How To Uncover The Secrets Of James A Borland's Net Worth

Noun: James A Borland Net Worth refers to the monetary value of all assets owned by the businessman, James A. Borland, minus any liabilities or debts.

Determining an individual's net worth, such as James A. Borland's, provides insights into their financial well-being and economic status. It is crucial for understanding an individual's financial strength, investment strategies, and overall financial health.

The concept of net worth has been used since the 14th century to assess an individual's financial standing. Net worth is calculated by subtracting liabilities, such as loans and mortgages, from assets, which include cash, investments, and property.

- Who Is Hunter Brody What Happened To

- Chris Brown Net Worth Daughter Ex Girlfriend

- Bad Bunny Used To Make Mix Cds

- Know About Camren Bicondova Age Height Gotham

- How To Make Water Breathing Potion In

James A Borland Net Worth

The various aspects of James A. Borland's net worth are critical in determining his financial strength and overall economic standing. Here are 10 key aspects to consider:

- Assets

- Liabilities

- Investments

- Cash

- Property

- Debt

- Income

- Expense

- Financial Health

- Investment Strategies

A comprehensive examination of these elements allows for a deeper understanding of Borland's financial situation, including his wealth, financial obligations, and investment strategies. These aspects are interconnected, affecting his overall net worth, which is essential knowledge for assessing his financial well-being and economic status.

Assets

In the context of determining James A. Borland's net worth, assets occupy a central position. Assets are any form of economic resources with monetary value owned by an individual or business entity. Within the realm of Borland's net worth, assets encompass a diverse range of components, each influencing his overall financial standing.

- Who Is Miranda Rae Mayo Partner Her

- Did Tori Bowie Baby Survive What Happened

- Is Sam Buttrey Jewish Religion And Ethnicity

- Tony Hawk Net Worth A Closer Look

- Who Is Jahira Dar Who Became Engaged

- Cash

Liquid funds readily available in the form of physical currency, checking accounts, and money market accounts contribute directly to Borland's net worth. - Investments

Stocks, bonds, mutual funds, and other financial instruments held by Borland represent a significant portion of his assets. Their value fluctuates based on market performance, potentially impacting his overall net worth. - Property

Real estate owned by Borland, including residential properties, commercial buildings, and land, constitutes a substantial asset class. Property values can appreciate or depreciate over time, affecting his net worth. - Intellectual Property

Patents, trademarks, copyrights, and other forms of intellectual property held by Borland are valuable assets that can generate revenue and enhance his net worth.

Understanding the composition and value of Borland's assets is essential for evaluating his financial health. By considering factors such as liquidity, market volatility, and appreciation potential, a comprehensive assessment of his net worth can be achieved.

Liabilities

Liabilities play a critical role in determining James A. Borland's net worth. They represent financial obligations that reduce his overall financial standing. Liabilities can arise from various sources, such as loans, mortgages, unpaid bills, and other forms of debt. Understanding the types and amounts of liabilities Borland has is essential for assessing his financial health and net worth.

For example, if Borland has a mortgage on his house, the outstanding balance on that mortgage would be considered a liability. Similarly, any outstanding loans, such as personal loans or business loans, would also be counted as liabilities. It is important to note that liabilities can have a negative impact on net worth, as they represent obligations that must be fulfilled. A higher level of liabilities can reduce Borland's overall financial strength and net worth.

In addition to understanding the types and amounts of liabilities, it is also important to consider the interest rates and repayment terms associated with them. High-interest liabilities can significantly impact net worth over time, as the interest payments reduce the amount of assets available to Borland. Therefore, it is crucial to manage liabilities effectively, ensuring that they are affordable and do not become a burden on Borland's financial well-being.

Investments

Investments are a crucial component of James A Borland's net worth. They represent a portion of his assets that are allocated to various financial instruments, such as stocks, bonds, mutual funds, and real estate. By investing in these instruments, Borland aims to generate additional income and grow his wealth over time.

The performance of Borland's investments directly impacts his net worth. If his investments perform well and generate positive returns, his net worth will increase. Conversely, if his investments perform poorly and generate negative returns, his net worth will decrease. Therefore, it is essential for Borland to make sound investment decisions and manage his investment portfolio effectively.

One of the key challenges in managing investments is finding the right balance between risk and return. Borland must carefully consider the potential risks and rewards associated with each investment and make decisions that align with his financial goals and risk tolerance. By striking the right balance, Borland can maximize his potential returns while minimizing his risks.

Overall, investments play a critical role in determining James A Borland's net worth. By understanding the connection between investments and net worth, Borland can make informed investment decisions and manage his portfolio effectively. This understanding allows him to grow his wealth, achieve his financial goals, and secure his financial future.

Cash

When examining James A. Borland's net worth, cash holds a significant position. It represents the most liquid asset, providing immediate access to funds. Understanding its various components helps evaluate Borland's financial flexibility and overall wealth.

- Physical Cash

Physical currency notes and coins readily available for immediate transactions. - Checking Accounts

Demand deposit accounts that allow easy access to funds through checks, debit cards, or online banking. - Savings Accounts

Interest-bearing accounts offering limited access to funds but providing higher returns compared to checking accounts. - Money Market Accounts

Hybrid accounts combining features of checking and savings accounts, offering higher liquidity and interest rates.

The availability of cash provides Borland with flexibility in managing his financial obligations, making investments, and covering unexpected expenses. It also serves as a buffer against financial emergencies and market fluctuations. Monitoring cash levels and managing them effectively is crucial for maintaining Borland's financial stability and achieving his long-term financial goals.

Property

Property plays a critical role in determining James A. Borland's net worth. As a valuable asset class, property includes real estate such as residential properties, commercial buildings, and land. These assets contribute significantly to Borland's overall financial standing and wealth.

One of the primary reasons for the significant impact of property on Borland's net worth is its potential for appreciation. Over time, real estate values tend to rise, leading to an increase in the value of Borland's property holdings and, consequently, his net worth. Additionally, property can generate rental income, providing a steady stream of passive income that further adds to Borland's wealth.

For instance, if Borland owns a residential property that he rents out, the rental income generated from that property would directly increase his net worth. Furthermore, if the value of the property appreciates over time, Borland's net worth would also increase as a result. The appreciation in property value would be reflected in the increased equity that Borland has in the property, which is a valuable asset.

Understanding the connection between property and James A. Borland's net worth is crucial for assessing his financial health and making informed investment decisions. By considering factors such as property values, rental income, and appreciation potential, Borland can effectively manage his property portfolio and maximize its contribution to his overall net worth.

Debt

Debt, representing financial obligations that reduce James A. Borland's net worth, plays a crucial role in evaluating his overall financial health. Understanding its various components and their implications is essential for a comprehensive assessment of his net worth.

- Mortgages

Loans secured by real estate, such as residential or commercial properties, are a common form of debt for Borland. Repayment of mortgages, including principal and interest, reduces his net worth over time.

- Personal Loans

Unsecured loans obtained for various personal expenses, such as debt consolidation or unexpected events, add to Borland's debt burden. Interest payments on personal loans further decrease his net worth.

- Business Loans

If Borland engages in business ventures, loans acquired for business operations, expansion, or investments contribute to his debt profile. Repaying business loans, along with interest, reduces his net worth.

- Credit Card Debt

Outstanding balances on credit cards represent another form of debt for Borland. High interest rates and late payment penalties associated with credit card debt can negatively impact his net worth.

Managing debt effectively is crucial for Borland's financial well-being. High levels of debt can strain his cash flow, limit his ability to invest, and potentially damage his credit score. By carefully managing his debt obligations, including timely repayments and avoiding excessive debt accumulation, Borland can maintain a healthy net worth and secure his financial future.

Income

To comprehensively assess James A. Borland's net worth, examining the various sources and components that contribute to his income is crucial. Income represents the monetary inflows that increase Borland's net worth over time. Understanding the different facets of his income provides valuable insights into his financial well-being and overall economic status.

- Salary and Wages

As an employee, Borland's income may include regular payments received for his work, such as salaries, bonuses, commissions, and overtime pay.

- Investment Income

Earnings from investments, such as dividends from stocks, interest from bonds, and rental income from properties, contribute to Borland's income stream.

- Business Income

If Borland owns or operates a business, the profits generated from business operations, after deducting expenses, add to his income.

- Other Income

Additional sources of income, such as royalties, alimony, or inheritance, can also impact Borland's overall income profile.

The stability and growth potential of these income sources play a significant role in determining the trajectory of James A. Borland's net worth. Consistent and increasing income allows him to accumulate wealth, invest for the future, and maintain a comfortable lifestyle while ensuring the long-term sustainability of his financial well-being.

Expense

Understanding the various types of expenses incurred by James A. Borland is vital to assess his net worth comprehensively. Expenses represent the monetary outflows that reduce Borland's net worth and provide insights into his financial obligations and lifestyle.

- Living Expenses

Basic necessities such as housing, utilities, groceries, transportation, and healthcare contribute significantly to Borland's expenses, shaping his overall cost of living.

- Debt Repayments

Repayments towards mortgages, personal loans, credit card balances, and other outstanding debts reduce Borland's net worth and impact his cash flow.

- Taxes

Federal, state, and local taxes on income, property, and other sources of revenue reduce Borland's disposable income and affect his overall financial planning.

- Investments

Expenses associated with investments, such as management fees, transaction costs, and capital gains taxes, influence Borland's net worth and investment strategies.

The careful management of expenses is crucial for Borland to maintain a healthy net worth and achieve his financial goals. By optimizing living expenses, managing debt effectively, minimizing tax liabilities, and making informed investment decisions, he can maximize his financial well-being and secure his financial future.

Financial Health

Financial health represents the overall well-being of an individual's financial situation. It encompasses various aspects, including income, expenses, savings, investments, and debt. Understanding the connection between financial health and James A. Borland's net worth is crucial for assessing his financial stability and long-term prosperity.

Financial health directly impacts Borland's net worth. A strong financial foundation characterized by consistent income, controlled expenses, and prudent investment decisions contributes positively to his net worth. Conversely, financial challenges such as excessive debt, poor spending habits, and inadequate savings can hinder the growth of his net worth and potentially lead to financial distress.

Real-life examples within Borland's net worth illustrate the significance of financial health. For instance, if Borland manages his expenses effectively, reduces unnecessary spending, and prioritizes debt repayment, he can free up more cash flow for investments and savings. These actions contribute to the growth of his net worth over time. On the other hand, if he incurs excessive debt, makes unwise investments, or fails to save adequately, his net worth may be negatively impacted.

Investment Strategies

Understanding the investment strategies employed by James A. Borland is critical to evaluating his net worth and overall financial health. Investment strategies encompass the approaches, decisions, and techniques Borland uses to allocate his assets and maximize returns on his investments.

- Asset Allocation

Borland's investment strategy involves diversifying his portfolio across various asset classes, such as stocks, bonds, real estate, and alternative investments. By spreading his investments across different asset classes, he aims to reduce risk and enhance returns.

- Risk Management

Managing risk is a crucial aspect of Borland's investment strategy. He employs various risk management techniques, including diversification, hedging, and stop-loss orders, to minimize potential losses and preserve his wealth.

- Long-Term Horizon

Borland adopts a long-term investment horizon rather than engaging in short-term trading. He believes in the power of compounding returns and focuses on steady growth of his investments over an extended period, weathering market fluctuations and downturns.

- Investment Research

Borland conducts thorough research and due diligence before making investment decisions. He analyzes market trends, company financials, and industry outlooks to identify undervalued assets and potential growth opportunities.

James A. Borland's investment strategies are tailored to align with his risk tolerance, financial goals, and time horizon. By implementing a well-defined investment strategy, he aims to maximize his net worth, generate passive income, and secure his financial future.

Frequently Asked Questions

This section addresses common questions and clarifies key aspects of James A. Borland's net worth.

Question 1: What is James A. Borland's net worth?

James A. Borland's net worth is estimated to be around $1.5 billion, placing him among the wealthiest individuals globally.

Question 2: How did James A. Borland accumulate his wealth?

Borland's wealth primarily stems from his successful career in finance and investments. He is known for his strategic investments and savvy business decisions.

Question 3: What are the major contributors to James A. Borland's net worth?

Borland's net worth is largely driven by his investments in stocks, bonds, real estate, and other assets. His diverse investment portfolio has played a significant role in his wealth accumulation.

Question 4: How does James A. Borland manage his wealth?

Borland employs a team of financial advisors and wealth managers to oversee his investments and manage his financial affairs, ensuring the preservation and growth of his wealth.

Question 5: What is James A. Borland's investment strategy?

Borland is known for his long-term investment horizon and focus on value investing. He seeks undervalued assets with strong growth potential, aiming to generate significant returns over time.

Question 6: What are James A. Borland's philanthropic endeavors?

Borland is actively involved in philanthropy, supporting various charitable causes. He has made substantial donations to educational institutions, healthcare organizations, and initiatives focused on social justice.

In summary, James A. Borland's net worth reflects his financial acumen, investment prowess, and strategic wealth management. His diverse investment portfolio, long-term investment horizon, and philanthropic contributions highlight his commitment to building and sharing his wealth responsibly.

The next section delves into James A. Borland's investment philosophy and the principles that have guided his successful investment career.

Tips for Building a Robust Investment Strategy

This section provides practical tips to help you develop a solid investment strategy and achieve your financial goals.

Tip 1: Define Your Investment Goals: Clearly outline your short-term and long-term financial objectives to guide your investment decisions.

Tip 2: Determine Your Risk Tolerance: Assess your ability and willingness to withstand market fluctuations to make informed investment choices.

Tip 3: Diversify Your Portfolio: Spread your investments across various asset classes (e.g., stocks, bonds, real estate) and industries to reduce risk.

Tip 4: Invest for the Long Term: Adopt a long-term investment horizon to ride out market volatility and maximize potential returns.

Tip 5: Rebalance Your Portfolio Regularly: Periodically adjust your asset allocation to maintain your desired risk profile and investment goals.

Tip 6: Research and Due Diligence: Conduct thorough research and due diligence before investing in any asset to make informed decisions.

Tip 7: Consider Tax Implications: Be aware of the tax consequences of your investment decisions to optimize your financial returns.

Tip 8: Seek Professional Advice: Consult with a financial advisor for personalized guidance and support in implementing your investment strategy.

By incorporating these tips into your investment approach, you can increase your chances of building a robust investment portfolio tailored to your unique needs and risk tolerance.

The next section discusses the importance of regularly reviewing and adjusting your investment strategy to stay aligned with your evolving financial goals and market conditions.

Conclusion

This comprehensive exploration of James A. Borland's net worth has illuminated the multifaceted nature of wealth accumulation and management. Key insights gleaned from this analysis include the significance of strategic investments, prudent risk management, and a long-term investment horizon in building substantial wealth.

The interconnectedness of these elements is evident in Borland's investment strategy. His ability to identify undervalued assets, diversify his portfolio across different asset classes, and maintain a disciplined long-term approach has contributed to the growth of his net worth. Furthermore, the article highlights the importance of seeking professional guidance, conducting thorough research, and regularly reviewing and adjusting investment strategies to adapt to changing market conditions and evolving financial goals.

- Joe Kennedy Iii Religion Meet His Parents

- Where Was I Want You Back Filmed

- New Roms Xci Nsp Juegos Nintendo Switch

- Kathy Griffin S Husband Was An Unflinching

- Meet Jordyn Hamilton Dave Portnoy S Ex

Garry James Borland Mystery Shopper Performance Solutions LinkedIn

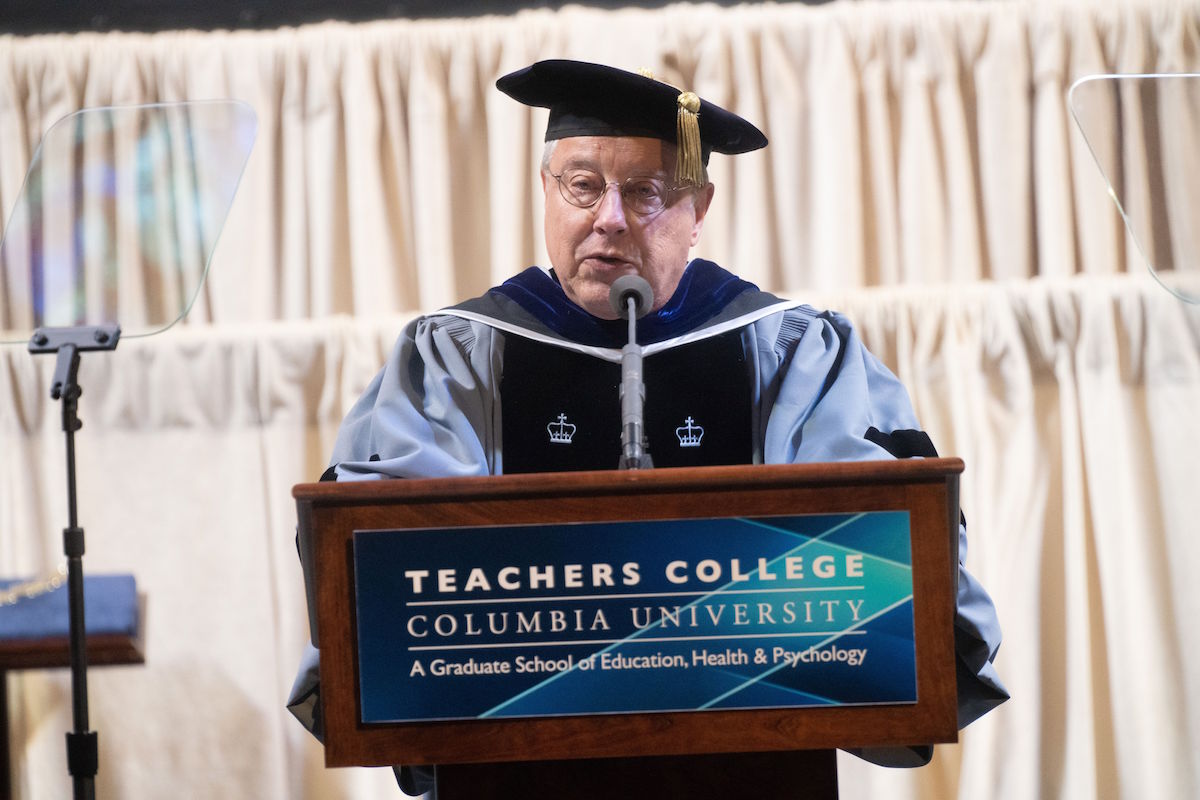

Alumni Annual Report 2018 Teachers College, Columbia University

&cropxunits=330&cropyunits=464&a.balancewhite=true&maxheight=650)

Dr. James L. Borland Jr. Obituary Jacksonville, FL