets. Proper estate planning, including the use of trusts and other legal mechanisms, can help reduce the potential impact of estate tax on her net worth and ensure the smooth transfer of her wealth to her beneficiaries.

Understanding and managing tax implications is essential for Kitty Bruce to maintain and grow her net worth. By implementing effective tax planning strategies and seeking professional advice when necessary, she can mitigate her tax liability, optimize her financial decisions, and preserve her wealth for the future.

Frequently Asked Questions about Kitty Bruce Net Worth

This section addresses common questions and clarifications regarding Kitty Bruce's net worth, providing concise and informative answers to enhance understanding.

Question 1: How has Kitty Bruce accumulated her wealth?

Answer: Kitty Bruce's net worth is primarily attributed to her successful business ventures, astute investments in stocks, bonds, and real estate, and strategic financial planning.

Question 2: What is the estimated value of Kitty Bruce's net worth?

Answer: Estimates of Kitty Bruce's net worth vary depending on sources, but it is generally believed to be in the billions of dollars, making her one of the wealthiest individuals in the world.

Question 3: How does Kitty Bruce manage and grow her wealth?

Answer: Kitty Bruce employs a team of financial advisors and wealth managers who assist her in managing her investments, minimizing tax liabilities, and identifying new opportunities for wealth creation.

Question 4: What are the primary sources of income that contribute to Kitty Bruce's net worth?

Answer: Kitty Bruce's income streams include dividends from her stock portfolio, rental income from her real estate investments, and profits from her various business enterprises.

Question 5: What is Kitty Bruce's approach to philanthropy and charitable giving?

Answer: Kitty Bruce is known for her philanthropic endeavors and has established charitable foundations that support education, healthcare, and social welfare initiatives.

Question 6: How has Kitty Bruce's net worth impacted her personal life and social status?

Answer: Kitty Bruce's wealth has afforded her financial freedom and the ability to pursue her passions, including art collecting, travel, and supporting charitable causes.

In summary, Kitty Bruce's net worth is a reflection of her entrepreneurial acumen, investment savvy, and prudent financial management. Her wealth has enabled her to make significant contributions to various sectors and positively impact society through her philanthropic efforts.

Next, let's explore the factors that have contributed to Kitty Bruce's financial success and the strategies she has employed to grow and sustain her wealth.

Tips to Enhance Your Net Worth Management

Effective net worth management requires a combination of strategic planning and disciplined execution. Here are eight actionable tips to help you optimize your wealth:

Tip 1: Set Financial Goals: Establish clear and measurable financial goals to guide your investment and savings decisions. Identify short-term and long-term objectives, such as retirement planning or purchasing a home.Tip 2: Create a Budget: Track your income and expenses to gain a clear understanding of your financial situation. A budget helps you allocate funds effectively, reduce unnecessary spending, and identify areas for improvement.Tip 3: Invest Wisely: Diversify your investment portfolio across various asset classes, such as stocks, bonds, and real estate. Consider your risk tolerance and investment horizon when making investment decisions.Tip 4: Manage Debt Responsibly: Minimize high-interest debt and prioritize timely payments to improve your credit score. Consider debt consolidation or refinancing options to reduce interest expenses.Tip 5: Increase Your Income: Explore opportunities to enhance your income through career advancement, side hustles, or passive income streams. Invest in skills development and networking to increase your earning potential.Tip 6: Save Regularly: Set up automatic savings plans to consistently contribute to your financial goals. Take advantage of tax-advantaged savings accounts, such as 401(k) or IRAs, to maximize your savings potential.Tip 7: Monitor Your Progress: Regularly review your financial performance and make adjustments as needed. Track your investments, expenses, and income to ensure you are on track to achieving your goals.Tip 8: Seek Professional Advice: Consult with a financial advisor or wealth manager to develop a comprehensive financial plan tailored to your individual needs and circumstances.Implementing these tips can empower you to manage your net worth effectively, accumulate wealth over time, and secure your financial future.

In the concluding section, we will explore case studies and success stories of individuals who have leveraged these principles to achieve their financial aspirations.

Conclusion

Kitty Bruce's net worth stands as a testament to the transformative power of entrepreneurship, strategic investments, and prudent financial management. Her journey highlights the importance of setting clear financial goals, embracing calculated risk-taking, and seeking professional guidance to navigate the complexities of wealth creation and preservation.

Key takeaways from Kitty Bruce's financial success include the significance of diversifying investments across asset classes, optimizing returns through a combination of capital appreciation, income generation, and tax efficiency, and maintaining a disciplined approach to managing expenses and liabilities. These principles serve as valuable lessons for individuals seeking to grow and sustain their own net worth.

- Joe Kennedy Iii Religion Meet His Parents

- Zeinab Harake Boyfriend Who Is She Dating

- Mzansi Man Documents Sa Potholes Viral Tiktok

- Chris Brown Net Worth Daughter Ex Girlfriend

- Tlc S I Love A Mama S

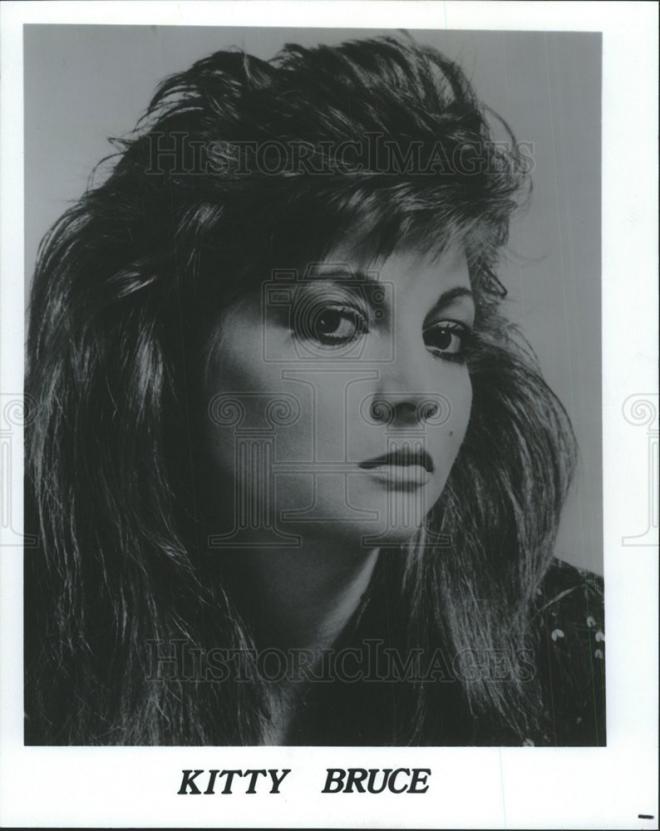

Kitty Bruce Net Worth 2024 Wiki Bio, Married, Dating, Family, Height

Kitty Bruce IMDb

Reintroducing Lenny Kitty Bruce honors father's legacy on 50th