Unlocking The Secrets Of Catherine Faylen's Net Worth: A Guide For Financial Success

Catherine Faylen Net Worth is a numerical representation of the combined value of her assets minus her liabilities. For instance, if Catherine Faylen owns assets worth $10 million and has liabilities of $2 million, her net worth would be $8 million.

Understanding net worth is crucial for financial planning and decision-making. It provides insights into an individual's overall financial health, can be used to assess creditworthiness, and has historically influenced estate planning and inheritance strategies.

This article will delve into the details of Catherine Faylen's net worth, exploring her income sources, assets, and financial journey.

- Earl Vanblarcom Obituary The Cause Of Death

- Julia Dweck Dead And Obituary Nstructor Willow

- Who Is Jay Boogie The Cross Dresser

- Tlc S I Love A Mama S

- Justin Bieber Sells Entire Music Catalogue For

Catherine Faylen Net Worth

Catherine Faylen's net worth is a multifaceted concept that encompasses various essential aspects, each contributing to a comprehensive understanding of her financial standing. These key elements include:

- Assets

- Liabilities

- Income

- Expenses

- Investments

- Cash flow

- Debt

- Equity

- Financial goals

- Estate planning

By examining these aspects in detail, we gain insights into Catherine Faylen's wealth accumulation strategies, financial management, and overall financial well-being. These factors are interconnected and influence her financial decision-making, shaping her financial future and the legacy she leaves behind.

Assets

Catherine Faylen's assets play a pivotal role in determining her net worth. Assets are anything of value that she owns, such as cash, investments, real estate, and personal belongings. The value of her assets contributes directly to her overall financial standing.

- Janice Huff And Husband Warren Dowdy Had

- Discover The Net Worth Of American Actress

- Hilaree Nelson Wiki Missing Husband Family Net

- Legendary Rella S Relationship Status Is She

- Patrick Alwyn Age Height Weight Girlfriend Net

As Catherine Faylen acquires more assets, her net worth increases, assuming no other changes in her financial situation. For example, if she inherits a valuable property or invests in a successful business venture, her net worth will rise. Conversely, if she sells an asset or incurs significant losses in her investments, her net worth will decrease.

Understanding the connection between assets and net worth is crucial for informed financial decision-making. By carefully managing her assets, Catherine Faylen can optimize her financial growth and achieve her financial goals. This includes evaluating the performance of her investments, diversifying her portfolio to mitigate risk, and making strategic decisions about acquiring and disposing of assets.

Liabilities

Liabilities represent a significant aspect of Catherine Faylen's net worth, as they directly impact her financial standing. Liabilities are obligations or debts that she owes to individuals, businesses, or institutions. Understanding the nature and extent of her liabilities is essential for assessing her overall financial health.

- Accounts Payable

These are short-term debts owed to suppliers or vendors for goods or services received on credit. Managing accounts payable efficiently can positively impact cash flow and supplier relationships.

- Loans

Loans represent borrowed funds that must be repaid with interest. They can be secured by collateral or unsecured, and the terms and conditions of loans can vary depending on the lender and the purpose of the loan.

- Mortgages

Mortgages are long-term loans secured by real estate. They are typically used to finance the purchase of a home or other property. Mortgage payments include principal, interest, and sometimes property taxes and insurance.

- Taxes

Taxes are mandatory payments owed to government entities, such as income tax, property tax, or sales tax. Timely payment of taxes is crucial for maintaining compliance and avoiding penalties.

Catherine Faylen's liabilities affect her net worth by reducing the overall value of her assets. As she incurs new liabilities or fails to fulfill existing obligations, her net worth decreases. Conversely, as she pays down her liabilities or acquires more assets, her net worth increases. Monitoring and managing liabilities effectively is vital for her financial well-being and long-term financial goals.

Income

Income plays a pivotal role in shaping Catherine Faylen's net worth. It represents the inflow of funds that contribute to her overall financial standing and economic well-being. Understanding the sources and types of income she generates is essential for assessing her financial health and potential for wealth accumulation.

- Salary

Salary refers to the fixed compensation received for employment, typically paid on a regular basis. Catherine Faylen's salary contributes directly to her net worth by increasing her cash flow and overall assets.

- Investments

Income from investments, such as dividends, interest, and capital gains, can significantly impact Catherine Faylen's net worth. These forms of income represent a passive flow of funds that can supplement her other income sources and contribute to her long-term financial growth.

- Business Income

If Catherine Faylen owns and operates a business, the profits generated from its operations are considered business income. This income can vary depending on the industry, market conditions, and the success of the business venture.

- Other Sources

Additional sources of income, such as royalties, rental income, or freelance work, can also contribute to Catherine Faylen's net worth. These sources provide diversification and can enhance her overall financial resilience.

The stability, growth potential, and diversity of Catherine Faylen's income streams are crucial factors in determining her financial well-being and ability to increase her net worth over time. By carefully managing her income, expenses, and investments, she can optimize her financial position and achieve her long-term financial goals.

Expenses

Expenses play a crucial role in shaping Catherine Faylen's net worth, representing the outflow of funds that reduce her overall financial standing. Understanding the types and implications of her expenses is essential for assessing her financial health and developing strategies for wealth accumulation.

- Fixed Expenses

These expenses remain relatively constant from month to month, such as rent or mortgage payments, car payments, and insurance premiums. Fixed expenses provide a stable baseline for budgeting and financial planning.

- Variable Expenses

Variable expenses fluctuate based on usage or consumption patterns, such as groceries, utilities, entertainment, and dining out. Managing variable expenses effectively can help control overall spending and improve cash flow.

- Discretionary Expenses

Discretionary expenses are non-essential purchases that can be adjusted or eliminated without significantly impacting Catherine Faylen's lifestyle. Examples include travel, hobbies, and luxury goods.

- Debt Repayments

Debt repayments, such as credit card payments, student loans, and mortgage principal, represent a significant portion of expenses for many individuals. Managing debt effectively can improve credit scores, reduce interest payments, and free up cash flow for other priorities.

By carefully monitoring and managing her expenses, Catherine Faylen can optimize her financial resources, reduce unnecessary outflows, and enhance her net worth. Striking a balance between essential and discretionary expenses, as well as prioritizing debt repayment, are key strategies for improving her financial well-being.

Investments

Within the realm of Catherine Faylen's net worth, investments occupy a prominent position, serving as vehicles for wealth growth and long-term financial security. Her investment portfolio encompasses a diverse range of assets, each playing a specific role in shaping her financial future.

- Stocks

Stocks represent ownership shares in publicly traded companies. Investing in stocks offers the potential for capital appreciation and dividend income, although it also carries inherent risks associated with market volatility.

- Bonds

Bonds are fixed-income securities that provide regular interest payments over a defined period. They generally offer lower returns compared to stocks but are considered less risky and provide a stable stream of income.

- Real Estate

Investing in real estate involves purchasing properties, such as residential or commercial buildings, with the potential for rental income, capital gains, and tax benefits. However, real estate investments require substantial capital and can be illiquid.

- Alternative Investments

This category encompasses a wide range of investments that fall outside the traditional asset classes, such as private equity, venture capital, hedge funds, and commodities. Alternative investments can offer diversification and the potential for higher returns, but they also carry higher risks and often have limited liquidity.

Catherine Faylen's investment strategy involves a careful balance of these asset classes, aligned with her risk tolerance, financial goals, and time horizon. Her investment portfolio contributes significantly to her overall net worth and is a key pillar of her long-term financial plan.

Cash flow

Cash flow plays a pivotal role in shaping Catherine Faylen's net worth, representing the movement of funds in and out of her financial accounts. A consistent and positive cash flow is essential for maintaining a healthy financial position and achieving long-term financial goals.

Catherine Faylen's cash flow is primarily influenced by her income and expenses. Positive cash flow occurs when her income exceeds her expenses, allowing her to accumulate wealth and increase her net worth. Conversely, negative cash flow occurs when her expenses exceed her income, leading to a decrease in her net worth. Monitoring and managing cash flow effectively is crucial for Catherine Faylen to make informed financial decisions and avoid financial distress.

For example, if Catherine Faylen receives a substantial income from her investments but simultaneously incurs high expenses due to unexpected medical costs, her cash flow may be negatively impacted. This could lead to a decline in her net worth if she does not take appropriate measures to address the cash flow shortage, such as reducing expenses or exploring additional income sources.

Understanding the interrelationship between cash flow and net worth empowers Catherine Faylen to make strategic financial decisions. By optimizing her cash flow through careful budgeting, expense management, and income-generating activities, she can enhance her financial well-being, achieve her financial goals, and ultimately increase her net worth over time.

Debt

Debt plays a significant role in shaping Catherine Faylen's net worth, representing borrowed funds that must be repaid with interest. Understanding the nature and extent of her debt is essential for assessing her overall financial health and evaluating her ability to accumulate wealth.

High levels of debt can negatively impact Catherine Faylen's net worth by reducing her disposable income and limiting her investment options. Interest payments on debt can drain her cash flow, making it challenging to save and invest for the future. Furthermore, excessive debt can damage her credit score, making it more expensive to borrow in the future and potentially hindering her ability to secure favorable loan terms.

On the other hand, strategic use of debt can contribute to the growth of Catherine Faylen's net worth. For example, taking out a mortgage to purchase a property can provide leverage, allowing her to acquire an asset that may appreciate in value over time. Additionally, business loans can be used to fund investments or expansions that generate additional income streams, potentially increasing her net worth in the long run.

Equity

Equity, in the context of Catherine Faylen's net worth, refers to the value of her assets minus any outstanding liabilities. Understanding the relationship between equity and net worth is crucial for assessing her financial health and ability to accumulate wealth.

Equity plays a critical role in determining Catherine Faylen's net worth. A higher level of equity generally indicates a stronger financial position. This is because equity represents the portion of her assets that she truly owns, free and clear of any debts or encumbrances. By increasing her equity, Catherine Faylen can enhance her financial security, reduce her reliance on debt, and improve her overall financial well-being.

Several factors can affect Catherine Faylen's equity, including the value of her assets, the amount of debt she owes, and her income and expenses. For instance, if she makes a significant investment that increases the value of her assets or pays down debt, her equity will increase. Conversely, if her expenses exceed her income or the value of her assets decline, her equity may decrease.

Understanding the connection between equity and net worth provides valuable insights for Catherine Faylen in managing her finances. By focusing on strategies that increase her equity, such as paying down debt, investing wisely, and growing her assets, she can lay the foundation for long-term financial success and achieve her financial goals.

Financial goals

Financial goals play a pivotal role in shaping and managing Catherine Faylen's net worth. They provide a roadmap for her financial aspirations, guiding her financial decisions and helping her prioritize her financial resources.

- Retirement Planning

Catherine may set retirement goals, such as saving for a comfortable retirement or pursuing financial independence. These goals involve estimating future expenses, planning for healthcare costs, and generating passive income streams.

- Wealth Accumulation

Growing her net worth is a common financial goal for Catherine. This could involve increasing her income, investing wisely, or reducing expenses to accumulate wealth over time.

- Financial Security

Catherine may prioritize financial security by ensuring she has adequate emergency funds, maintaining a steady income, and mitigating financial risks. This helps her weather unexpected life events and maintain financial stability.

- Philanthropy

Catherine's financial goals may extend beyond personal needs to include philanthropic aspirations. She may set goals for charitable giving or supporting causes that align with her values.

Financial goals are interconnected and influence Catherine Faylen's financial decisions. By setting clear and achievable financial goals, she can align her actions with her long-term financial well-being, increase her net worth, and live a fulfilling financial life.

Estate planning

Estate planning is an essential aspect of managing Catherine Faylen's net worth. It involves the strategies and legal documents she uses to control the distribution of her assets after her passing. Estate planning not only ensures her wishes are carried out but also minimizes taxes and legal complications, ultimately preserving and potentially increasing her net worth.

A critical component of estate planning is ensuring that Catherine Faylen's assets are distributed according to her wishes. Through a will or trust, she can specify who will inherit her property, including financial assets, real estate, and personal belongings. This level of control helps protect her net worth from being dispersed in ways she does not intend.

Estate planning also involves minimizing taxes and legal complications. By utilizing trusts and other legal strategies, Catherine Faylen can reduce the tax burden on her estate. This helps preserve her net worth for her intended beneficiaries and avoids unnecessary legal challenges or disputes.

In summary, estate planning is a crucial aspect of managing Catherine Faylen's net worth. It allows her to control the distribution of her assets, minimize taxes, and avoid legal complications. By implementing a comprehensive estate plan, she can ensure her wishes are carried out and protect her net worth for future generations.

Frequently Asked Questions (FAQs) about Catherine Faylen Net Worth

This FAQ section provides answers to common questions and clarifications regarding Catherine Faylen's net worth.

Question 1: How is Catherine Faylen's net worth calculated?

Answer: Catherine Faylen's net worth is calculated by subtracting her liabilities, such as debts and loans, from her total assets, including cash, investments, real estate, and personal property.

Question 2: What are the primary factors influencing Catherine Faylen's net worth?

Answer: Catherine Faylen's net worth is influenced by her income, expenses, investments, and overall financial management strategies.

Question 3: How has Catherine Faylen's net worth changed over time?

Answer: Catherine Faylen's net worth has fluctuated over time due to changes in her income, expenses, investments, and other financial factors.

Question 4: What are some of Catherine Faylen's most valuable assets?

Answer: Catherine Faylen's most valuable assets may include real estate, investments, and businesses, depending on her specific financial situation.

Question 5: How does Catherine Faylen manage her net worth?

Answer: Catherine Faylen likely utilizes various financial strategies to manage her net worth, including budgeting, investing, and seeking professional financial advice.

Question 6: What are some potential risks to Catherine Faylen's net worth?

Answer: Catherine Faylen's net worth may be affected by market fluctuations, economic downturns, and personal financial decisions.

In summary, understanding Catherine Faylen's net worth involves examining her assets, liabilities, income, expenses, and financial strategies. Her net worth is a dynamic measure that can be influenced by various factors over time.

The next section will delve deeper into the components of Catherine Faylen's net worth, exploring her income sources, investment portfolio, and financial management practices.

Tips for Managing Your Net Worth

Understanding your net worth is crucial for making informed financial decisions. These tips provide actionable steps to help you manage your net worth effectively:

Tip 1: Track your income and expenses: Monitor your cash flow to identify areas for savings and potential income growth.

Tip 2: Create a budget: Plan your spending and allocate funds wisely to minimize unnecessary expenses.

Tip 3: Invest for the long term: Diversify your investments and consider long-term growth potential to increase your net worth.

Tip 4: Reduce debt: Prioritize paying down high-interest debts to improve your financial standing.

Tip 5: Save for retirement: Start saving early and consistently to secure your financial future.

Tip 6: Seek professional advice: Consult with a financial advisor to develop a personalized plan and optimize your financial decisions.

Tip 7: Review your net worth regularly: Monitor your progress and make adjustments as needed to stay on track.

Summary: Managing your net worth requires discipline, planning, and smart financial choices. By implementing these tips, you can increase your financial stability, achieve your financial goals, and build a secure financial future.

These tips provide a solid foundation for effective net worth management. In the next section, we will explore advanced strategies for maximizing your financial growth and preserving your wealth over time.

Conclusion

This comprehensive exploration of Catherine Faylen's net worth has shed light on the multifaceted aspects that contribute to her financial standing. Her net worth is a dynamic measure influenced by her income, expenses, assets, liabilities, and overall financial strategies.

Key insights include the significance of strategic asset allocation, prudent debt management, and long-term investment planning. These elements are interconnected and play a crucial role in shaping Catherine Faylen's financial well-being. By understanding these factors, we gain a deeper appreciation of the complexity and importance of net worth management.

As we reflect on the topic of net worth, it is essential to remember that financial success is not solely defined by the accumulation of wealth. True financial well-being encompasses financial security, the ability to pursue personal goals, and the freedom to live a fulfilling life. Catherine Faylen's net worth serves as a reminder that responsible financial management is a cornerstone of achieving our financial aspirations and securing our future.

- Singer Sami Chokri And Case Update As

- Eve Wembanyama Parents Meet Fc3a9lix Wembanyama

- Justin Bieber Sells Entire Music Catalogue For

- Thomas Lineberger Aberdeen Nc Famous Internal Medicine

- Wwe Billy Graham Illness Before Death Was

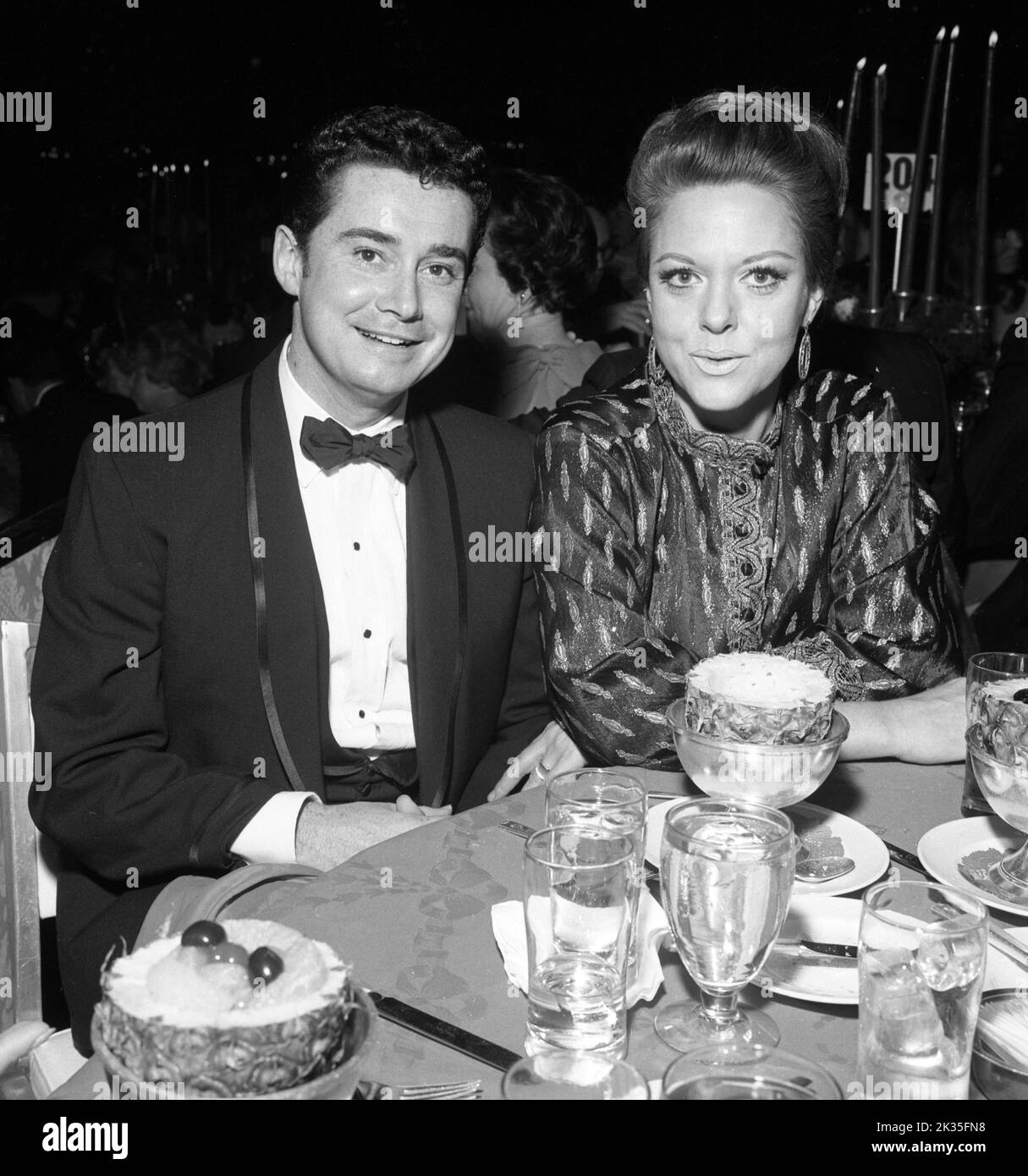

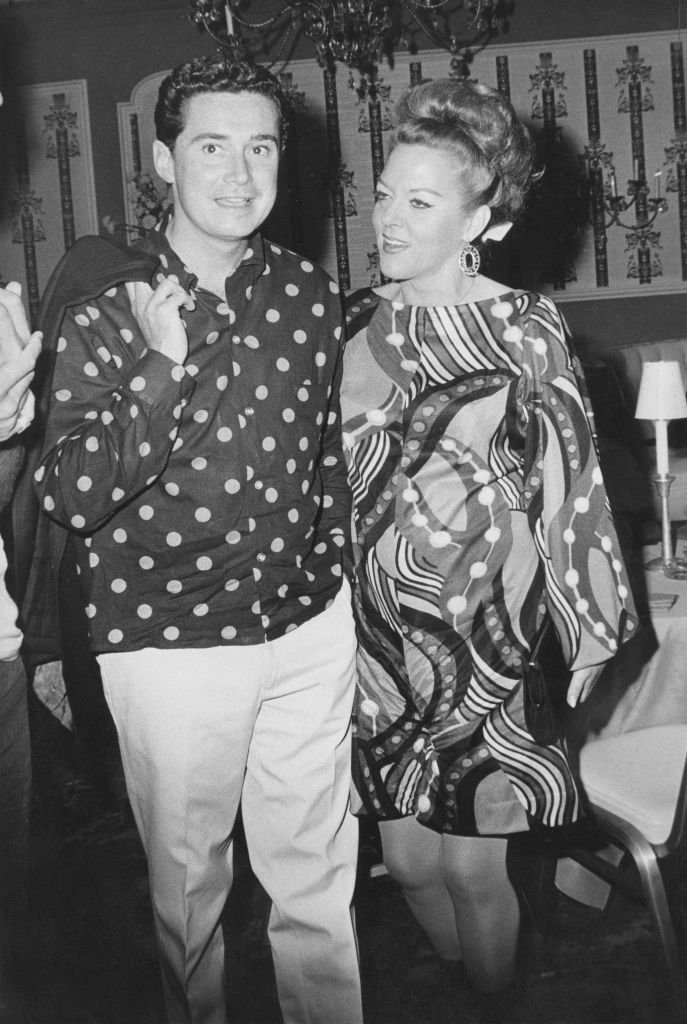

Regis Philbin and Catherine 'Kay' Faylen. Circa 1960's Credit Ralph

Catherine Faylen Net Worth How Much is Faylen Worth?

Regis Philbin Called Disabled Son His ‘Hero in Life’ Yet ExdaughterIn