Unlocking The Secrets: Rahul Subramanian's Path To Net Worth

Rahul Subramanian Net Worth (noun): The combined value of all Rahul Subramanian's financial assets and liabilities, reflecting his overall financial standing. For instance, a tech entrepreneur with substantial investments in startups and real estate would have a significantly higher net worth than an employee with a modest salary and few assets.

Understanding Rahul Subramanian's net worth provides insights into his financial success, investment strategies, and overall wealth management practices. It can serve as a valuable benchmark for individuals seeking financial guidance and inspiration.

Historically, net worth has played a crucial role in shaping financial policies and regulations. Its emergence as a key metric in assessing financial health dates back to the early 19th century.

- Is Gerrit Cole Jewish Or Christian Ethnicity

- Is Sam Buttrey Jewish Religion And Ethnicity

- Milo Ventimiglia Reportedly Dating New Girlfriend Jarah

- Who Is Natalie Tene What To Know

- Bad Bunny Used To Make Mix Cds

Rahul Subramanian Net Worth

The essential aspects of Rahul Subramanian Net Worth provide a comprehensive overview of his financial standing, investment strategies, and wealth management practices. These aspects are crucial for understanding his overall financial success and serve as valuable insights for individuals seeking financial guidance and inspiration.

- Assets

- Liabilities

- Investments

- Income

- Expenses

- Cash Flow

- Debt

- Equity

- Net Worth

Examining these aspects in detail reveals Rahul Subramanian's financial strengths and weaknesses, his ability to generate and manage wealth, and his overall financial health. For instance, a high net worth may indicate significant assets and investments, while a high debt-to-equity ratio could suggest financial risks. By analyzing these aspects, investors and financial professionals can make informed decisions about potential investments and partnerships.

Assets

Assets form the foundation of Rahul Subramanian's net worth, representing the valuable resources and properties he owns. These assets can be tangible or intangible, and their combined value significantly influences his overall financial standing.

- Who Is Miranda Rae Mayo Partner Her

- Meet Jason Weathers And Matthew Weathers Carl

- Where Was I Want You Back Filmed

- Meet Ezer Billie White The Daughter Of

- Meet Jordyn Hamilton Dave Portnoy S Ex

- Cash and Cash Equivalents: This includes physical cash, money in bank accounts, and short-term investments that can be easily converted into cash, providing liquidity and flexibility.

- Investments: Rahul Subramanian's investments encompass stocks, bonds, mutual funds, and real estate holdings. These investments represent his stake in businesses and properties, potentially generating income and appreciating in value over time.

- Property and Equipment: This category includes his primary residence, vacation homes, vehicles, and any other real estate or equipment owned by him. These assets provide shelter, transportation, and potential rental income.

- Intellectual Property: Rahul Subramanian may possess valuable intellectual property such as patents, trademarks, or copyrights. These intangible assets can generate royalties, license fees, or other forms of income.

Analyzing the composition and value of Rahul Subramanian's assets offers insights into his investment strategies, risk tolerance, and overall financial health. A diversified portfolio of assets can mitigate risks and enhance returns, while a high concentration in a particular asset class may indicate a specific investment focus or risk appetite.

Liabilities

Liabilities represent the financial obligations of Rahul Subramanian, which reduce his net worth and impact his overall financial health. Understanding the composition and extent of his liabilities is crucial for assessing his financial risks, solvency, and ability to meet future commitments.

- Debt: This includes outstanding loans, mortgages, credit card balances, and any other borrowed funds. Debt can be a significant liability, especially if interest rates rise or income decreases, potentially straining Rahul Subramanian's cash flow and financial stability.

- Accounts Payable: These are unpaid bills and invoices for goods or services received but not yet paid for. Managing accounts payable effectively is essential for maintaining good relationships with suppliers and avoiding late payment penalties.

- Taxes Payable: Rahul Subramanian is liable for various taxes, including income tax, property tax, and sales tax. Failure to meet tax obligations can result in penalties, interest charges, and even legal consequences.

- Deferred Revenue: This represents payments received in advance for goods or services that have not yet been delivered or performed. Deferred revenue creates a liability until the underlying obligation is fulfilled.

Analyzing Rahul Subramanian's liabilities provides insights into his financial leverage, liquidity, and risk profile. High levels of debt relative to assets may indicate financial strain and increased vulnerability to economic downturns. Conversely, a manageable debt-to-asset ratio suggests a more conservative financial stance and reduced risk exposure.

Investments

Investments constitute a pivotal component of Rahul Subramanian's net worth, reflecting his strategic allocation of financial resources to generate income, appreciate in value, and achieve long-term financial goals.

- Stocks: Rahul Subramanian may invest in stocks, representing ownership shares in publicly traded companies. Stocks offer the potential for capital appreciation and dividend income but also carry market risk.

- Bonds: Bonds are fixed-income securities that provide regular interest payments and return the principal amount at maturity. They offer lower risk and potential returns than stocks but contribute to portfolio diversification.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They offer professional management, diversification, and lower investment minimums.

- Real Estate: Rahul Subramanian may invest in residential or commercial properties, either directly or through real estate investment trusts (REITs). Real estate offers potential rental income, appreciation, and tax benefits but also requires significant capital and ongoing maintenance.

Rahul Subramanian's investment strategy and the performance of his investments significantly impact his overall net worth. A well-diversified portfolio across asset classes can mitigate risk and enhance returns, while underperforming investments can erode his wealth. Monitoring and managing his investments effectively are crucial for preserving and growing his financial assets.

Income

Rahul Subramanian's income plays a crucial role in determining his net worth by providing the financial resources to acquire and maintain his assets while servicing his liabilities. Income encompasses various sources, each with its unique characteristics and implications for his financial well-being.

- Salary and Wages: This represents income earned from employment, including regular wages, bonuses, and commissions. It provides a steady and predictable stream of income, forming the foundation of Rahul Subramanian's financial stability.

- Business Income: If Rahul Subramanian owns a business, the profits generated from its operations contribute to his income. Business income can be highly variable, influenced by market conditions, competition, and business decisions.

- Investment Income: Income derived from investments, such as dividends from stocks, interest from bonds, and rental income from real estate, supplements Rahul Subramanian's earned income. Investment income can provide a passive stream of income and enhance his overall net worth.

- Other Income: This category includes income from various sources, such as royalties, pensions, and annuities. Other income can provide additional financial support and contribute to Rahul Subramanian's overall financial security.

The composition and stability of Rahul Subramanian's income sources significantly impact his net worth. A diversified income stream, with a balance between earned and passive income, can enhance financial resilience and support long-term wealth accumulation. Monitoring and optimizing his income streams are essential for Rahul Subramanian to maintain and grow his financial well-being.

Expenses

Expenses play a pivotal role in determining Rahul Subramanian's net worth by reducing his overall financial resources. Understanding the nature and extent of his expenses is crucial for assessing his financial health, managing his cash flow, and making informed decisions about his financial future.

Fixed expenses, such as mortgage payments, rent, car payments, and insurance premiums, are essential outlays that remain relatively constant each month. These expenses form the foundation of Rahul Subramanian's financial obligations and must be prioritized to maintain his lifestyle and financial stability.

Variable expenses, on the other hand, fluctuate depending on his spending habits and lifestyle. Examples include groceries, entertainment, dining out, and travel. Managing variable expenses effectively can free up financial resources for savings, investments, or debt reduction, positively impacting Rahul Subramanian's overall net worth.

By tracking and analyzing his expenses, Rahul Subramanian can identify areas where he can save money or optimize his spending. Reducing unnecessary expenses, negotiating lower bills, or finding more cost-effective alternatives can significantly increase his disposable income and contribute to long-term wealth accumulation. Monitoring expenses also helps him stay within his budget, avoid excessive debt, and maintain a healthy financial position.

Cash Flow

Cash flow is a crucial aspect of Rahul Subramanian's net worth, reflecting the movement of money into and out of his financial accounts. Understanding the various components of his cash flow provides insights into his financial health, liquidity, and overall ability to generate and manage wealth.

- Operating Cash Flow: This represents the cash generated from Rahul Subramanian's business or investment activities. It includes income from sales, investments, and other sources, as well as expenses related to operations.

- Investing Cash Flow: This reflects the cash used for acquiring or disposing of assets, such as purchasing property, investing in stocks, or making loans. It helps assess Rahul Subramanian's investment strategy and his allocation of financial resources.

- Financing Cash Flow: This involves the cash flow associated with financing activities, such as borrowing money, issuing bonds, or paying dividends. It provides insights into Rahul Subramanian's debt management and capital structure.

- Net Cash Flow: This represents the overall cash flow position, calculated as the sum of operating, investing, and financing cash flows. A positive net cash flow indicates that Rahul Subramanian is generating more cash than he is using, while a negative net cash flow suggests the opposite.

Analyzing Rahul Subramanian's cash flow patterns can reveal his financial strengths and weaknesses. A consistent positive cash flow indicates financial stability, liquidity, and the ability to meet financial obligations. Conversely, a negative cash flow may indicate financial strain, overspending, or difficulty in generating sufficient income. Monitoring and managing cash flow effectively are crucial for Rahul Subramanian to maintain financial health, make informed investment decisions, and achieve long-term financial goals.

Debt

Debt plays a significant role in shaping Rahul Subramanian's net worth, influencing his financial health, investment strategies, and overall wealth management practices.

- Outstanding Loans: These include personal loans, mortgages, and business loans that Rahul Subramanian has borrowed and must repay with interest. High levels of outstanding loans can reduce his net worth and strain his cash flow.

- Credit Card Balances: Rahul Subramanian may carry credit card balances, which accrue interest charges if not paid in full each month. Excessive credit card debt can negatively impact his credit score and increase his financial burden.

- Deferred Taxes: In some cases, Rahul Subramanian may have deferred tax liabilities, where taxes on certain income or gains are postponed to a later date. These deferred taxes represent a future financial obligation that can affect his net worth.

- Other Liabilities: Rahul Subramanian may have other liabilities, such as unpaid bills, legal judgments, or contractual obligations. These liabilities can accumulate over time and potentially reduce his net worth if not managed properly.

The presence and extent of debt in Rahul Subramanian's financial profile provide insights into his risk tolerance, liquidity, and overall financial management. Prudent debt management involves balancing the use of debt to finance growth and investments while minimizing its potential risks and negative impact on his net worth.

Equity

Equity represents a critical component of Rahul Subramanian's net worth, reflecting the value of his ownership interest in assets minus any outstanding liabilities. Essentially, equity measures the residual financial value that belongs to Rahul Subramanian after accounting for all debts and obligations. A higher equity position indicates a stronger financial standing and greater wealth accumulation.

The relationship between equity and Rahul Subramanian's net worth is directly proportional: as his equity increases, so does his net worth. This is because equity represents the portion of assets that Rahul Subramanian truly owns, free and clear of any debt. Therefore, increasing equity levels through strategic investments, asset appreciation, or debt reduction can significantly boost his overall net worth.

For instance, if Rahul Subramanian invests in a property with a market value of $1 million and puts down a 20% down payment of $200,000, his initial equity in the property is $200,000. As he continues to pay down the mortgage and the property appreciates in value, his equity in the property will grow, positively impacting his net worth.

Understanding the connection between equity and Rahul Subramanian's net worth is crucial for effective financial planning and wealth management. By focusing on strategies that enhance equity, such as investing in appreciating assets and reducing debt, Rahul Subramanian can proactively increase his net worth and achieve long-term financial success.

Net Worth

Rahul Subramanian's net worth serves as a comprehensive measure of his financial well-being, encompassing all his assets and liabilities. Understanding the various aspects of net worth is essential for assessing his overall financial health and making informed decisions.

- Assets

Assets refer to everything Rahul Subramanian owns that holds value, including cash, investments, property, and personal belongings. A higher asset value indicates greater financial resources and potential for wealth accumulation.

- Liabilities

Liabilities represent debts and financial obligations that Rahul Subramanian owes, such as mortgages, loans, and credit card balances. A high level of liabilities can reduce his net worth and impact his financial stability.

- Investments

Investments encompass Rahul Subramanian's holdings in various financial instruments, including stocks, bonds, and real estate. The performance of these investments can significantly influence his net worth over time.

- Equity

Equity represents the value of Rahul Subramanian's ownership interest in assets after deducting any outstanding liabilities. A higher equity position indicates greater financial strength and potential for wealth growth.

These facets of net worth provide a multifaceted view of Rahul Subramanian's financial standing. By carefully managing his assets, liabilities, investments, and equity, he can proactively enhance his net worth and secure his financial future.

FAQs on Rahul Subramanian Net Worth

This section addresses frequently asked questions and clarifies key aspects related to Rahul Subramanian's net worth, providing a deeper understanding of its components and significance.

Question 1: What is included in Rahul Subramanian's net worth?

Rahul Subramanian's net worth encompasses all his financial assets, including cash, investments, and property, minus any liabilities such as debts and loans.

Question 2: How does Rahul Subramanian's investment strategy impact his net worth?

Rahul Subramanian's investment strategy plays a crucial role in determining the growth of his net worth. Prudent investment decisions, such as diversifying his portfolio and investing in appreciating assets, can significantly enhance its value.

Question 3: What are some factors that can negatively affect Rahul Subramanian's net worth?

Factors such as poor investment performance, excessive debt, and financial mismanagement can negatively impact Rahul Subramanian's net worth, reducing its overall value.

Question 4: How does Rahul Subramanian's net worth compare to others in his industry?

Benchmarking Rahul Subramanian's net worth against industry peers provides insights into his financial success relative to others in the same field.

Question 5: What are the potential risks associated with a high net worth?

While a high net worth indicates financial success, it also comes with potential risks, such as increased exposure to market volatility and the need for sophisticated wealth management strategies.

Question 6: How can Rahul Subramanian increase his net worth?

Rahul Subramanian can increase his net worth by implementing strategies such as maximizing income, investing wisely, reducing expenses, and managing debt effectively.

In summary, understanding the various aspects of Rahul Subramanian's net worth is crucial for assessing his financial health and making informed decisions. The FAQs addressed in this section provide valuable insights into the factors that influence his net worth and its implications.

Moving forward, the next section will delve deeper into Rahul Subramanian's investment strategies and how they have contributed to his overall net worth.

Tips to Enhance Rahul Subramanian's Net Worth

This section provides actionable strategies that Rahul Subramanian can implement to grow his net worth and achieve long-term financial success.

Tip 1: Optimize Your Investment Strategy

Rahul Subramanian should regularly review his investment portfolio and adjust it based on market conditions and his risk tolerance. Diversifying across different asset classes and sectors can help mitigate risk and enhance returns.

Tip 2: Maximize Income Streams

Exploring additional income streams, such as starting a side hustle or investing in passive income sources, can significantly contribute to Rahul Subramanian's overall net worth.

Tip 3: Reduce Unnecessary Expenses

Identifying and cutting back on discretionary expenses, such as dining out or entertainment, can free up more financial resources for saving and investing.

Tip 4: Manage Debt Effectively

Rahul Subramanian should prioritize high-interest debts and consider consolidating or refinancing to lower interest rates. Reducing debt can increase his net worth and improve his financial stability.

Tip 5: Seek Professional Financial Advice

Consulting with a financial advisor or wealth manager can provide personalized guidance and expert insights, helping Rahul Subramanian make informed financial decisions.

By implementing these tips, Rahul Subramanian can enhance his financial well-being, increase his net worth, and secure his future financial goals.

The following section will delve into the impact of Rahul Subramanian's investment strategies on his overall net worth, providing further insights into his financial success.

Conclusion

In conclusion, Rahul Subramanian's net worth stands as a testament to his astute investment strategies, prudent financial management, and commitment to long-term wealth accumulation. Key insights gleaned from an exploration of his net worth include the crucial role of asset diversification, the benefits of maximizing income streams, and the importance of managing debt effectively.

These interconnected elements form the foundation of Rahul Subramanian's financial success, demonstrating the profound impact of well-informed decision-making and a disciplined approach to wealth management. As the financial landscape continues to evolve, individuals seeking financial growth can draw inspiration from Rahul Subramanian's journey, recognizing the significance of strategic planning and responsible financial practices.

- Antony Varghese Wife Net Worth Height Parents

- Patrick Alwyn Age Height Weight Girlfriend Net

- Dd Returns Ott Release Date The Most

- Know About Camren Bicondova Age Height Gotham

- New Roms Xci Nsp Juegos Nintendo Switch

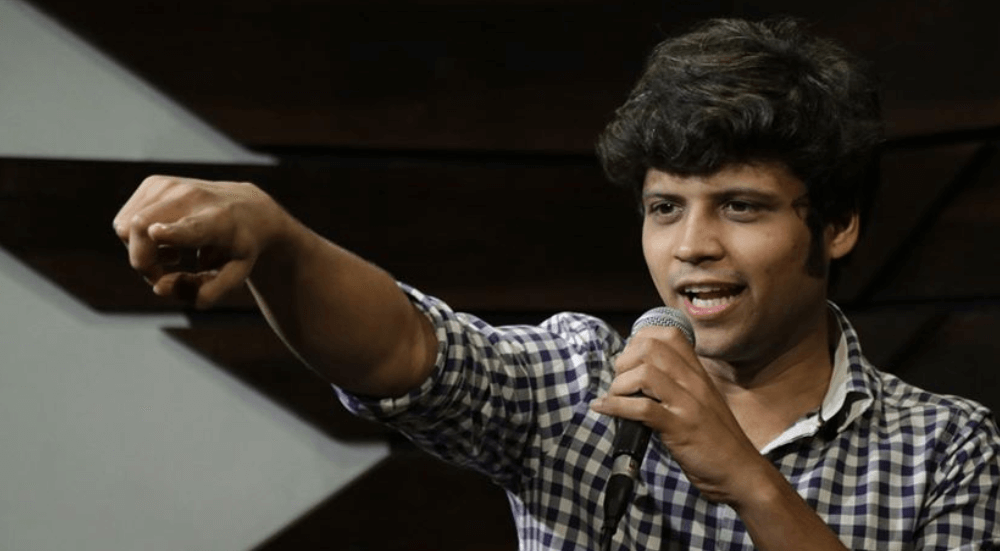

Rahul Subramanian Wikipedia, Bio, Age, Height, Weight

Know Your Comic The Top 5 Rahul Subramanian Videos To Watch Online

Rahul Subramanian Wiki, Biography, Age, Family, Images & More wikimylinks