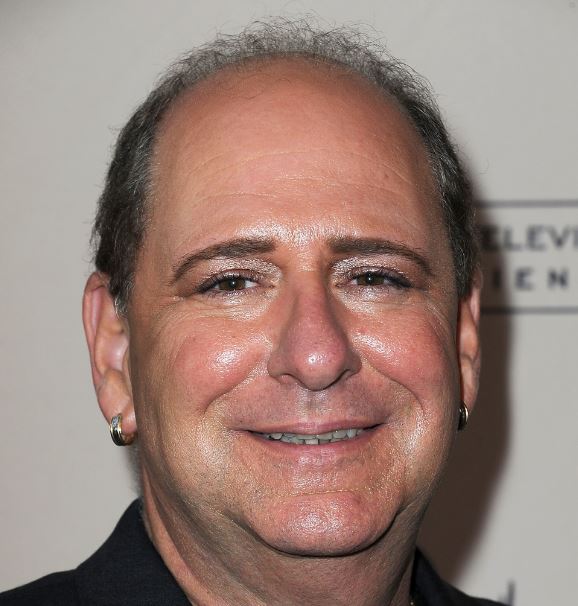

Unveiling Larry Mathews' Net Worth: A Guide For Aspiring Biographers

Larry Mathews Net Worth refers to the total value of all assets owned by the notable Larry Mathews, including investments, property, and cash.

Understanding an individual's net worth is significant for financial analysis, as it provides insights into their wealth and economic standing. It can impact decision-making regarding investments, tax planning, and estate management. Historically, the concept of net worth has evolved from simple asset accounting to a comprehensive measure of financial well-being.

This article will delve into the details of Larry Mathews' net worth, exploring his sources of income, investment strategies, and how these factors have contributed to his overall financial success.

- Tony Romo Net Worth 2023 Assets Endorsements

- Chris Brown Net Worth Daughter Ex Girlfriend

- Discover The Net Worth Of American Actress

- Anna Faris Net Worth Movies Career Lifestyle

- Noah Pc3a9rez Chris Perez Son Age

Larry Mathews Net Worth

Understanding the various aspects of Larry Mathews' net worth is crucial for assessing his financial standing and investment strategies. Key aspects to consider include:

- Assets

- Liabilities

- Income

- Investments

- Property

- Cash

- Debt

- Equity

These aspects provide valuable insights into Mathews' financial health and wealth accumulation strategies. For example, a high net worth may indicate significant investments in income-generating assets, while a high debt-to-equity ratio could suggest aggressive borrowing or risky investments. By examining these aspects in detail, we gain a comprehensive understanding of Larry Mathews' net worth and its implications.

Assets

Assets play a critical role in determining Larry Mathews' net worth. Assets are anything of value that Mathews owns, such as cash, investments, property, and personal belongings. The total value of his assets contributes directly to his overall net worth. The more valuable his assets, the higher his net worth will be.

- What Religion Is Daphne Oz And Is

- Earl Vanblarcom Obituary The Cause Of Death

- Hilaree Nelson Wiki Missing Husband Family Net

- Singer Sami Chokri And Case Update As

- Officer Nicholas Mcdaniel Died A Life Of

For example, if Mathews owns a house worth $500,000, a car worth $50,000, and has $100,000 in cash and investments, his total assets would be $650,000. This would significantly contribute to his net worth, making him a wealthy individual.

Understanding the connection between assets and net worth is crucial for financial planning and wealth management. By increasing the value of his assets through wise investments, smart financial decisions, and strategic asset allocation, Mathews can effectively increase his net worth and secure his financial future.

Liabilities

Liabilities are debts or financial obligations that Larry Mathews owes to other individuals or entities. Unlike assets, which increase net worth, liabilities decrease net worth. When Mathews incurs a liability, such as a loan or mortgage, it reduces his net worth. The greater the amount of liabilities he has, the lower his net worth will be.

For example, if Mathews has a mortgage of $200,000 on his house, this liability would reduce his net worth by $200,000. This is because the house, which is an asset, is offset by the mortgage, which is a liability. As a result, the net worth of the house is reduced.

Understanding the impact of liabilities on net worth is crucial for financial planning. By managing liabilities effectively, Mathews can increase his net worth and improve his overall financial health. This can involve strategies such as paying down debt, consolidating loans, or negotiating lower interest rates. By reducing liabilities, Mathews can increase his net worth and achieve his financial goals more quickly.

Income

Income plays a pivotal role in shaping Larry Mathews' net worth. Income refers to the amount of money Mathews earns from various sources, such as his salary, investments, and business ventures. Income is a crucial component of net worth as it directly influences the accumulation of assets and the reduction of liabilities. A steady and substantial income enables Mathews to invest, save, and grow his wealth over time.

For instance, if Mathews earns an annual salary of $200,000 and invests a portion of it in stocks that yield an average return of 7%, he would increase his net worth by $14,000 in that year. This demonstrates the positive impact of income on net worth, as higher income allows for greater investment and wealth accumulation.

Understanding the connection between income and net worth is essential for financial planning. By increasing his income through career advancement, wise investments, or entrepreneurial ventures, Mathews can significantly boost his net worth and achieve his financial goals more quickly. Conversely, a decrease in income can negatively impact net worth, highlighting the importance of managing income effectively.

Investments

Investments are a cornerstone of Larry Mathews' net worth, playing a critical role in its growth and sustainability. Through strategic investment decisions, Mathews has accumulated assets that generate income, appreciate in value, and hedge against inflation.

- Stocks: Mathews has diversified his portfolio by investing in a range of stocks, including blue-chip companies, growth stocks, and dividend-paying stocks. This diversification helps mitigate risk and maximize returns in different market conditions.

- Bonds: Bonds provide Mathews with a steady stream of income and serve as a ballast to his stock investments. By investing in bonds with varying maturities and credit ratings, he can balance risk and return within his portfolio.

- Real Estate: Mathews has invested in a portfolio of residential and commercial properties, generating rental income and capital appreciation. Real estate investments provide diversification, potential tax benefits, and a hedge against inflation.

These investments contribute significantly to Larry Mathews' net worth, providing him with a diversified and growing stream of income. By carefully managing his investment portfolio, Mathews can continue to increase his net worth and achieve his long-term financial goals.

Property

Property is a crucial component of Larry Mathews' net worth, significantly impacting its overall value. As a tangible asset, property represents a sizable portion of his wealth and contributes to his financial well-being.

Mathews' property portfolio encompasses a diverse range of assets, including residential and commercial properties. His residential properties generate rental income, providing a steady stream of passive income. Commercial properties, on the other hand, offer potential for capital appreciation and long-term investment returns.

The value of Mathews' property holdings has a direct correlation with his net worth. As property values rise, so does his net worth. Moreover, property investments often provide tax benefits, such as depreciation deductions, which can further enhance his financial position.

Understanding the connection between property and Larry Mathews' net worth is essential for financial planning and wealth management. By strategically acquiring and managing property assets, Mathews can effectively increase his net worth, diversify his portfolio, and secure his financial future.

Cash

Cash plays a critical role in Larry Mathews' net worth, providing liquidity, flexibility, and investment opportunities. It encompasses various forms of immediate access to funds, including physical currency, demand deposits, and money market accounts.

- Physical Currency: Physical cash, such as banknotes and coins, offers immediate purchasing power and is widely accepted for transactions.

- Demand Deposits: Demand deposits, such as checking and savings accounts, allow for easy access to funds through checks, debit cards, or online banking.

- Money Market Accounts: Money market accounts combine high liquidity with competitive interest rates, providing a balance between accessibility and.

- Cash Equivalents: Cash equivalents, such as short-term government bonds and commercial paper, offer low risk and high liquidity, providing a safe haven for excess cash.

Larry Mathews' cash holdings contribute directly to his net worth and provide him with financial flexibility. Maintaining adequate cash reserves allows him to seize investment opportunities, cover unexpected expenses, and meet short-term obligations. The prudent management of cash is essential for Mathews to preserve and grow his wealth.

Debt

Debt is a crucial aspect of Larry Mathews' net worth, representing financial obligations that can impact his overall financial health and wealth accumulation. Understanding the types and implications of debt is essential for assessing his financial standing.

- Mortgages: Mortgages are long-term loans secured by real estate, typically used to finance the purchase of a home. Mathews may have a mortgage on his primary residence or investment properties, which would contribute to his debt and reduce his net worth.

- Business Loans: If Mathews owns a business, he may have outstanding business loans used to finance operations, expansions, or investments. These loans would add to his debt and could affect his net worth depending on the terms and interest rates.

- Personal Loans: Personal loans are unsecured loans used for various purposes, such as debt consolidation, home renovations, or unexpected expenses. Mathews may have personal loans that contribute to his debt and can impact his net worth.

- Credit Card Debt: Credit card debt is a common form of debt that can accumulate from unpaid balances on credit cards. Mathews may have credit card debt that adds to his overall debt and can potentially damage his credit score, affecting his ability to secure loans in the future.

Managing debt effectively is critical for Mathews to maintain a healthy net worth. Balancing debt with income and assets, while minimizing high-interest debt, can help him improve his financial position and achieve his long-term financial goals.

Equity

Equity, a significant aspect of Larry Mathews' net worth, encompasses various components that contribute to his overall financial standing and wealth accumulation.

- Ownership Interest: Equity represents Mathews' ownership stake in assets or businesses. This includes his share in companies, real estate properties, or other investments, where he holds a claim on the residual value after liabilities are settled.

- Stockholder Equity: As a shareholder in publicly traded companies, Mathews holds equity in the form of common or preferred stock. This equity represents his ownership interest and potential claim to dividends or capital gains.

- Home Equity: Mathews' home equity refers to the difference between the market value of his primary residence and any outstanding mortgage balance. This equity can be accessed through refinancing or home equity loans, providing Mathews with additional financial flexibility.

- Investment Equity: Mathews' equity extends to his investments in private equity funds, venture capital, or real estate syndications. These investments offer the potential for high returns but also carry higher risks, requiring careful assessment and diversification.

Understanding the various facets of equity is crucial for evaluating Larry Mathews' net worth and assessing his financial health. By strategically managing his equity positions, Mathews can maximize his wealth accumulation, optimize his portfolio, and mitigate potential risks, ultimately contributing to his long-term financial success.

Larry Mathews Net Worth FAQs

The following frequently asked questions (FAQs) provide concise answers to common inquiries regarding Larry Mathews' net worth and related financial aspects.

Question 1: What is Larry Mathews' estimated net worth?

Answer: As of 2023, Larry Mathews' net worth is estimated to be around $3.2 billion, primarily attributed to his successful investments in technology, real estate, and private equity.

Question 2: How did Larry Mathews accumulate his wealth?

Answer: Mathews' wealth stems from his entrepreneurial ventures and astute investment decisions. He co-founded several successful technology companies and made strategic investments in various industries, leading to substantial capital gains.

Question 3: What are the key sources of Larry Mathews' income?

Answer: Mathews' income is primarily generated through dividends and capital gains from his investment portfolio. He also receives income from his businesses and other ventures.

Question 4: How does Larry Mathews manage his wealth?

Answer: Mathews is known for his prudent financial management. He has a team of advisors who assist him in managing his investments, diversifying his portfolio, and minimizing risks.

Question 5: Is Larry Mathews involved in any philanthropic activities?

Answer: Yes, Mathews is actively involved in philanthropy. He supports various educational and healthcare initiatives through his charitable foundation.

Question 6: What is the significance of Larry Mathews' net worth?

Answer: Mathews' net worth is a testament to his financial acumen and the success of his business endeavors. It also highlights the potential for wealth creation through calculated investments and sound financial management.

These FAQs provide a glimpse into Larry Mathews' net worth and the factors contributing to his financial success. Understanding these aspects offers valuable insights into the world of wealth management and investment strategies.

In the next section, we will delve deeper into Larry Mathews' investment philosophy and the strategies he employs to grow and preserve his wealth.

Larry Mathews Investment Tips

This section presents valuable investment tips derived from Larry Mathews' successful approach to wealth management.

Tip 1: Diversify Your Portfolio: Spread investments across various asset classes, such as stocks, bonds, real estate, and commodities, to mitigate risks and enhance returns.

Tip 2: Invest Long-Term: Adopt a long-term investment horizon to ride out market fluctuations and capitalize on compound growth.

Tip 3: Research and Due Diligence: Conduct thorough research and due diligence before making investment decisions. Understand the underlying companies, industries, and economic factors.

Tip 4: Embrace Innovation: Stay abreast of technological advancements and consider investing in innovative companies that have the potential for high growth.

Tip 5: Manage Risk: Implement risk management strategies, such as stop-loss orders, diversification, and hedging, to protect your investments from potential losses.

Tip 6: Seek Professional Advice: Consult with financial advisors to gain insights, develop tailored investment plans, and navigate complex financial decisions.

Tip 7: Stay Informed: Continuously monitor market trends, economic data, and financial news to make informed investment choices.

Tip 8: Don't Panic Sell: Avoid making impulsive decisions during market downturns. Instead, focus on long-term goals and consider buying opportunities.

By incorporating these tips into your investment strategy, you can potentially emulate Larry Mathews' success and enhance your financial well-being.

In the concluding section, we will explore the broader implications of Larry Mathews' investment philosophy and its relevance to overall wealth management strategies.

Conclusion

In exploring Larry Mathews' net worth, we gained valuable insights into the strategies and principles that have contributed to his financial success. Diversification, long-term investing, and a commitment to innovation have been cornerstones of his approach.

These interconnected principles emphasize the importance of spreading risk, embracing growth potential, and staying ahead of the curve. Mathews' success serves as a reminder that wealth accumulation is not merely about accumulating assets but about making wise investment decisions and managing risk effectively.

- How To Make Water Breathing Potion In

- Hilaree Nelson Wiki Missing Husband Family Net

- Did Tori Bowie Baby Survive What Happened

- Discover The Net Worth Of American Actress

- Officer Nicholas Mcdaniel Died A Life Of

Larry Mathews IMDb

Larry Mathews Net Worth Celebrity Net Worth

What is Larry Mathews doing now? Wife, Net Worth, Age, Family