Texas Teacher Retirement: Your System & Benefits

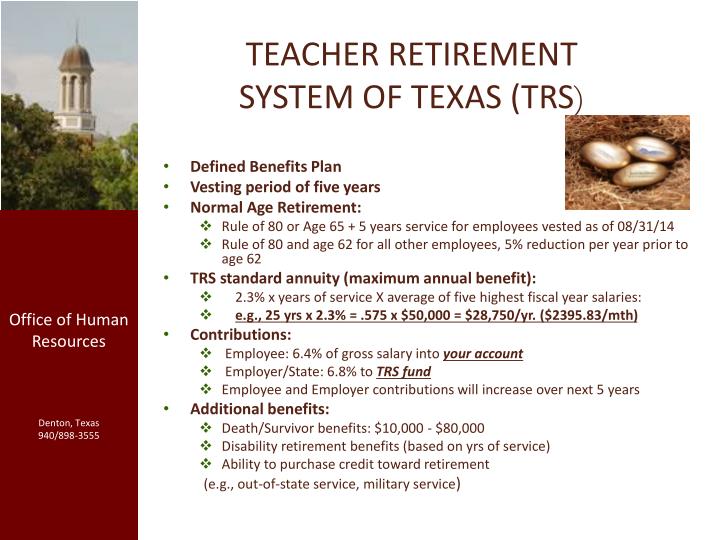

This entity serves as the pension fund for educators employed by public schools within the state. It manages contributions from both employees and the state to provide retirement, disability, and death benefits. These benefits are calculated based on factors such as years of service, average salary, and a predetermined benefit formula.

The establishment and maintenance of a financially secure retirement system is vital for attracting and retaining qualified educators. This, in turn, has a positive impact on the quality of education provided to students across the state. The historical context reveals ongoing efforts to ensure the system's long-term solvency through legislative action and careful investment strategies, safeguarding the financial future of its members.

The following sections will delve into specific aspects of the plan, including eligibility requirements, benefit calculation methodologies, investment strategies, and ongoing challenges faced in maintaining its financial stability. Further discussion will address the role of legislation and governance in shaping the system's future.

- Truth About Nadine Caridi Jordan Belfort S

- Antony Varghese Wife Net Worth Height Parents

- Is Duncan Crabtree Ireland Gay Wiki Partner

- Julia Dweck Dead And Obituary Nstructor Willow

- Hilaree Nelson Wiki Missing Husband Family Net

Frequently Asked Questions

This section addresses common inquiries regarding the state-sponsored pension program for public education employees.

Question 1: What are the eligibility requirements for retirement benefits?

Eligibility is determined by a combination of age and years of creditable service. Specific requirements vary based on the applicable benefit structure at the time of entry into the system. Consult official documentation for precise details.

- Layke Leischner Car Accident Resident Of Laurel

- Noah Pc3a9rez Chris Perez Son Age

- Is Max Muncy Christian Or Jewish Religion

- Who Is Natalie Tene What To Know

- Dd Returns Ott Release Date The Most

Question 2: How is the retirement benefit amount calculated?

The calculation involves a formula that considers average salary, years of service, and a pre-determined accrual rate. The specific formula in effect at the time of retirement governs the benefit calculation.

Question 3: Can a retiree return to work in a public school and still receive benefits?

Returning to work in a public education position may impact the ongoing receipt of retirement benefits. Restrictions and potential earnings limitations may apply. Contact the system directly for clarification on applicable rules.

Question 4: What happens to retirement benefits in the event of a member's death?

Survivor benefits may be payable to designated beneficiaries, depending on the retirement option selected and the beneficiary's relationship to the deceased member. Specific provisions are outlined in the plan documents.

Question 5: How is the system funded?

Funding originates from employee contributions, state contributions, and investment returns on the assets held in trust. The proportion contributed by each party may vary over time based on legislative decisions and actuarial valuations.

Question 6: How can I access my account information?

Account information is typically accessible through an online portal or by contacting the system directly. Members are encouraged to regularly review their account statements and beneficiary designations.

In summary, the retirement system represents a crucial component of the financial well-being for education professionals. Understanding its provisions is essential for effective retirement planning.

The subsequent section will examine the governance structure and the role of the legislature in overseeing the retirement fund.

Navigating Retirement Planning

Effective retirement planning requires a thorough understanding of the plan's provisions and active engagement in managing one's individual account. The following tips are provided to assist educators in maximizing their retirement benefits.

Tip 1: Understand Your Benefit Structure: Determine which benefit structure applies based on your date of employment. This impacts eligibility requirements and benefit calculation formulas. Refer to official system documents for clarification.

Tip 2: Maximize Creditable Service: Explore options for purchasing service credit for prior eligible employment, if applicable. Increasing years of creditable service directly affects the retirement benefit amount.

Tip 3: Review Beneficiary Designations Regularly: Ensure that beneficiary designations are current and reflect desired wishes. Life events such as marriage, divorce, or the birth of a child necessitate a review of beneficiary forms.

Tip 4: Attend Informational Seminars: Participate in seminars and workshops offered by the retirement system to gain insights into benefit options and retirement planning strategies. These events provide opportunities to ask questions and receive personalized guidance.

Tip 5: Utilize Online Resources: Familiarize yourself with the online resources provided by the system, including account statements, benefit estimators, and informational publications. These tools can assist in tracking progress and projecting future benefits.

Tip 6: Plan for Healthcare Costs: Consider the cost of healthcare in retirement and explore available options for health insurance coverage. Understanding healthcare expenses is a critical component of retirement financial planning.

Tip 7: Consider Tax Implications: Understand the tax implications of retirement benefits and consult with a qualified tax advisor to develop a tax-efficient retirement income strategy. Retirement income may be subject to federal and state taxes.

By diligently applying these tips, members can proactively manage their retirement savings and secure a more financially stable future.

The subsequent section will offer resources and contact information for further assistance and clarification.

Conclusion

This exploration of the teacher retirement system of texas has detailed its core functions, eligibility criteria, benefit calculation methods, and governance structure. It has also addressed frequently asked questions and offered practical retirement planning advice. Understanding these elements is crucial for those contributing to and relying upon this system for their financial security in retirement.

The teacher retirement system of texas plays a vital role in securing the financial futures of dedicated educators. Its long-term stability necessitates ongoing vigilance, responsible stewardship, and informed participation from all stakeholders. Continued attention to its actuarial soundness and adaptability to evolving economic conditions remains paramount to ensuring its continued success and fulfilling its commitment to its members.

- Did Tori Bowie Baby Survive What Happened

- Beloved Irish Father Clinton Mccormack Dies After

- Thomas Lineberger Aberdeen Nc Famous Internal Medicine

- A Tragic Loss Remembering Dr Brandon Collofello

- Melissa Kaltveit Died Como Park Senior High

Teacher Retirement System of Texas, 9786137928660, 6137928667

PPT New Employee Orientation Benefits PowerPoint Presentation ID

Teacher Retirement System Of Texas Secure Your Tomorrow WealthCaves