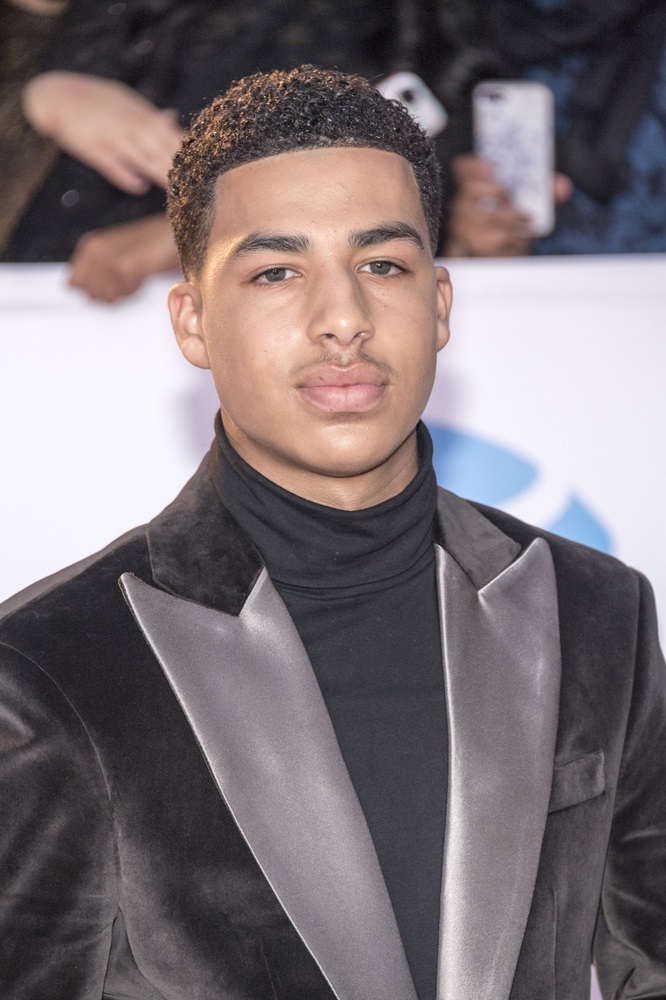

Marcus Scribner Net Worth: Secrets Of The Hollywood Star

Marcus Scribner Net Worth: The total financial value of all Marcus Scribner's assets and income sources, such as real estate, investments, and earnings from acting.

Determining an individual's net worth provides insight into their financial success and serves as a benchmark for financial planning. It has been a relevant metric since the development of modern economics.

This article will explore Marcus Scribner's net worth, including details about his income, assets, and overall financial standing.

- What Religion Is Daphne Oz And Is

- Patrick Alwyn Age Height Weight Girlfriend Net

- Antony Varghese Wife Net Worth Height Parents

- Tony Hawk Net Worth A Closer Look

- Thomas Lineberger Aberdeen Nc Famous Internal Medicine

Marcus Scribner Net Worth

Evaluating an individual's net worth involves considering several key aspects that provide a comprehensive understanding of their financial status.

- Income Sources

- Assets

- Investments

- Debt

- Liabilities

- Taxes

- Expenses

- Financial Goals

By examining these aspects in detail, including Marcus Scribner's income streams, property holdings, investment portfolios, outstanding obligations, and financial aspirations, we can gain a deeper understanding of his overall financial well-being and the strategies he employs to manage his wealth.

Income Sources

Income sources play a critical role in determining Marcus Scribner's net worth. As an actor, his primary income is derived from his work in film, television, and theater. His earnings from these ventures directly contribute to his overall financial standing.

- Dd Returns Ott Release Date The Most

- Who Is Miranda Rae Mayo Partner Her

- Meet Jordyn Hamilton Dave Portnoy S Ex

- What Is Sonia Acevedo Doing Now Jamison

- Benoni Woman Shows R4 000 Grocery Haul

The stability and magnitude of Marcus Scribner's income sources significantly impact his net worth. Consistent work and high-paying roles can lead to a substantial increase in his net worth over time. Conversely, periods of unemployment or lower-paying projects can have a negative impact.

Understanding the connection between income sources and net worth is crucial for financial planning and decision-making. By carefully managing his income streams and diversifying his sources, Marcus Scribner can mitigate risks and ensure the long-term growth of his net worth.

Assets

Assets are a crucial component of Marcus Scribner's net worth, representing his ownership of valuable resources that contribute to his overall financial well-being. Assets can include tangible properties such as real estate, vehicles, and artwork, as well as intangible assets like investments, intellectual property, and cash. The value of these assets, minus any outstanding liabilities or debts, contributes directly to Marcus Scribner's net worth.

Acquiring and managing assets is a key strategy for Marcus Scribner to increase his net worth. Real estate, for example, has historically been a stable investment that can appreciate in value over time, providing a potential return on investment. Additionally, diversifying his asset portfolio by investing in stocks, bonds, or other financial instruments can help mitigate risks and generate additional income streams.

Understanding the relationship between assets and net worth is essential for financial planning and decision-making. By carefully managing his assets, Marcus Scribner can optimize their value and maximize his net worth. This involves making informed choices about asset allocation, managing debt, and seeking professional financial advice when necessary.

Investments

Investments are a critical component of Marcus Scribner's net worth, playing a significant role in its growth and stability. By allocating a portion of his income to investments, Marcus Scribner can potentially increase his net worth over time through capital appreciation, dividends, and interest earned. Stocks, bonds, real estate, and mutual funds are common investment vehicles that offer varying levels of risk and return.

A well-diversified investment portfolio can help Marcus Scribner mitigate risks and maximize returns. For example, investing in a mix of stocks and bonds can provide a balance between growth potential and income generation. Additionally, investing in real estate can provide a hedge against inflation and potentially generate rental income. By carefully managing his investment portfolio, Marcus Scribner can enhance the growth of his net worth and secure his financial future.

Understanding the connection between investments and net worth is essential for informed financial decision-making. By investing wisely and seeking professional financial advice when necessary, Marcus Scribner can optimize his investment strategies and maximize his net worth growth. This understanding empowers him to plan for long-term financial goals, such as retirement, and navigate financial challenges effectively.

Debt

Debt is a crucial component of Marcus Scribner's net worth, representing his financial obligations and liabilities. Understanding the connection between debt and net worth is essential for informed financial decision-making.

Debt can impact Marcus Scribner's net worth in several ways. High levels of debt, particularly unsecured debt with high interest rates, can reduce his net worth by consuming a significant portion of his income towards debt servicing. Conversely, managed debt, such as a mortgage or business loan used for investment purposes, can contribute to an increase in net worth if the return on investment exceeds the cost of debt.

Marcus Scribner's debt-to-income ratio, which measures the amount of debt he has relative to his income, is a key indicator of his financial health. A high debt-to-income ratio can make it difficult to qualify for additional credit and increase the risk of financial distress. By carefully managing his debt and maintaining a healthy debt-to-income ratio, Marcus Scribner can protect his net worth and improve his financial stability.

Understanding the practical applications of this relationship empowers Marcus Scribner to make informed financial decisions. By prioritizing high-return investments and minimizing unnecessary debt, he can optimize his net worth growth and secure his financial future. Additionally, seeking professional financial advice can provide valuable insights and strategies for managing debt effectively and enhancing overall financial well-being.

Liabilities

Within the context of Marcus Scribner's net worth, liabilities play a critical role in determining his overall financial standing. Liabilities represent financial obligations or debts that reduce his net worth and impact his overall financial health.

- Outstanding Loans: These include mortgages, auto loans, and personal loans that Marcus Scribner has taken out and must repay with interest. High levels of outstanding loans can strain his cash flow and reduce his disposable income.

- Unpaid Taxes: Any unpaid taxes, such as income tax or property tax, constitute liabilities that can accumulate penalties and interest over time, affecting his net worth.

- Accounts Payable: These are unpaid bills or invoices for goods or services that Marcus Scribner has purchased but not yet paid for. Managing accounts payable effectively is crucial to maintaining a positive cash flow.

- Deferred Revenue: This refers to income received in advance for goods or services that have not yet been delivered. It is considered a liability until the goods or services are provided, impacting his net worth until the obligation is fulfilled.

Understanding the types and implications of liabilities is essential for Marcus Scribner to make informed financial decisions. By managing his liabilities effectively, he can protect his net worth, improve his cash flow, and enhance his overall financial stability.

Taxes

Taxes play a significant role in determining Marcus Scribner's net worth, representing his financial obligations to various governing authorities. Understanding the different types of taxes and their implications is crucial for managing his net worth effectively.

- Income Tax: This tax is levied on Marcus Scribner's earnings from acting and other sources of income. The amount of income tax he owes depends on his income bracket and applicable tax rates, impacting his disposable income.

- Property Tax: Owning real estate, such as a house or land, incurs property tax. This tax is based on the assessed value of the property and can vary depending on local tax rates.

- Sales Tax: When Marcus Scribner purchases goods or services subject to sales tax, a percentage of the purchase price is added to the cost. This tax is collected by retailers and remitted to the relevant authorities.

- Capital Gains Tax: If Marcus Scribner sells assets, such as stocks or real estate, for a profit, he may be liable for capital gains tax. This tax is calculated based on the difference between the purchase price and the sale price of the asset.

Managing tax liabilities effectively is crucial for Marcus Scribner to optimize his net worth and financial well-being. By understanding his tax obligations and utilizing available deductions and credits, he can minimize his tax burden while ensuring compliance with tax laws.

Expenses

Expenses are a crucial aspect of Marcus Scribner's net worth, representing the costs associated with maintaining his lifestyle and pursuing his professional endeavors. Understanding and managing expenses effectively is essential for preserving and growing his financial resources.

- Living Expenses: These include basic necessities such as housing, food, transportation, and utilities. Marcus Scribner's living expenses can vary depending on his lifestyle choices and location.

- Career Expenses: As an actor, Marcus Scribner incurs expenses related to his profession, such as acting classes, headshots, wardrobe, and travel for auditions or filming.

- Investments: While investments can contribute to Marcus Scribner's net worth over time, they also involve associated expenses such as management fees, trading commissions, and potential losses.

- Taxes: Marcus Scribner's tax obligations, as discussed earlier, represent a significant expense that impacts his net worth.

By carefully managing his expenses, Marcus Scribner can optimize his financial resources, minimize unnecessary spending, and prioritize investments that align with his long-term financial goals. This involves creating a budget, tracking expenses, and seeking professional financial advice when necessary.

Financial Goals

Financial goals are an integral aspect of Marcus Scribner's net worth, guiding his financial decision-making and shaping his long-term financial trajectory. Understanding his financial goals helps provide a comprehensive view of his overall financial well-being.

- Retirement Planning: Marcus Scribner's financial goals likely include ensuring a secure and comfortable retirement. This involves estimating future expenses, determining retirement income needs, and planning investments to bridge the gap between his working years and retirement.

- Wealth Preservation: Preserving his net worth and protecting it from erosion are crucial financial goals for Marcus Scribner. This may involve diversifying his investments, managing risk, and utilizing financial instruments such as trusts or annuities.

- Philanthropy: As a public figure, Marcus Scribner may have philanthropic goals, such as supporting charitable causes or establishing foundations to give back to his community. These goals can influence his financial planning and investment strategies.

- Financial Independence: Achieving financial independence, where passive income covers living expenses, may be a goal for Marcus Scribner. This involves building wealth through investments, real estate, or other income-generating assets.

Marcus Scribner's financial goals are interconnected and influence his overall financial strategy. By setting clear and achievable financial goals, he can make informed decisions, prioritize investments, and maximize his net worth growth while aligning his financial resources with his personal values and aspirations.

Frequently Asked Questions about Marcus Scribner Net Worth

This FAQ section aims to address commonly asked questions and provide clarifications regarding various aspects of Marcus Scribner's net worth and related topics.

Question 1: How much is Marcus Scribner's net worth?

Answer: As of 2023, Marcus Scribner's net worth is estimated to be around $2 million. This figure is based on his earnings from acting, investments, and other ventures.

Question 2: How does Marcus Scribner make money?

Answer: Marcus Scribner primarily generates income through his acting career, including roles in television shows, films, and theater productions. Additionally, he earns revenue from endorsements, sponsorships, and investments.

Question 3: What is Marcus Scribner's most notable role?

Answer: Marcus Scribner is best known for his portrayal of Andre Johnson Jr. in the ABC sitcom "black-ish." This role has significantly contributed to his recognition and financial success.

Question 4: How does Marcus Scribner manage his wealth?

Answer: Marcus Scribner likely has a team of financial advisors and managers who assist him in managing his wealth. This includes making investment decisions, planning for the future, and minimizing tax liabilities.

Question 5: What is Marcus Scribner's financial strategy?

Answer: Marcus Scribner's financial strategy likely involves a combination of income diversification, smart investments, and long-term planning. He may also focus on balancing financial growth with personal fulfillment.

Question 6: How can I increase my net worth?

Answer: Increasing your net worth requires a combination of strategies, including increasing your income, managing expenses effectively, investing wisely, and planning for the future. Seek professional financial advice to tailor a strategy to your specific circumstances.

These FAQs provide insights into various aspects of Marcus Scribner's net worth and wealth management practices. Understanding these factors can help individuals make informed financial decisions and pursue their own financial goals.

The discussion of Marcus Scribner's net worth highlights the importance of financial planning, investment strategies, and wealth management. In the following sections, we will delve deeper into these topics and explore how individuals can manage their finances effectively.

Tips to Enhance Your Financial Well-being

This section provides actionable tips to help individuals manage their finances effectively and improve their overall financial well-being.

Tip 1: Create a Budget and Track ExpensesCreating a detailed budget helps you allocate your income wisely, prioritize expenses, and identify areas where you can save.

Tip 2: Negotiate and Compare Before Making Financial DecisionsWhether it's negotiating a salary, utility bill, or loan terms, taking the time to compare options and negotiate can save you significant money.

Tip 3: Invest for the Long TermStart investing early, even small amounts, and let compound interest work in your favor over time.

Tip 4: Build an Emergency FundHaving an emergency fund provides a financial cushion for unexpected expenses, preventing you from going into debt.

Tip 5: Reduce Unnecessary SpendingIdentify areas where you can cut back on unnecessary expenses, such as subscriptions, dining out, or impulse purchases.

Tip 6: Seek Professional Financial AdviceConsult a qualified financial advisor for personalized guidance on managing your finances, investing, or planning for the future.

By implementing these tips, you can gain control over your finances, make informed decisions, and work towards long-term financial success.

The following section will discuss the importance of financial literacy and how it can empower individuals to achieve their financial goals.

Conclusion

This examination of Marcus Scribner's net worth underscores the multifaceted nature of financial well-being, encompassing income sources, assets, investments, and financial strategies. Understanding these components is crucial for individuals seeking to manage their finances effectively and achieve their financial goals.

Key takeaways include the significance of income diversification, smart investment decisions, and long-term financial planning. Marcus Scribner's financial journey serves as an example of how deliberate financial management can contribute to financial success.

- Jasprit Bumrah Injury Update What Happened To

- Justin Bieber Sells Entire Music Catalogue For

- Meet Jason Weathers And Matthew Weathers Carl

- Matthew Cassina Dies In Burlington Motorcycle Accident

- Patrick Alwyn Age Height Weight Girlfriend Net

Marcus Scribner Ethnicity of Celebs What Nationality Ancestry Race

Marcus Scribner Height Age Weight Wiki Biography & Net Worth

Marcus Scribner NFYI