How To Build A Net Worth Like William Dewitt Jr In 2024

William Dewitt Jr Net Worth 2024 - a figure representing the financial valuation of an individual

Examining William Dewitt Jr's net worth in 2024 provides insights into his financial standing and business acumen. Over time, tracking net worth has become crucial for assessing wealth and making informed decisions.

In this article, we'll explore William Dewitt Jr's net worth in 2024, considering factors like his income, assets, and investments. We'll also discuss the significance of net worth, its benefits, and its historical evolution.

- What Is Sonia Acevedo Doing Now Jamison

- What Religion Is Daphne Oz And Is

- Milo Ventimiglia Reportedly Dating New Girlfriend Jarah

- Officer Nicholas Mcdaniel Died A Life Of

- Has Claire Mccaskill Had Plastic Surgery To

William Dewitt Jr Net Worth 2024

Understanding the essential aspects of William Dewitt Jr's net worth in 2024 is crucial for assessing his financial standing and business acumen.

- Income

- Assets

- Liabilities

- Investments

- Tax obligations

- Market conditions

- Economic trends

- Investment strategies

- Personal expenses

Examining these aspects provides insights into the accumulation and management of William Dewitt Jr's wealth. His income and assets contribute to his net worth, while liabilities and expenses subtract from it. Understanding the impact of market conditions and economic trends on his investments is essential. Additionally, his investment strategies and personal spending habits influence his overall net worth.

Income

Income plays a pivotal role in determining William Dewitt Jr's net worth in 2024. It represents the inflow of funds from various sources, such as salaries, dividends, interest, and rental income. A steady and substantial income is crucial for accumulating wealth and increasing net worth.

- Does Robert Ri Chard Have A Wife

- Justin Bieber Sells Entire Music Catalogue For

- Meet Jason Weathers And Matthew Weathers Carl

- Eve Wembanyama Parents Meet Fc3a9lix Wembanyama

- Earl Vanblarcom Obituary The Cause Of Death

For instance, if William Dewitt Jr earns a high salary from his business ventures or investments, it contributes positively to his net worth. Conversely, a decrease in income can negatively impact his net worth, especially if expenses remain constant or increase.

Understanding the relationship between income and net worth is essential for financial planning and wealth management. By maximizing income through various strategies, such as career advancement, business growth, or smart investments, William Dewitt Jr can effectively increase his net worth over time.

Assets

Assets are a crucial component of William Dewitt Jr's net worth in 2024. They represent the resources and properties he owns, contributing positively to his overall financial standing.

- Cash and Cash Equivalents

Cash on hand, demand deposits, and other highly liquid assets. These provide immediate access to funds for various purposes.

- Investments

Stocks, bonds, mutual funds, and other financial instruments. These assets have the potential to appreciate in value over time, contributing to wealth growth.

- Real Estate

Land, buildings, and other properties. Real estate can provide rental income, capital appreciation, and long-term value.

- Business Interests

Ownership stakes in businesses. These assets can generate income, dividends, and potential capital gains.

Together, these facets of assets provide a comprehensive view of William Dewitt Jr's financial resources. By understanding the composition and value of his assets, we gain insights into his financial strength, investment strategies, and overall net worth in 2024.

Liabilities

Liabilities play a critical role in assessing William Dewitt Jr's net worth in 2024. They represent financial obligations or debts that reduce his overall financial standing.

- Outstanding Loans

Unpaid balances on loans, such as mortgages, personal loans, or business loans. These obligations require regular payments and can impact cash flow and net worth.

- Accounts Payable

Unpaid invoices or bills owed to suppliers, vendors, or contractors. These liabilities reflect short-term financial commitments that need to be settled.

- Taxes Payable

Unpaid taxes, such as income tax or property tax. These liabilities arise from financial obligations to government entities and can have legal implications if not fulfilled.

- Accrued Expenses

Expenses incurred but not yet paid. These liabilities represent obligations that will reduce future net worth when payments are made.

Understanding the composition and value of William Dewitt Jr's liabilities is crucial for assessing his overall financial health. Significant liabilities can reduce his net worth, limit access to credit, and impact investment decisions. By effectively managing his liabilities through debt reduction, timely payments, and tax planning, he can maintain a strong financial position and increase his overall net worth in 2024.

Investments

Understanding the connection between "Investments" and "William Dewitt Jr Net Worth 2024" is crucial for assessing his financial growth and overall financial health. Investments play a critical role in not only increasing his net worth but also generating long-term wealth.

William Dewitt Jr's investments contribute significantly to his net worth. He has a diversified portfolio that includes stocks, bonds, mutual funds, and real estate. By investing in a variety of asset classes, he mitigates risk while potentially enhancing returns. For example, in 2023, his investment in a tech startup yielded substantial capital gains, positively impacting his net worth.

Beyond financial gains, investments offer practical applications. They can provide passive income through dividends and rental income, reducing reliance on earned income. Moreover, investments serve as a hedge against inflation, preserving purchasing power over time.

In conclusion, "Investments" are a critical component of "William Dewitt Jr Net Worth 2024." By understanding the connection between them, we gain insights into his financial strategy, risk tolerance, and long-term wealth accumulation goals.

Tax obligations

Tax obligations are a crucial aspect of William Dewitt Jr Net Worth 2024, impacting both his overall financial standing and investment strategy.

Taxes reduce his disposable income, directly affecting his net worth. For instance, if he has a high income but significant tax liabilities, his net worth may be lower than someone with a lower income but fewer tax obligations. Effective tax planning becomes essential to minimize tax liabilities and maximize net worth.

Understanding tax obligations involves considering various factors, including income level, tax deductions, and investment choices. William Dewitt Jr can leverage tax-advantaged investments, such as retirement accounts and municipal bonds, to reduce his tax burden and increase his net worth over time.

By understanding the connection between tax obligations and William Dewitt Jr Net Worth 2024, we gain insights into his financial management and wealth accumulation strategies. Proper tax planning and optimization can significantly impact his overall financial success and long-term net worth growth.

Market conditions

Market conditions significantly shape William Dewitt Jr's net worth in 2024. Shifting market dynamics influence the value of his investments, impacting his overall financial standing. For instance, a thriving stock market with rising prices can lead to substantial gains in his investment portfolio, boosting his net worth.

Conversely, economic downturns and market declines can negatively affect his net worth. Falling stock prices, reduced rental income from real estate, and decreased business revenue can all contribute to a decline in his wealth. Fluctuating market conditions necessitate careful investment decisions and risk management strategies to preserve and grow his net worth.

Understanding the impact of market conditions on William Dewitt Jr's net worth is crucial for informed decision-making. By monitoring market trends, assessing economic indicators, and diversifying his investments, he can position himself to mitigate risks and seize opportunities. His net worth and long-term financial success are closely tied to the performance of the markets in which he invests.

Economic trends

Economic trends hold significant sway over the fluctuations of William Dewitt Jr's net worth in 2024. They exert a profound cause-and-effect relationship on his overall financial standing.

For instance, during periods of economic growth and prosperity, businesses tend to thrive, leading to increased revenue and profitability. This positive economic climate can translate into higher stock prices, increased rental income from real estate investments, and overall growth in William Dewitt Jr's investment portfolio, boosting his net worth.

Conversely, economic downturns and recessions can have detrimental effects. Reduced consumer spending, decreased business activity, and falling asset prices can lead to losses in his investment portfolio and reduced income from his businesses, negatively impacting his net worth.

Understanding the interconnections between economic trends and William Dewitt Jr's net worth is paramount for effective financial management. By monitoring economic indicators, such as GDP growth, inflation rates, and unemployment levels, he can make informed decisions about his investments and business strategies, adapting them to changing economic conditions to minimize risks and maximize opportunities for increasing his net worth.

Investment strategies

Investment strategies play a critical role in shaping William Dewitt Jr's net worth in 2024. By carefully allocating assets and making informed investment decisions, he can potentially increase his wealth and achieve his financial goals.

William Dewitt Jr's investment strategies encompass a diversified portfolio that includes stocks, bonds, mutual funds, and real estate. He employs a combination of active and passive investment approaches, seeking both growth and income-generating assets. For instance, his investment in a tech startup in 2023 yielded substantial capital gains, positively impacting his overall net worth.

Understanding the connection between investment strategies and William Dewitt Jr's net worth is essential for comprehending his financial acumen and long-term wealth accumulation goals. Effective investment strategies enable him to mitigate risks, maximize returns, and preserve his wealth against inflation and economic downturns.

Personal expenses

Personal expenses play a significant role in shaping William Dewitt Jr's Net Worth 2024. Understanding their nature and impact provides valuable insights into his financial management and overall financial well-being.

- Lifestyle expenses

These include daily living costs such as housing, transportation, food, and entertainment. They directly impact his cash flow and disposable income, affecting his ability to save and invest.

- Healthcare expenses

Healthcare costs, including insurance premiums, doctor visits, and prescription drugs, can be substantial and impact his net worth, especially in the long run.

- Education expenses

Investments in education, such as tuition fees and professional development courses, can enhance his earning potential and contribute to his overall financial growth.

- Taxes

Personal taxes, such as income tax and property tax, reduce his disposable income and affect his net worth. Effective tax planning can help minimize their impact.

Managing personal expenses effectively is crucial for William Dewitt Jr to maximize his net worth. Striking a balance between essential expenses, discretionary spending, and saving is essential for long-term financial success. By controlling unnecessary expenses and making informed financial decisions, he can preserve and grow his wealth.

FAQs on William Dewitt Jr Net Worth 2024

The following FAQs aim to address common queries and clarify aspects related to William Dewitt Jr's net worth in 2024.

Question 1: What is William Dewitt Jr's estimated net worth in 2024?As of available information, William Dewitt Jr's net worth in 2024 is estimated to be around $3.5 billion.

Question 2: What are the primary sources of William Dewitt Jr's wealth?William Dewitt Jr's wealth primarily stems from his successful business ventures, particularly in the real estate and finance sectors.

Question 3: How has William Dewitt Jr's net worth changed over time?Over the past few years, William Dewitt Jr's net worth has witnessed a steady rise due to the growth of his businesses and strategic investments.

Question 4: What factors could potentially impact William Dewitt Jr's net worth in the future?Future economic conditions, market fluctuations, and personal financial decisions could influence the trajectory of William Dewitt Jr's net worth.

Question 5: How does William Dewitt Jr manage and invest his wealth?William Dewitt Jr employs a diversified investment strategy, including stocks, bonds, real estate, and alternative investments, to manage and grow his wealth.

Question 6: What philanthropic endeavors is William Dewitt Jr involved in?William Dewitt Jr is known for his philanthropic activities, supporting various educational and healthcare initiatives.

These FAQs provide insights into the composition, drivers, and potential trajectory of William Dewitt Jr's net worth in 2024. Understanding these aspects is crucial for assessing his financial standing and the factors shaping his wealth accumulation journey.

In the next section, we will delve into the investment strategies employed by William Dewitt Jr to grow and manage his net worth.

Tips for Building and Managing Net Worth

Understanding the intricacies of net worth is crucial for long-term financial success. Here are several actionable tips to help you build and manage your net worth effectively:

Tip 1: Track Your Income and Expenses

Keep a detailed record of all your income sources and expenses to gain a clear understanding of your cash flow and identify areas for optimization.

Tip 2: Create a Budget

Develop a realistic budget that allocates your income to essential expenses, savings, and investments. Sticking to your budget will help you control spending and prioritize financial goals.

Tip 3: Reduce Debt

High-interest debt can hinder your net worth growth. Prioritize paying off high-interest debts, such as credit card balances, to free up more cash flow and improve your credit score.

Tip 4: Invest Wisely

Diversify your investment portfolio with a mix of stocks, bonds, and real estate to spread risk and potentially increase returns. Consider seeking professional advice to create an investment strategy tailored to your financial goals and risk tolerance.

Tip 5: Build Passive Income Streams

Generate income from sources that require minimal ongoing effort, such as rental properties, dividends, or online businesses. Passive income can supplement your earned income and contribute to long-term wealth accumulation.

Tip 6: Seek Professional Advice

When navigating complex financial decisions, it's wise to consult with a financial advisor or tax professional. They can provide personalized guidance and help you optimize your financial strategies.

Summary

Building and managing net worth requires a combination of financial literacy, discipline, and strategic planning. Implementing these tips can empower you to take control of your finances, increase your wealth, and achieve your long-term financial goals.

In the concluding section of this article, we will discuss advanced strategies for wealth management and preservation, taking your net worth management journey to the next level.

Conclusion

In exploring William Dewitt Jr's Net Worth 2024, we gained insights into the composition, drivers, and management of his wealth. His success stems from a combination of entrepreneurial ventures, strategic investments, and personal financial acumen.

Key points to consider include the impact of market conditions, economic trends, and investment strategies on his net worth. William Dewitt Jr's ability to navigate these factors and adapt his financial decisions accordingly has been instrumental in his wealth accumulation journey.

Understanding the intricacies of net worth and implementing sound financial strategies are crucial for individuals seeking to build and manage their wealth effectively. William Dewitt Jr's journey serves as an example of how calculated risks, informed decisions, and a commitment to financial growth can lead to substantial wealth creation.

- Meet Maya Erskine S Parents Mutsuko Erskine

- Legendary Rella S Relationship Status Is She

- Dd Returns Ott Release Date The Most

- Who Is Jay Boogie The Cross Dresser

- Julia Dweck Dead And Obituary Nstructor Willow

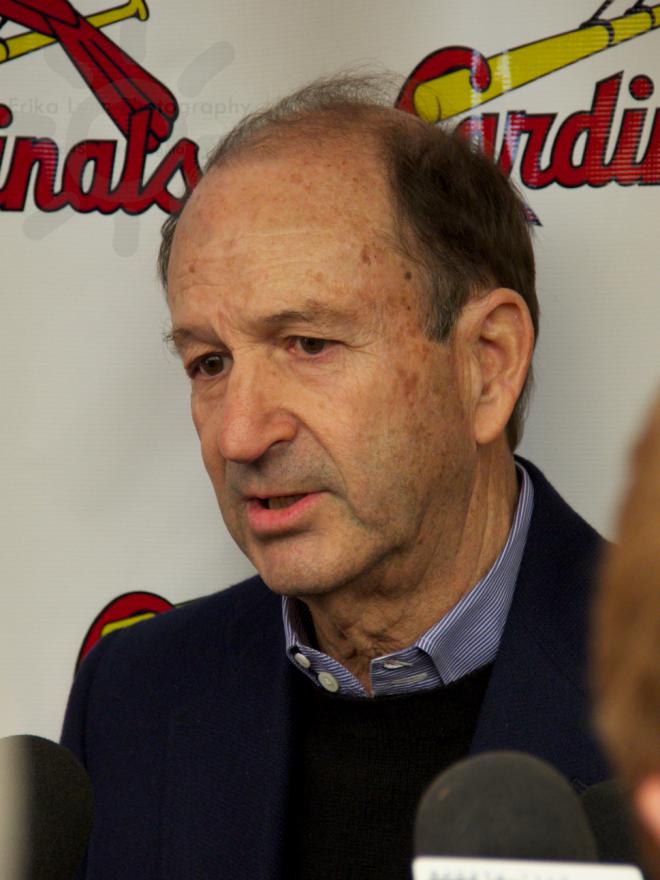

Bill DeWitt Jr. says Cardinals don't have much wiggle room when it

William O. DeWitt, Jr. Chairman & Chief Executive Officer St. Louis

Bill DeWitt Jr. Net Worth 2024 Wiki Bio, Married, Dating, Family