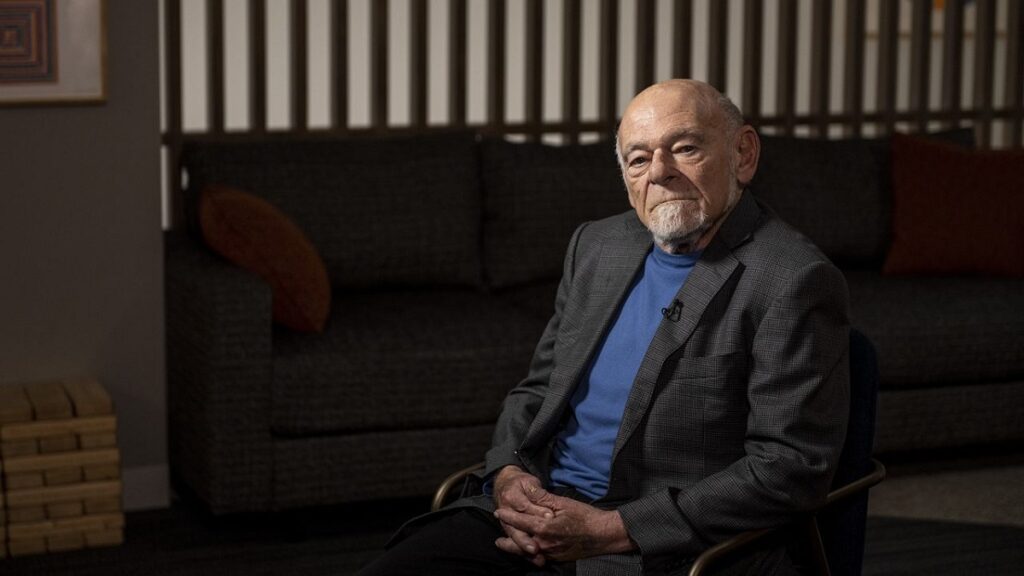

Unveiling Sam Zell's Net Worth 2024: A Guide For Wealth Builders

Sam Zell Net Worth 2024 refers to the estimated value of assets and financial resources accumulated by billionaire businessman and investor Sam Zell by the year 2024. It's a commonly searched topic, indicating the public's interest in the financial success of prominent individuals.

Understanding the net worth of individuals like Sam Zell is important for various reasons. It provides insights into the business strategies and investments that have led to their financial growth. Additionally, it can serve as inspiration and motivation for aspiring entrepreneurs and investors.

The history of net worth estimations dates back to the concept of personal finance management, where individuals track their assets and liabilities to assess their financial position. Sam Zell's net worth, in particular, has been subject to ongoing analysis and speculation, primarily due to his extensive involvement in real estate, private equity, and other business ventures.

- Who Is Natalie Tene What To Know

- Discover The Net Worth Of American Actress

- Is Gerrit Cole Jewish Or Christian Ethnicity

- Chris Brown Net Worth Daughter Ex Girlfriend

- Matthew Cassina Dies In Burlington Motorcycle Accident

Sam Zell Net Worth 2024

Understanding the essential aspects of Sam Zell's net worth in 2024 is crucial for assessing his financial success and the factors that have contributed to it. Here are ten key aspects to consider:

- Real estate investments

- Private equity portfolio

- Equity holdings

- Dividend income

- Capital gains

- Investment strategy

- Risk management

- Business acumen

- Market conditions

- Economic trends

Sam Zell's success in real estate has been a major driver of his net worth. His investments in office buildings, apartments, and other properties have generated substantial returns over the years. Additionally, his private equity portfolio, which includes investments in various industries, has contributed to his wealth. Zell's ability to identify undervalued assets and negotiate favorable deals has played a key role in his financial growth.

Real estate investments

Real estate investments constitute a significant portion of Sam Zell's net worth in 2024. Zell's strategic acquisitions and developments in the real estate market have been instrumental in his financial success.

- Singer Sami Chokri And Case Update As

- Meet Jason Weathers And Matthew Weathers Carl

- All About Dmx S Son Tacoma Simmons

- How To Make Water Breathing Potion In

- Zeinab Harake Boyfriend Who Is She Dating

- Office buildings

Zell has invested heavily in office buildings, particularly in major metropolitan areas. These investments have generated substantial rental income and capital appreciation over the years.

- Apartments

Zell's investment portfolio also includes a diverse range of apartment buildings, catering to various income levels. This diversified approach has provided a stable source of income and long-term value appreciation.

- Retail properties

Zell has ventured into retail properties, including shopping centers and retail spaces. These investments offer potential for rental income, redevelopment opportunities, and long-term appreciation.

- Development projects

Zell actively engages in real estate development projects, acquiring land and overseeing the construction of new buildings. These projects involve higher risk but also have the potential for significant returns.

Zell's real estate investments have not only contributed to his net worth but have also played a crucial role in shaping the urban landscape of major cities. His ability to identify undervalued assets, negotiate favorable deals, and manage risk has been key to his success in the real estate market.

Private equity portfolio

Sam Zell's private equity portfolio has been a crucial component of his net worth in 2024. Private equity involves investing in privately held companies, providing capital for growth, acquisitions, or restructuring. Zell's strategic investments in various industries have contributed significantly to his overall financial success.

One of the key benefits of private equity investments is the potential for high returns. Private equity firms typically target companies with strong growth prospects and the potential for significant value creation. Zell's ability to identify such companies and negotiate favorable investment terms has been instrumental in generating substantial returns on his private equity investments.

For instance, Zell's investment in Equity Office Properties Trust, a real estate investment trust, generated significant returns. He acquired the company in 2007 for $36 per share and took it private. In 2019, the company was sold for $43 per share, resulting in a substantial profit for Zell and his investors.

Understanding the connection between private equity portfolio and Sam Zell Net Worth 2024 is crucial for assessing his investment strategy and the factors that have contributed to his financial growth. Private equity investments have played a significant role in Zell's overall net worth, providing him with access to high-growth companies and the potential for substantial returns.

Equity holdings

Equity holdings, a critical component of Sam Zell Net Worth 2024, represent his ownership interests in various companies. These holdings include both publicly traded stocks and private equity investments. Zell's strategic investments in equity markets have significantly contributed to his overall financial growth.

One of the key factors that connect equity holdings to Sam Zell Net Worth 2024 is the potential for capital appreciation. When the value of a company's stock increases, the value of Zell's equity holdings in that company also increases, positively impacting his net worth. For instance, Zell's early investment in Equity Office Properties Trust, a real estate investment trust, generated substantial returns due to the company's successful performance and subsequent sale.

Additionally, equity holdings provide Zell with a source of passive income through dividends. Many publicly traded companies distribute a portion of their profits to shareholders in the form of dividends. Zell's diversified portfolio of equity holdings generates a steady stream of dividend income, contributing to his overall net worth growth.

Understanding the relationship between equity holdings and Sam Zell Net Worth 2024 is crucial for assessing the diversification and risk-reward profile of his investment strategy. Equity holdings can offer the potential for significant returns but also carry inherent risks associated with market fluctuations. Zell's ability to manage risk and identify undervalued investment opportunities has been instrumental in preserving and growing his net worth.

Dividend income

Dividend income, a crucial aspect of Sam Zell Net Worth 2024, represents the portion of his wealth generated from dividends distributed by companies in which he holds equity. Zell's strategic investments and diverse portfolio of dividend-paying stocks have significantly contributed to his overall financial growth.

- Regular income stream

Dividend income provides Zell with a steady and predictable stream of income, regardless of market fluctuations. This income can be used to fund expenses, reinvest in new opportunities, or simply add to his overall wealth.

- Tax efficiency

Dividend income is often tax-advantaged, especially in certain jurisdictions. Zell's ability to structure his investments to minimize tax implications has contributed to the preservation and growth of his net worth.

- Investment diversification

Dividend-paying stocks represent a diverse range of industries and sectors. Zell's investments in these companies provide him with exposure to various market segments, reducing his overall investment risk.

- Long-term growth potential

Companies that consistently pay dividends often exhibit strong financial performance and growth prospects. Zell's investments in such companies offer the potential for both dividend income and capital appreciation over the long term.

Dividend income is a vital component of Sam Zell Net Worth 2024, providing him with a steady income stream, tax benefits, investment diversification, and long-term growth potential. Zell's ability to identify and invest in dividend-paying companies has been instrumental in preserving and growing his wealth over time.

Capital gains

Capital gains play a critical role in Sam Zell Net Worth 2024. They represent the profit realized when an asset is sold for a price higher than its original purchase price. Capital gains can be a significant source of wealth accumulation, especially for investors like Zell who engage in strategic asset acquisition and disposition.

One of the key ways in which capital gains contribute to Sam Zell Net Worth 2024 is through real estate investments. Zell has a long history of acquiring undervalued properties, developing them, and selling them for a profit. For instance, his investment in the former Chicago Sun-Times building exemplifies this strategy. Zell purchased the property in 2000 for $50 million and sold it in 2019 for $285 million, generating substantial capital gains.

Understanding the connection between capital gains and Sam Zell Net Worth 2024 is crucial for assessing his investment strategy and the factors that have contributed to his financial growth. Capital gains have been a significant driver of Zell's wealth, and his ability to identify and capitalize on opportunities for profitable asset sales has been instrumental in building his net worth.

Investment strategy

Investment strategy lies at the heart of Sam Zell Net Worth 2024, shaping his approach to wealth accumulation and preservation. Zell's strategic investment decisions have played a pivotal role in building his financial empire.

- Value investing

Zell is renowned for his value investing approach, seeking undervalued assets with the potential for significant appreciation. His investments in distressed real estate and private equity have exemplified this strategy.

- Diversification

Zell's portfolio is highly diversified across various asset classes, industries, and geographic regions. This diversification strategy mitigates risk and enhances the overall stability of his net worth.

- Long-term horizon

Zell adopts a long-term investment horizon, allowing his investments to mature and appreciate over time. This patient approach has contributed to the substantial growth of his net worth.

- Active management

Zell actively manages his investments, continuously monitoring market trends and adjusting his portfolio accordingly. His hands-on approach has enabled him to capture opportunities and mitigate potential losses.

These facets of Zell's investment strategy highlight his focus on value, diversification, a long-term perspective, and active management. These principles have been instrumental in driving the growth of Sam Zell Net Worth 2024 and continue to shape his investment decisions.

Risk management

Within the realm of Sam Zell Net Worth 2024, risk management assumes paramount importance. Zell's strategic approach to managing risk has been instrumental in preserving and growing his wealth over several decades.

- Portfolio diversification

Zell's portfolio encompasses a diverse range of asset classes, including real estate, private equity, and public equities. This diversification strategy reduces overall risk by mitigating the impact of fluctuations in any single asset class or market sector.

- Hedging strategies

Zell employs hedging strategies to mitigate specific risks. For instance, he may use financial instruments such as options or futures to protect against adverse market movements or currency fluctuations.

- Stress testing

Zell conducts rigorous stress testing to assess the resilience of his portfolio under various economic scenarios. This process helps him identify potential risks and develop contingency plans to minimize their impact.

- Scenario planning

Zell engages in scenario planning to anticipate potential market disruptions or economic crises. By considering different scenarios, he can develop proactive strategies to navigate these challenges and safeguard his wealth.

These facets of risk management underscore Zell's prudent approach to wealth preservation. By actively managing risk, he has been able to weather market downturns and capitalize on opportunities, contributing significantly to the growth of Sam Zell Net Worth 2024.

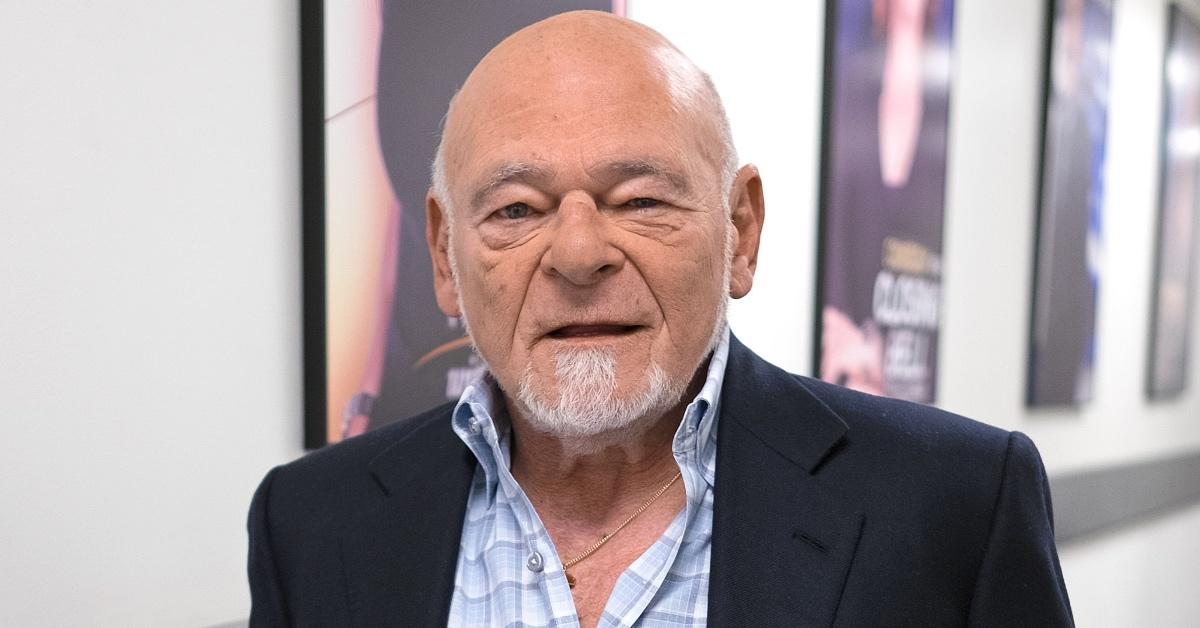

Business acumen

Sam Zell's business acumen has been a driving force behind his remarkable net worth in 2024. Business acumen refers to the combination of knowledge, skills, and instincts that enable individuals to make sound business decisions and achieve success in the business world. Zell's sharp business acumen has manifested in several ways throughout his career.

One of the key aspects of Zell's business acumen is his ability to identify and capitalize on undervalued assets. He has a knack for spotting opportunities where others may see challenges, and his willingness to take calculated risks has paid off handsomely. For instance, his acquisition of Equity Office Properties Trust in 2007, which was then the largest office REIT in the US, was considered a bold move at the time. However, Zell recognized the long-term value in the company's portfolio and successfully turned it around, generating substantial returns for his investors.

Another facet of Zell's business acumen is his strategic mindset. He thinks long-term and is not afraid to make bold decisions that may not yield immediate returns but have the potential for significant growth in the future. This strategic approach has been evident in his real estate investments, where he has focused on acquiring and developing properties in areas with high growth potential. His patience and foresight have contributed significantly to the appreciation of his real estate portfolio over time.

Zell's business acumen has not only led to the accumulation of wealth but has also had a broader impact on the business landscape. His success has inspired countless entrepreneurs and investors, and his insights and advice are highly sought after. His contributions to the business community have been recognized through numerous awards and accolades, including the Horatio Alger Award for Distinguished Americans and the Ellis Island Medal of Honor.

Market conditions

Market conditions play a significant role in shaping Sam Zell Net Worth 2024. The overall economic climate, industry trends, and specific market dynamics can influence the value of his assets, investment returns, and business ventures.

- Economic growth

Strong economic growth typically leads to increased demand for real estate, higher occupancy rates, and rising property values. Conversely, economic downturns can negatively impact the real estate market and reduce the value of Zell's real estate portfolio.

- Interest rates

Changes in interest rates can affect the cost of borrowing for real estate development and acquisition. Rising interest rates may make it more expensive to finance new projects, while falling interest rates can provide opportunities for refinancing and acquiring assets at a lower cost.

- Real estate market trends

Specific trends in the real estate market, such as changes in supply and demand, can influence the value of Zell's properties. Factors such as population growth, job creation, and infrastructure development can drive demand and increase property values in certain areas.

- Industry competition

The level of competition in the real estate industry can impact Zell's ability to acquire and develop properties profitably. High competition may lead to lower profit margins and reduced returns on investment.

Understanding and navigating market conditions is essential for Zell to preserve and grow his net worth. By carefully monitoring economic indicators, real estate trends, and industry dynamics, he can make informed investment decisions, mitigate risks, and capitalize on opportunities in the ever-changing market landscape.

Economic trends

Economic trends exert a profound influence on Sam Zell Net Worth 2024. The overall economic climate, industry trends, and specific market dynamics can impact the value of his assets, investment returns, and business ventures.

Strong economic growth typically leads to increased demand for real estate, higher occupancy rates, and rising property values. Conversely, economic downturns can negatively impact the real estate market and reduce the value of Zell's real estate portfolio. Economic growth also affects Zell's private equity investments, as companies tend to perform better and generate higher returns in a growing economy. Zell's ability to identify and capitalize on economic trends has been a key factor in his financial success.

One notable example of the impact of economic trends on Zell's net worth is his investment in Equity Office Properties Trust (EOP) in 2007. At the time, the U.S. economy was experiencing a housing market boom. Zell recognized the potential for growth in the office real estate sector and acquired EOP, the largest office REIT in the U.S. The subsequent economic downturn in 2008 led to a decline in property values and a decrease in EOP's share price. However, Zell maintained his investment, believing in the long-term value of the company's portfolio. As the economy recovered, EOP's share price rebounded, and Zell eventually sold his stake in the company for a substantial profit.

FAQs on Sam Zell Net Worth 2024

This FAQ section provides answers to common questions and clarifies aspects related to Sam Zell's net worth in 2024.

Question 1: What is the estimated value of Sam Zell's net worth in 2024?

According to various sources, Sam Zell's net worth is projected to be around $6.2 billion in 2024.

Question 2: What are the primary sources of Sam Zell's wealth?

Zell's wealth primarily stems from his extensive real estate investments, private equity portfolio, and equity holdings.

Question 3: How has Zell's investment strategy contributed to his net worth growth?

Zell's value investing approach, diversification strategy, and long-term investment horizon have been key factors in the growth of his net worth.

Question 4: What role does risk management play in preserving Zell's wealth?

Zell actively manages risk through portfolio diversification, hedging strategies, stress testing, and scenario planning.

Question 5: How does the overall economic climate impact Zell's net worth?

Economic growth, interest rates, real estate market trends, and industry competition can significantly influence the value of Zell's assets and investments.

Question 6: What is the significance of Sam Zell's business acumen in his financial success?

Zell's ability to identify undervalued assets, make strategic decisions, and adapt to market conditions has been crucial to his business ventures and overall net worth.

In summary, Sam Zell's net worth in 2024 is a result of a combination of factors, including his real estate investments, private equity portfolio, investment strategy, risk management, and business acumen. His ability to navigate market conditions and make strategic decisions has contributed to the preservation and growth of his wealth.

Moving forward, we will delve deeper into Sam Zell's investment strategies and examine how his approach has influenced his financial success over the years.

Tips for Understanding Sam Zell's Net Worth in 2024

This section provides practical tips to help you better understand and analyze Sam Zell's net worth in 2024.

Tip 1: Examine his real estate portfolio

Analyze the types of properties Zell invests in, their locations, and their performance over time.

Tip 2: Evaluate his private equity investments

Identify the companies Zell has invested in, their industries, and their financial performance.

Tip 3: Assess his investment strategy

Understand Zell's approach to value investing, diversification, and risk management.

Tip 4: Consider market conditions

Analyze how economic trends, interest rates, and real estate market dynamics impact Zell's net worth.

Tip 5: Study his business acumen

Examine Zell's ability to identify undervalued assets, make strategic decisions, and navigate market challenges.

By following these tips, you can gain a deeper understanding of Sam Zell's investment strategies and the factors that have contributed to his financial success.

These insights will serve as a foundation for the concluding section, which will delve into the broader implications of Zell's net worth and its significance in the business world.

Conclusion

Sam Zell's net worth in 2024 is a testament to his astute investment strategies and business acumen. His real estate portfolio, private equity investments, and long-term investment horizon have been key drivers of his financial success.

Understanding Zell's approach to value investing, portfolio diversification, and risk management provides valuable insights for investors seeking to build and preserve wealth. His ability to identify undervalued assets and make strategic decisions has consistently generated substantial returns.

The exploration of Sam Zell's net worth in 2024 underscores the significance of sound investment principles, market analysis, and a keen eye for opportunity. It serves as a reminder that financial success is not merely a matter of luck but a product of informed decision-making and a disciplined investment approach.- Wiki Biography Age Height Parents Nationality Boyfriend

- Is Gerrit Cole Jewish Or Christian Ethnicity

- Beloved Irish Father Clinton Mccormack Dies After

- Joe Kennedy Iii Religion Meet His Parents

- Fun Fact Is Sydney Leroux Lesbian And

Sam Zell Children Meet Matthew, JoAnn And Kellie

Sam Zell Net Worth American businessman career earning and achievement

What's Sam Zell's Net Worth? Investing Made Him a Billionaire