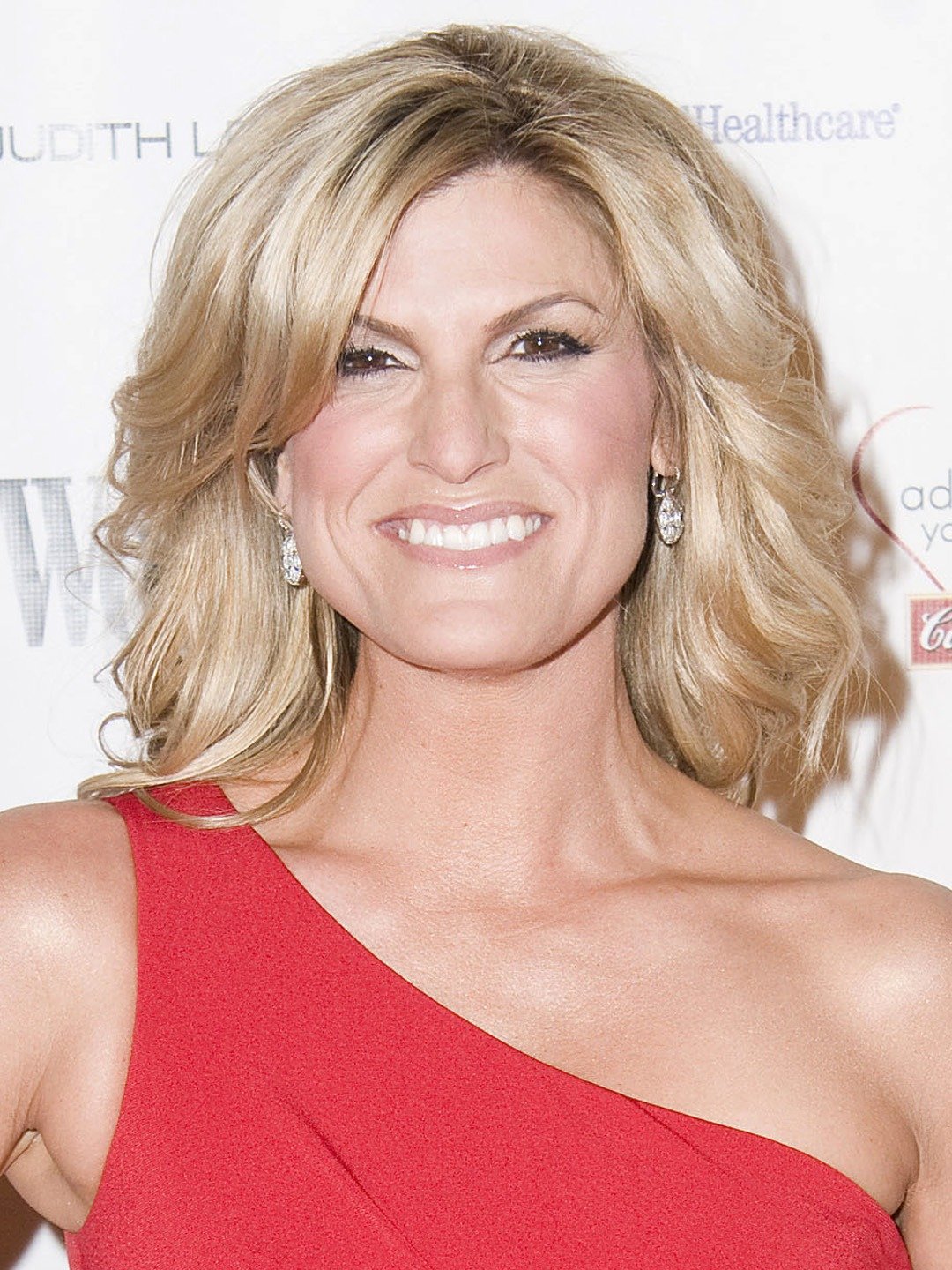

How To Uncover The Secrets Of Trish Suhr's Net Worth

Trish Suhr Net Worth is the monetary value of all of Trish Suhr's assets, including her earnings from her acting career, investments, and other sources. For example, if Trish Suhr owns a house worth $1 million, a car worth $50,000, and has $100,000 in the bank, her net worth would be $1.15 million.

Knowing the net worth of individuals like Trish Suhr can provide insights into their financial success, investment strategies, and overall wealth management. It can also serve as a benchmark for comparing their financial performance to others in the entertainment industry or to the general population. Historically, tracking net worth has been crucial for assessing an individual's financial standing and creditworthiness.

This article aims to explore Trish Suhr's net worth in detail, providing an overview of her income sources, investment portfolio, and any significant financial events that have shaped her wealth. It will analyze the factors that have contributed to her financial success and discuss her overall financial strategy.

- Melissa Kaltveit Died Como Park Senior High

- Is Sam Buttrey Jewish Religion And Ethnicity

- Where Was I Want You Back Filmed

- Simona Halep Early Life Career Husband Net

- All About Dmx S Son Tacoma Simmons

Trish Suhr Net Worth

Understanding the key aspects of Trish Suhr's net worth provides insights into her financial status, investment strategies, and overall wealth management. These aspects encompass various dimensions, including her income sources, assets, liabilities, and financial history.

- Income: Earnings from acting, investments, and other sources.

- Assets: Properties, vehicles, investments, and valuable possessions.

- Investments: Stocks, bonds, real estate, and other financial instruments.

- Liabilities: Debts, loans, and mortgages.

- Financial History: Past financial performance and significant events.

- Investment Strategies: Approaches used to manage and grow wealth.

- Tax Planning: Strategies to optimize financial outcomes.

- Estate Planning: Arrangements for managing wealth after death.

- Philanthropy: Charitable giving and support for causes.

Analyzing these aspects can reveal the factors that have contributed to Trish Suhr's financial success, her risk tolerance, and her overall financial goals. It can also provide context for understanding her financial decision-making and the impact of external factors on her net worth.

Income

Income streams form the foundation of Trish Suhr's net worth, comprising earnings from her acting career, investments, and other sources. Understanding the composition of her income provides insights into the drivers of her financial success and overall wealth.

- Meet Jordyn Hamilton Dave Portnoy S Ex

- Janice Huff And Husband Warren Dowdy Had

- Najiba Faiz Video Leaked On Telegram New

- Meet Ezer Billie White The Daughter Of

- Anna Faris Net Worth Movies Career Lifestyle

- Acting Income: Earnings from starring in movies, television shows, and stage productions. This income stream is directly tied to her talent, popularity, and ability to secure roles.

- Investment Income: Returns from investments in stocks, bonds, real estate, and other financial instruments. This income stream reflects her financial acumen and risk tolerance, as well as the performance of her investments.

- Endorsement Deals: Compensation for promoting products, services, or brands. This income stream is based on her public image, popularity, and perceived influence over consumer behavior.

- Other Income: Earnings from writing, producing, or directing. This income stream showcases her versatility and ability to generate revenue from multiple sources.

Collectively, these income streams contribute to Trish Suhr's overall net worth, providing her with the financial resources to maintain her lifestyle, invest in her future, and support her philanthropic endeavors. Analyzing the stability, growth potential, and diversification of these income sources can provide insights into the resilience and sustainability of her financial position.

Assets

Assets are a critical component of Trish Suhr's net worth, representing her ownership of valuable resources and possessions. They contribute directly to her financial standing and provide a foundation for her wealth. Understanding the composition and value of her assets offers insights into her investment strategies, financial stability, and overall financial health.

Properties, such as real estate and land, are significant assets that can appreciate in value over time. Trish Suhr's ownership of properties provides her with a stable source of income through rent or lease payments, and the potential for capital gains when sold. Vehicles, while depreciating assets, are essential for transportation and can reflect her lifestyle and personal preferences.

Investments, encompassing stocks, bonds, and other financial instruments, represent Trish Suhr's participation in the financial markets. These assets can generate income through dividends, interest payments, or capital gains. The performance of her investments is influenced by market conditions, her risk tolerance, and investment strategies. Valuable possessions, including jewelry, artwork, and collectibles, may hold sentimental or financial value, contributing to her overall net worth.

In conclusion, Trish Suhr's assets play a vital role in determining her net worth. They represent her accumulated wealth, provide financial stability, and reflect her investment strategies and personal preferences. Analyzing the composition, value, and performance of her assets can reveal her financial strengths, investment acumen, and overall financial management skills.

Investments

Investments in stocks, bonds, real estate, and other financial instruments play a critical role in driving Trish Suhr's net worth. These investments represent a substantial portion of her assets and contribute significantly to her overall financial standing. By allocating her wealth across a diversified portfolio of investments, Trish Suhr seeks to generate income and grow her wealth over time.

The performance of Trish Suhr's investments directly impacts her net worth. When the value of her investments increases, so does her net worth. Conversely, when the value of her investments decreases, her net worth also declines. As a result, Trish Suhr's investment decisions have a profound impact on her financial well-being.

Real estate, in particular, has been a key component of Trish Suhr's investment strategy. She owns several properties, including residential and commercial buildings, that generate rental income and have appreciated in value over time. These properties provide Trish Suhr with a stable source of income and contribute significantly to her net worth.

Understanding the connection between investments and Trish Suhr's net worth is essential for assessing her financial health and investment acumen. By analyzing the composition and performance of her investment portfolio, we can gain insights into her risk tolerance, investment strategies, and overall financial management skills.

Liabilities

Liabilities represent Trish Suhr's financial obligations, such as debts, loans, and mortgages. They are essential considerations when assessing her net worth as they directly impact her financial standing and overall wealth. Understanding the connection between liabilities and Trish Suhr's net worth provides valuable insights into her financial management and overall financial health.

A critical component of net worth calculation, liabilities reduce an individual's overall financial position. For Trish Suhr, her liabilities represent the amount of money she owes to creditors, including banks, lenders, and other financial institutions. These obligations can include mortgages on her properties, personal loans, and any outstanding debts. As her liabilities increase, her net worth decreases, as she has less equity in her assets.

For example, if Trish Suhr has a net worth of $1 million and liabilities totaling $200,000, her actual net worth would be $800,000. This is because her liabilities reduce the value of her assets, which include her investments, properties, and other possessions. As a result, managing liabilities effectively is crucial for maintaining a healthy financial position.

In conclusion, liabilities play a critical role in determining Trish Suhr's net worth. By understanding the connection between liabilities and net worth, we gain insights into her financial obligations, debt management strategies, and overall financial health. This understanding is essential for assessing her financial standing, making informed investment decisions, and planning for the future effectively.

Financial History

Trish Suhr's financial history plays a crucial role in understanding her current net worth. Past financial performance and significant events can greatly impact an individual's wealth, both positively and negatively. Analyzing Trish Suhr's financial history provides insights into the factors that have shaped her net worth and the decisions she has made along the way.

For instance, let's consider Trish Suhr's early career as an actress. Her initial success in landing roles and negotiating favorable contracts laid the foundation for her financial growth. Over time, as she gained recognition and popularity, her earning potential increased, directly contributing to her rising net worth. Additionally, her savvy investments in real estate and other assets further enhanced her overall wealth.

Furthermore, significant life events can also impact an individual's net worth. For example, if Trish Suhr had experienced a major financial setback, such as a failed business venture or a costly legal battle, her net worth could have been significantly affected. Similarly, personal decisions such as marriage, divorce, or the birth of children can also have financial implications that shape an individual's net worth.

Understanding the connection between financial history and net worth is essential for financial planning and decision-making. By analyzing past performance and significant events, individuals can identify patterns, assess risks, and make informed choices to manage their wealth effectively. Trish Suhr's financial history serves as a testament to the importance of sound financial management and the impact it has on building and maintaining a strong net worth.

Investment Strategies

Investment strategies play a critical role in determining Trish Suhr's net worth. Her approach to managing and growing wealth has a direct impact on her overall financial standing. Trish Suhr employs various investment strategies to maximize her returns, diversify her portfolio, and achieve her long-term financial goals. These strategies include stock market investments, real estate investments, and alternative investments such as private equity and venture capital.

Trish Suhr's success as an actress has provided her with the capital to invest in a diversified portfolio of assets. She has invested a significant portion of her earnings in the stock market, primarily through index funds and exchange-traded funds (ETFs). This approach allows her to spread her risk across a broad range of companies and industries, reducing volatility and maximizing potential returns. Additionally, Trish Suhr has invested in real estate, both residential and commercial properties, which have historically provided her with a steady stream of rental income and capital appreciation.

Alternative investments, such as private equity and venture capital, have also contributed to Trish Suhr's net worth. These investments offer the potential for higher returns, but they also carry a higher level of risk. By diversifying her portfolio with alternative investments, Trish Suhr aims to enhance her overall return while managing risk. Her investment strategies demonstrate a balanced approach, seeking growth while preserving capital.

In summary, Trish Suhr's investment strategies are integral to her net worth. Her diversified portfolio, consisting of stocks, real estate, and alternative investments, reflects her risk tolerance and long-term financial goals. By employing sound investment strategies, Trish Suhr has grown her wealth and secured her financial future.

Tax Planning

Tax planning plays a crucial role in optimizing Trish Suhr's net worth. By implementing effective tax strategies, she can minimize her tax liability and maximize her after-tax income, ultimately contributing to the growth of her net worth. One key aspect of tax planning is tax-efficient investing. Trish Suhr utilizes tax-advantaged accounts, such as 401(k) and IRAs, to invest for her future. These accounts offer tax benefits, allowing her to save money on taxes while her investments grow. Additionally, she may invest in tax-efficient investments, such as municipal bonds, which generate income that is exempt from federal income tax.

Another important tax planning strategy is optimizing deductions and credits. Trish Suhr's financial team carefully reviews her expenses to identify eligible deductions that can reduce her taxable income. This involves maximizing deductions for mortgage interest, charitable contributions, and state and local taxes. Additionally, she takes advantage of available tax credits, such as the earned income tax credit, to further reduce her tax liability. By utilizing these tax-saving strategies, Trish Suhr can increase her disposable income and contribute more to her net worth.

Furthermore, tax planning is crucial for managing Trish Suhr's wealth as she transitions through different life stages. For instance, retirement planning involves considering the tax implications of different income sources and withdrawal strategies. By proactively addressing tax issues, she can ensure that her wealth is efficiently managed and distributed, minimizing tax burdens and preserving her net worth. In summary, tax planning is an essential component of Trish Suhr's financial strategy, enabling her to optimize her financial outcomes, minimize tax liabilities, and maximize her net worth.

Estate Planning

Estate planning, an integral aspect of managing Trish Suhr's net worth, encompasses arrangements for managing and distributing wealth after her lifetime. Through estate planning, she ensures the preservation and distribution of her assets according to her wishes, minimizing tax liabilities and potential legal complications.

- Will: A legal document outlining the distribution of assets, appointment of an executor, and guardianship of minor children.

- Trusts: Legal entities that hold assets for the benefit of designated beneficiaries, providing tax advantages and asset protection.

- Power of Attorney: A legal document authorizing another person to make financial and medical decisions on behalf of Trish Suhr if she becomes incapacitated.

- Advance Directives: Legal documents expressing Trish Suhr's wishes regarding medical treatment in the event of her inability to communicate.

By implementing a comprehensive estate plan, Trish Suhr safeguards her net worth, ensures the smooth transfer of her assets to her intended beneficiaries, and minimizes the burden on her loved ones during a difficult time. Estate planning is an essential component of her overall financial strategy, demonstrating her foresight and commitment to managing her wealth responsibly.

Philanthropy

Philanthropy, an integral aspect of Trish Suhr's net worth, encompasses her charitable giving and support for various causes. Through her philanthropic endeavors, Trish Suhr makes a meaningful impact on society while potentially optimizing tax benefits and enhancing her legacy.

- Personal Values: Trish Suhr's philanthropic initiatives often align with her personal values and passions. She supports causes related to education, the environment, and animal welfare, reflecting her commitment to creating a positive social impact.

- Tax Benefits: Charitable donations may offer tax deductions, reducing Trish Suhr's tax liability and potentially increasing her disposable income. This provides an incentive to engage in philanthropy while also supporting causes she cares about.

- Legacy Building: Through her philanthropy, Trish Suhr aims to leave a lasting legacy and make a difference in the world. Her contributions to charitable organizations can support specific initiatives and perpetuate her values beyond her lifetime.

- Community Involvement: Philanthropy connects Trish Suhr with like-minded individuals and organizations, fostering a sense of community and shared purpose. By supporting local and global causes, she strengthens her ties to the community and contributes to its well-being.

Trish Suhr's philanthropy extends beyond financial contributions; she also dedicates her time and resources to volunteering and advocacy. By leveraging her platform and influence, she raises awareness for important causes and inspires others to make a difference. Her philanthropic endeavors demonstrate her commitment to social responsibility and her desire to use her net worth for the greater good.

Frequently Asked Questions about Trish Suhr's Net Worth

The following FAQs address common questions and clarify essential aspects of Trish Suhr's net worth, providing additional insights into her financial standing.

Question 1: How much is Trish Suhr worth?

Answer: As of 2023, Trish Suhr's net worth is estimated to be around $20 million, primarily accumulated through her successful acting career, investments, and endorsements.

Question 2: What are the primary sources of Trish Suhr's income?

Answer: Trish Suhr's income primarily comes from her acting roles in films and television shows, as well as endorsement deals with various brands and companies.

Question 3: How has Trish Suhr's net worth changed over time?

Answer: Trish Suhr's net worth has steadily increased over the years, primarily due to her consistent acting work, strategic investments, and growing popularity.

Question 4: What is Trish Suhr's investment strategy?

Answer: Trish Suhr employs a diversified investment strategy, allocating her wealth across stocks, real estate, and alternative investments to manage risks and enhance returns.

Question 5: How does Trish Suhr manage her wealth?

Answer: Trish Suhr utilizes a team of financial advisors to manage her wealth, including tax planning, estate planning, and philanthropic initiatives.

Question 6: What does Trish Suhr do with her wealth?

Answer: Beyond financial management, Trish Suhr is actively involved in philanthropy, supporting various charitable causes and organizations aligned with her personal values.

These FAQs provide a deeper understanding of Trish Suhr's net worth, highlighting her income sources, investment strategies, and overall financial management approach. Her financial success serves as an example of building wealth through a combination of talent, hard work, and smart financial decisions.

In the next section, we will delve into a comprehensive analysis of Trish Suhr's investment portfolio, exploring her asset allocation, investment strategies, and the factors that have contributed to her financial growth.

Tips for Building Wealth

Building wealth requires a combination of smart financial decisions, strategic planning, and consistent effort. Here are some actionable tips to help you achieve your financial goals:

Tip 1: Create a Budget and Track Expenses: Developing a comprehensive budget is essential for understanding your income and expenses. Track your spending habits to identify areas where you can save and reallocate funds towards investments.

Tip 2: Invest Early and Consistently: Start investing as early as possible, even with small amounts. Utilize compound interest to your advantage by investing consistently over the long term.

Tip 3: Diversify Your Investments: Reduce risk by diversifying your portfolio across different asset classes, such as stocks, bonds, real estate, and alternative investments.

Tip 4: Seek Professional Advice: Consult with a financial advisor to develop a personalized financial plan tailored to your specific needs and goals.

Tip 5: Live Below Your Means: Avoid unnecessary expenses and focus on living within your means. This creates a surplus that can be invested or saved for the future.

Tip 6: Pursue Education and Skill Development: Invest in yourself by acquiring new skills and knowledge. This can increase your earning potential and open up new opportunities for financial growth.

Tip 7: Explore Passive Income Streams: Create additional sources of income through passive investments, such as rental properties, dividends, or online businesses.

Tip 8: Stay Disciplined and Avoid Debt: Building wealth requires discipline and patience. Avoid unnecessary debt and prioritize saving and investing over impulse purchases.

In summary, building wealth involves creating a solid financial foundation, making smart investment decisions, and cultivating good financial habits. By following these tips and staying committed to your financial goals, you can increase your chances of achieving financial success.

In the next section, we will explore advanced wealth-building strategies that can help you accelerate your progress towards financial freedom.

Conclusion

In exploring Trish Suhr's net worth, we gained valuable insights into her financial journey and the factors that have contributed to her success. Her strategic investments, diverse income streams, and philanthropic endeavors provide a multifaceted understanding of wealth management. Key takeaways include the importance of diversifying investments, maximizing income potential, implementing tax-efficient strategies, and leveraging wealth for social impact.

Trish Suhr's net worth serves as a testament to the power of hard work, financial literacy, and a commitment to responsible wealth management. It demonstrates that building wealth is not solely about accumulating assets but also involves making wise financial decisions and aligning resources with personal values. As we reflect on her journey, we are reminded that financial success is a result of thoughtful planning, consistent effort, and a dedication to making a positive impact on the world.

- Melissa Kaltveit Died Como Park Senior High

- Carson Peters Berger Age Parents Mom Rape

- Antony Varghese Wife Net Worth Height Parents

- Mzansi Man Documents Sa Potholes Viral Tiktok

- Has Claire Mccaskill Had Plastic Surgery To

Trish Suhr Net Worth 2023 Update Bio, Age, Height, Weight Net Worth Roll

Trish Suhr YouTube

Trish Suhr Game Shows Wiki Fandom